Overview

eToro was established in the year 2007, known as one of the leading social trading platforms. eToro offers more than 1,000 assets over 5 categories like stocks, commodities, currencies, ETFs, and Indices; with different social elements. eToro is considered one of the most preferred platforms for its clients. eToro provides a perfect trading experience and trading instruments for its customers; the platform is available on the mobile app and on its web interface.

eToro Reviews – Top Social Trading Platform

| Pros | Cons |

| Free Demo Account | High forex fees |

| Hassle-free account opening | A minimum deposit of 200 USD |

| Free stock and ETF trading | Only one account base currency |

| Good Social trading features | Withdrawal is slow and expensive |

Why eToro?

- eToro provides Forex services along with CFD trading. eToro platform presents lots of information concerning its various instruments to its users so that the traders remain aware of high-risk investment decisions.

- If the traders want to experience trading 24×7 they can access their trading accounts at any time, they can access eToro’s mobile application which has the same features, accessibility, and intuitive interface.

- eToro’s Copy portfolio service provides the traders with both short term and long term options which permits them to set up a comprehensive portfolio.

- eToro is completely regulated and follows the guidelines of the FCA, CySEC, and ASIC. It has associated itself with leading financial institutions like China’s Ping An Group, and Russia’s Sberbank to promote financial education and online trading in these markets.

- Further, eToro offers excellent educational programs to its traders and its most extraordinary feature is its financial trading community which is considered to be the world’s largest community.

- Recently, eToro replaced its two popular platforms – Openbook and Webtrader into one platform which offers the trader access to all their financial services over all types of devices. eToro offers more than 1,083 various instruments for trades, which includes 47 currency pairs.

- Based on what region or country the client lives in, the first time minimum deposit for the eToro live account starts from 200 dollars to 1,000 dollars. Further to open a funded account, eToro provides a Demo account, just for registering at no cost.

- When compared to other online forex brokers, eToro does not charge any commission on trades; as an alternative, the company depends on slightly wider spreads to balance themselves.

- eToro’s mobile trading app caters to iOS devices and also for Android phones and tablets. Moreover, the application can be downloaded from the Google Play store and the apple app store.

eToro Reviews – Download eToro App now!

eToro UK offers zero commission to customers of eToro Europe Ltd. and eToro UK Ltd and there are no leverages or short stocks.

eToro Review – 0% Commission Fee

USPs of eToro

Some of the USP’s of eToro are given below –

- eToro is used by more than 6,000,000 traders

- Personal service for VIPs

- Hassle-free account opening

- Copy-trading

eToro Reviews by Customers

Customers of eToro are satisfied and it is a provider you should consider while choosing a trading platform. Customers who are using eToro have given their past performance feedback on the platform. A few of them are given below –

An eToro review given by a satisfied customer –

“Great platform for beginners; The virtual portfolio is the best way to introduce yourself to this world. Once you are ready, eToro gives you all you need to invest like a PRO.”

“Excellent platform, User-friendly platform for both PC’s and smartphones and with good charting features”

Another review of eToro regarding app – “Great, simple trading app; As a first-time trader eToro makes trading simple. I would definitely recommend”

How eToro is Unique when Compared to Other Platforms?

- Looking at past performance, one of the unique ways of how eToro stands out from the other trading platforms is the availability of more number of trading and investment options for its traders.

