Overview

Plus500 Pty Ltd was founded in 2008 and it offers online CFD service. Plus500 is a leading online CFD and Forex broker. Currently, Plus500 Ltd has built a platform that has a wide client base in Europe and Asia. At present, they do not offer services to US clients. Plus500 offers over 2000 financial instruments for the clients to trade. Investors recommend this broker as every financial instrument that they offer can help you make money in substantial amounts. Plus500 has a proven track record of success; you can opt to use Plus500 by opening an account and start trading with this financial services provider.

The trading market is subject to volatility; the market experiences both highs and lows. Your capital is at risk when you indulge in trading. 76.4 percent of retail investor accounts lose money when trading CFDs with this provider. So, it is better to analyze the market trends and consider whether you can afford to take the high risk of losing your money while trading. Also, consider whether you understand the technicalities of the trading market and then take your decisions based on how much money you can invest. Many trading accounts lose money due to overindulgence or wrong trading decisions.

You will find numerous reviews on Plus500 over the internet. Among all Plus500 reviews, ours is a comprehensive, well researched, and highly recommended as well. Let’s start by having a look at a few pros and cons of this broker.

Pros and Cons of Plus500

| Pros | Cons |

| Regulated Broker | No phone support offered |

| Website supports Multi-Language | No education materials provided for trading |

| Demo Account available | Details about news not available |

| Easy to use platform | Non-availability of advanced trading tools |

| Low trading fees | Meta Trader 4 not available |

| Plus500 is listed on London Stock Exchange |

Restricted product portfolio |

Why Plus500?

- Plus500 Pty Ltd is a well-known online CFD and Forex broker. The company was established in Israel. Presently, it has regional offices in Cyprus, the UK, Singapore, and Australia. This broker offers several trading instruments that can be traded on its various platforms.

- In Australia, Plus500 operates under the name Plus500AU Pty Ltd as a legal CFD trading provider. Plus500AU Pty Ltd has its main office in Sydney, Australia, and is authorised and regulated by the Australian Securities and Investments Commission (ASIC). Plus500AU Pty Ltd enjoys the license to provide trading for CFDs only.

Plus500 Review – Why Plus500?

- Plus500 has been listed on the London Stock exchange and is also included in UK FTSE 250 Index.Plus500 is the proud sponsor of the Atletico de Madrid football club, which is known to be one of the top football clubs in Spain.

- Plus 500 broker serves CFD and Forex traders by its regulated subsidiaries that possess licenses in some of the major financial hubs, which include the United Kingdom, New Zealand, Australia, Singapore, and Israel.

- Plus500 offers several tradable products such as Forex pairs, indices, Trading CFDs on shares, ETFs, digital assets, and options. To trade on the Plus500 platform, the traders can choose among mobile, desktop, and web-based trading platforms.

- Plus500 offers a wide range of tradable assets of 2000+ CFDs, 50+ currency pairs. Plus500’s range is higher and better than most other forex brokers available in the market.

- Plus500 is a well-known online contract for difference (CFDs) trading platform, which is associated with a holding company called Plus500 limited. This company is listed on the main market of London stock exchange which is operating through three different subsidiaries.

- Plus500 provides a variety of CFDs on top-most producers of medical cannabis-based products and cannabinoid derivatives like Aurora Cannabis, Tilray, and GW pharmaceuticals.

- Plus500 trading platform can be accessed in over 50 countries through several regulated and authorized entities across the world.

Is Plus500 Regulated?

When you are choosing a CFD or forex broker, you need to be very careful. The cryptocurrency and forex market is highly volatile; many trading enthusiasts lose money owing to wrong decisions. While choosing your broker, it is very important to check if it is a reliable and well-regulated platform or not. This goes a big way in defining the credibility of the platform.

The financial conduct and financial services offered by Plus500 is regulated and supervised by various prominent regulatory authorities. These include:

- The Cyprus Securities and Exchange Commission (CySEC)

- The UK’s Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Financial Markets Authority (FMA) of New Zealand

- The Financial Sector Conduct Authority (FSCA) of South Africa

- The Monetary Authority of Singapore (MAS)

- The Israel Securities Authority (ISA)

Plus500 Reviews – Explore Market!

Our Plus500 review suggests the following Advantages –

Some of the advantages of Plus500 are given below –

- Plus500 does not charge any commissions for its financial services. The charges are built into the spread, and the spreads are low

- Plus500 have multiple licensing and regulation in various countries

- It has tighter spreads and zero trading commissions

- It offers its traders risk advanced management tools such as guaranteed stop and trailing stop-loss orders to ensure that no trader accounts lose money while trading

- Plus500 offers its users exclusive multilingual customer support that is available 24×7

Negative Balance Protection

For Plus500 customer safety is the first priority. Plus500 offers its users negative balance protection for trading CFDs and Forex, which is only for retail clients from the European Union. Non-EU clients and professionals are not offered negative balance protection; which means if the balance in the account goes negative the trader’s account will be protected. This helps keep client money safe and clients can rest assured that their funds are properly protected.

CFDs are complex instruments and come with high risk and volatility. It is however advisable to analyze your financial standards and consider whether you can afford to take the high risk of losing your money by trading CFDs in this market.