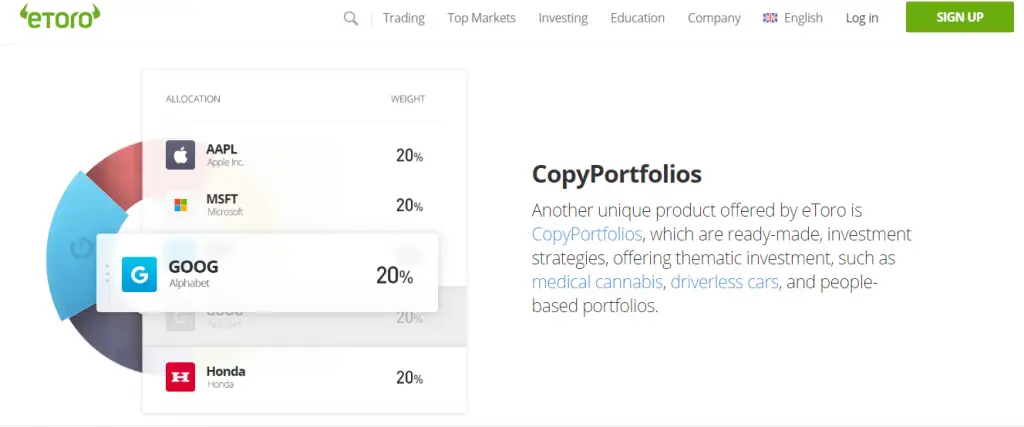

- Also, the Social feature available in the eToro platform makes it unique. One example is CopyPortfolios; it is a long term investment model in the form of managing a portfolio of bundling assets for experienced traders with a pre-planned strategy. The capability to copy the investment plans from successful traders is innovative like a Popular investor program.

- eToro is client focused, hence they offer their services in 16 languages and operates 24 hours and 5 days a week customer service.

eToro in the Latest news

- Last November 2019, eToro had acquired the cryptocurrency portfolio application “Delta”, an app that tracks as much as 6,000 various tokens and cryptocurrencies on 180 exchanges. This acquisition of Delta presents eToro’s is the second acquisition last year. The first acquisition of eToro was Firmo, a smart contracts development company.

- Again last November, eToro launched a brand new global investment portfolio that focused on food tech, a sector valued to be worth 700 billion dollars by 2030.

- In December, eToro initiated a portfolio for shopaholics before Christmas. This “shopping cart” portfolio allows investors to invest in some of the fast-developing companies without the usual fees that come with purchasing funds and shares.

- In January, eToro offered a long term crypto portfolio for new users; It had been given to new users who wanted to gain diverse exposure to different markets effortlessly.

- eToro plans to launch its debit card by the end of 2020, simultaneously expanding its operations in South Africa, the US, and Hong Kong. It also has plans to expand its services to customers in more than 100 countries.

Who Can Use eToro?

eToro says that it is a trading platform that can be used by individuals as long it is legal in their country. Also, eToro has a list of nations where the platform is blocked because of changes in the regulations that clashes with trading laws.

Those in the U.S, Cuba, Canada, Japan, Iran, North Korea, Turkey, Syria, Serbia, Sudan, and Albania cannot use eToro legally.

eToro Account Details

- Before starting to trade with the real cash, where there are possibilities of losing, eToro offers its customers a Demo Account. In this demo retail investor account, the trader will be provided with 100,000 dollars called “testing money.”

- This limitless demo account will allow the traders to test any number of strategies the trader has, also they can copy from other successful traders with no risk.This can ensure that no retail investor accounts lose money when trading CFDs, stocks, or other financial commodities. It also gives you a chance to consider whether you can afford to take the high risk of trading CFDs as 75% of retail investor accounts lose money while trading CFDs.

- Moreover, there is only a small difference between the real account and the demo account. The trader needs to start trading with the real cash; which can be transferred to the credit through the Deposit Funds Button, where the trader can deposit funds into the trading account.

eToro’s Login

- eToro’s trading platform has a safer, optional, two-step login system; it can be a bit complicated, yet, it provides the trader with the added security.

eToro Registration Process

- eToro’s registration process is easy and quick. The registration process is identical to that of any other trading broker. Few forms need to be filled and the new user must provide copies of personal documents like a passport or identity card. Providing some kind of proof of identity is the basic condition for any regulated broker. Few brokers even ask for a “Selfie” with the necessary documentation. This authentication is mandatory to ensure that no investor accounts lose money to malicious entities.

eToro Commissions & Fees

- eToro does not have commission charges for trading; rather, they make it up with the spread. By checking the past performance with this broker, there are no separate trading fees or commissions applied to trader accounts except for specific situations; they apply credit card charges, weekend or overnight fees.

- eToro spreads would look wider when compared with other brokers, especially as they charge for commissions separately. Besides, some fees are applied for specific currencies.

Inactivity Fee

eToro comes with a high charge for inactivity. When the trader does not sign into their trading account for over 12 months or into their trial accounts for over 4 months, eToro will charge the customer 10 dollars per month. Nevertheless, it will be done when there is a required balance left in the trader’s account. When the trader signs in to their account, there will be a cancellation of this inactivity fee; where the high risk of losing money is minimized. In the official eToro website, the current fees can be seen.

Fees for stocks and ETFs

As a part of exclusive service to its customers, eToro provides zero commission ETF and stocks trading for clients in Europe. eToro is a CFD broker that allows the trader to trade with ETFs and real stocks if the leverage is set to one. Considering non-European clients, there is no zero-commission trading, yet eToro offers lower fees that are lower in spreads. If the trader sets the leverage above than one, then they can trade CFDs with this provider. But the trader should act with due diligence while he trades CFDs as 75% of retail investor accounts lose money when trading CFDs. You should carefully consider whether to trade CFDs with this provider and whether you can afford to take the high risk of losing your money.

Non-trading fees

eToro comes with a high non-trading fee, which is 10 dollars per month after one year of inactivity from its clients. Further, it charges a withdrawal fee of 25 dollars.

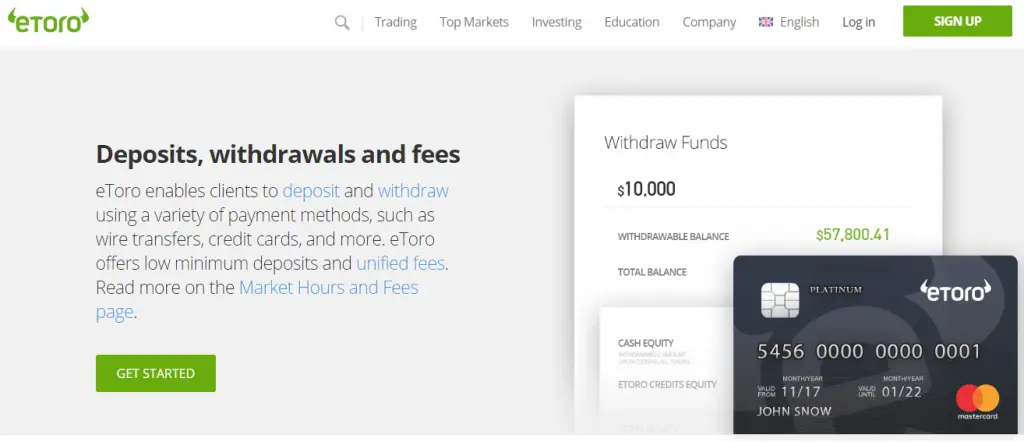

eToro Reviews – About Fees!

Deposit and Withdrawal Fees

This broker does not charge any deposit fees. Traders are entitled to 25 dollars withdrawal fees, which is considerably high when compared to other CFD brokers. Further, eToro has a minimum of 50 dollars amount limit on the withdrawals.

Minimum Deposit at eToro

In several cases, the required eToro minimum deposit is 200 dollars. Currently, it is different for the below-mentioned countries.

- For Israel traders, the minimum deposit is 10,000 dollars

- For Australia and the USA traders, the first-time minimum deposit is 50 dollars.

- For China, Russia, Taiwan, Hong Kong and Macau residents, the first time minimum deposit is 500 dollars.

Funding methods

- Credit cards

- Skrill

- PayPal

- Bank Transfer

- Neteller

eToro’s Trading Hours

eToro platform opens for trading 24 hours a day, 5 days a week starting from Monday to Friday.

Trading Platform

- eToro’s web-based trading platform is created on Java technology and it can be accessed from any computer having an internet connection. Moreover, it is a web-based application and downloading is not required.

- Further, eToro permits the trader to access the platform from any of the web browsers like Mozilla, chrome, Firefox and Internet Explorer.

- eToro platform includes a complete set of interactive charts and technical indicators and can be used to trade selected crude oil, stock indices, gold, and cryptocurrencies.

- eToro’s platform has been synchronized with eToro’s social trading platform, by helping the traders to copy trades from the successful traders who are listed on the leaderboard. This helps the trader from the high risk of losing money and have a good trading experience.

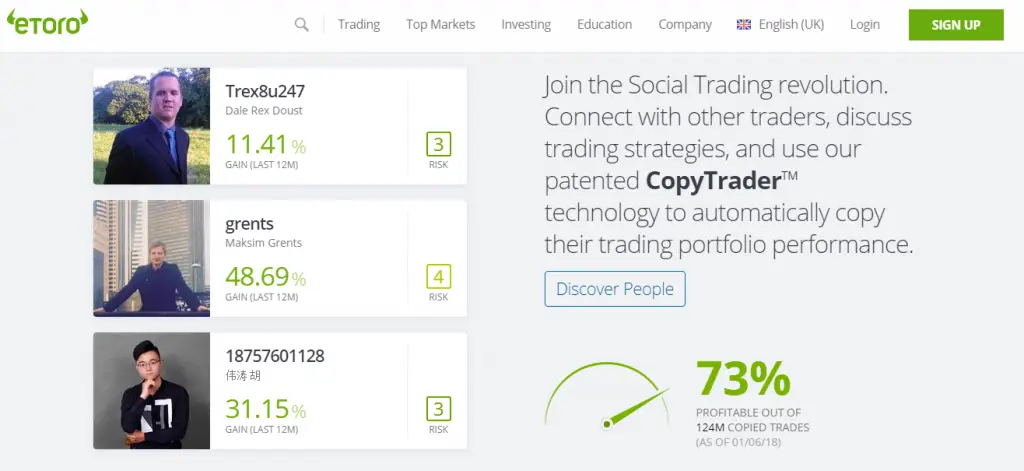

Social Trading

- eToro is a market leader when it comes to social trading, with a set of features and services that shows that it has numerous clients. In the beginning, eToro integrated two separate platforms such as Webtrader, which is a multi-trading platform and OpenBook.

- OpenBook is a social trading platform that was introduced in 2010. When both the platforms merged into the social trading platform, it had become one of eToro’s important aspects, allowing the users to interact, follow others and copy the trades of successful traders.

- The social trading platform offers the users enough access to the information, ensures they make good investment decisions. It also offers easy to understand charts, a daily financial newsletter, and also permits clients to learn from one other, while helping them to deal with a high risk.

eToro Review – Global Leader

What can you Trade on eToro?

eToro offers trading of various assets for its customers. It has something or the other to offer for its different types of clients, be it a beginner or an experienced trader. Further, the eToro website displays a list of all assets like stocks that were traded. Below given are the few examples of assets offered by eToro.

- Commodities like Gold, Gas, Oil

- Stocks like Google, Facebook, Apple and many more

- Cryptocurrencies such as Ethereum, Bitcoin, Litecoin, and others

- ETFs such as SPDR Gold, Proshares Ultra S&P 500 and many others

- Stock Index like DAX, Nasdaq, Dow Jones, and several others

eToro Reviews – Trade Markets

Minimum and Maximum’s that can be traded on eToro?

eToro’s Minimum trade contract size is 1,000 units of the base currency, which is equivalent to a lot size of 0.01 for currencies, 1 unit for stock indices and 10 units for commodities. Moreover, there is no limit on the maximum contract size that is to be traded.

eToro’s Tools and it’s Services

Below given are the Tools that are found on the eToro’s platform.

- OpenBook

Previously, the initial eToro trading platform was known as WebTrader and it was combined with eToro’s OpenBook and created a more sophisticated platform for its clients. Besides, Openbook is not only a trading platform but also a social app where the traders can view other user’s profiles, check prices on all accessible markets and use eToro tools such as Copy Portfolios and CopyTrader.

eToro Review – OpenBook Portfolio

- CopyTrader

This tool is designed to permit new traders to easily select the successful trader’s strategy and add funds for copy trading. This takes out the high risk of losing money over unsuccessful strategies. The trader can copy over 100 different trades immediately and they will need a minimum amount of 200 dollars to open a live account. Establishing a trading strategy on Copy Trader can be done by just a few mouse clicks.

eToro Reviews – CopyTrader

- CopyPortfolios

CopyPortfolio is a combination of two different methods, such as market portfolios and top trader portfolios. The top trader portfolio permits traders to copy trades using a particular strategy to optimize their trading experience. If the trader wants to trade commodities, the top trader portfolio connects the account with successful stocks, silver, gold or oil traders.

eToro Review – CopyPortfolios

- Social News Feed

All of the eToro clients get a fully customized news feed that is much similar to the twitter feed. The traders can post updates, discuss their strategies and can tag other users to begin conversations. Additionally, the news feed also offers alerts when markets become unstable or when a trader who is being followed creates a new trade or a post.

Mobile Trading

eToro’s flagship product, eToro Mobile app is available for both Android and iOS operating systems. By using the mobile app, the traders can get access to all the features and markets which also includes the CopyPortfolio features.

eToro Reviews – Mobile Trading

eToro’s Research Offerings

CFDs can be described as complex financial products and eToro thinks that there is a need to educate the new traders. Based on this, the broker had set up an education center with more insights and research material for both new and experienced traders. 75% of retail investor accounts lose money when trading CFDs. So, before trading in CFDs with this provider or any other provider, consider whether you can afford to take the high risk of losing your money.

Online e-Courses

The online trader course offers information on fundamental forex terms, order types and several basic strategies. It also provides complete financial concepts and glossary. The trader not only learns about the implications of global trading but also can learn about capital management, various ways to review financial services which also include advanced technical analysis.

eToro Supported Cryptocurrencies

Currently, eToro is supporting a wide range of various cryptocurrencies. Few of them include Ethereum, Bitcoin, Bitcoin Cash, Dash, Ripple, Ethereum Classic, Litecoin, Cardano, Stellar, IOTA, EOS, Zcash, NEO, and Binance Coin. Further, few of the cryptocurrency trading pairs include –

- ETH/EOS

- BTC/XLM

- ETH/BTC

- EOS/XLM

- ETH/XLM

- BTC/EOS

Cryptocurrency Trading

Recently, eToro has added around 35 new fiat currency pairs on its platform which comes to a total of 44 currency pairs accessible to its users. The latest currency pairs cover different currencies and regions and are aimed at residents of countries like Australia, Canada, and Japan. Even though the broker has problems when compared to other forex brokers, the platform is well customized for traders who have a basic understanding of cryptocurrency and forex trading. It is a provider you should consider.

eToro Reviews – Cryptocurrency Trading

eToro wallet

- In the U.S, eToro had officially declared a cryptocurrency based trading platform along with a crypto wallet and Integrated mobile app that permits cryptocurrency purchases by using a credit card.

- Simultaneously, the multi-signature crypto wallet of eToro supports 6 cryptocurrencies such as Bitcoin, Ethereum, Bitcoin Cash, Litecoin, XRP, and Stellar with additional cryptos to be added shortly.

- eToro had also reviewed and declared that cryptocurrency mobile wallets had been made available for both Android and iOS device users.

- eToro wallet allows its users to –

- Store and manage several cryptocurrencies

- Can exchange crypto for crypto

- Can transfer cryptos from their eToro account, which is restricted to certain coins and Gold accounts.

Research Offering

Even though eToro offers a wide range of asset classes to trade, its prime focus is on FX and a market standard range of CFDs. Cryptocurrency trading is a big plus for this broker with a range of cryptos offered to its traders which gives an added advantage over other brokers. The main disadvantage is that it offers a reduced choice of CFD products around 500 stock options to trade. This might be a serious issue for traders who might want to invest in a small or medium-sized business.

Alerts and notifications

Traders can set notifications and price alerts easily. Further, eToro’s alert function allows the trader to know when the asset reaches a certain price target, and the trader gets a notification when the order is fulfilled. In the web platform, it is in the form of browser notification or an icon update; on mobile, it is seen as a push notification.

Client support

Traders can contact customer support either through live chat or through a web-based ticketing system where they receive a reply through email. On the other side, customer service cannot be reached on the weekends. Traders need to use a ticket and chat system to solve the issues. Moreover, there is FAQ database support available to help traders. eToro supports the customers by offering a wide range of languages which includes English, Spanish, German, Italian and French.

Educational Materials

- eToro offers a range of free educational materials to help traders with learning and research, but still, a long way to go. A review about eToro confirms that the training videos and the articles found on the site are very limited compared to educational materials offered by other forex brokers.

- One of the helpful tools is the ‘Guide’ section where the traders are taken an introductory tour on the website. The Q & A section explains how to execute a trade. Experienced traders can review and save by taking the site tour.

- One of the fundamental tools like an Economic calendar is available and provides valuable support for its traders. Even though the education and learning resources offered by eToro are satisfactory, they are not exceptional.

- Some of the features offered by this broker include Surveys, statistics, and the ability to communicate with the network about assessing them.

eToro’s Security

Shift to safety and risk management

- Concerning Security, eToro had registered itself with the British Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Also, FinCEN in the U.S and the Australian Securities and Investment Commission (ASIC) identify eToro as a licensed broker. Moreover, client funds are held in top tier European banks. This information about eToro alleviates the high risk of losing your money.

- Only specified information about clients can be accessed by eToro authorized employees. Needless to say, client data comes with high protection by using a top-class firewall technology and line data encryption technology, where the risk of losing data is minimized. When the customer is depositing or withdrawing money, their transactions are protected using a secure socket layer (SSL) technology to ensure that retail investors do not undergo losses as 75% of retail investor accounts lose money when trading CFDs with this provider or any other provider.

Risk Warning

There is a risk warning stating that 75% of retail investor accounts lose money when trading CFDs with this provider. You should carefully consider whether to trade CFDs with this provider and whether you can afford to take the high risk of losing your money.

The Popular Investor Program

One of the most important features that make eToro unique is its well known popular Investor program. When an investor has enough copiers on eToro, they get popular investor status and this can fetch them exceptional benefits and special fees. Clients are offered great incentives when they become popular investors because they receive a monthly payment from this broker and receive a special reduction of up to 100 percent, which enables popular investors to trade commission-free.

Drawbacks

- eToro platform does not offer traders the ability to customize graphs, draw lines or use indicators. To use the advanced, interactive graphs, one needs to click on “full screen” in the top right corner.

- Even though the mobile app is user-friendly, it is a bit basic for an active, tech-savvy, experienced trader. Traders might find that a few buttons and icons are not optimally used on mobile apps which can be a bit disturbing.

- The platform’s higher trading costs for forex trades and online-only customer support portal displays an environment where either the customer likes the platform or moves out.

- One of the major disadvantages of this broker is that it takes five long days for a withdrawal and has a withdrawal fee.

- Experienced traders and professionals who want to trade on copy based strategies should analyze and understand the risks and should take necessary precautions when needed. Professionals looking for a wider range of brokerage services, competitive costs, and good customer service should need to check out elsewhere.

- eToro is not an apt choice when a trader wants to trade with lesser-known cryptocurrencies; it is a good choice for those who want to trade on the most popular ones or who want to use the platform for both crypto and fiat trades.

- In cryptocurrency trading, if a trader needs to review and sort out real-time problems in trade, eToro does not offer any solution to this problem, where there is a chance of accounts losing money. This is one of the major causes of driving trader complaints.

Wrap up

eToro had come a long way since its inception and put itself ahead of several problems and issues. Moreover, eToro’s platform is highly functional without a learning curve and few interactions of the users are similar to that of twitter. The major disadvantage of this broker is its lack of appeal to tech-savvy and experienced traders. It is not advanced in terms of research and charting compared to other brokers in the market. Even though the general fee structure is okay, traders are not okay with a withdrawal fee of 25 dollar, and one of the major drawbacks is long response times whenever the trader tries to connect customer support with an issue.

On the other hand, eToro is one of the most prominent platforms when it comes to a wide range of options for an ultimate trading experience. The trading platform has gained remarkable traction over a short time span and is continuing to operate in the same way. eToro is a trading provider you should consider for a satisfactory trading experience.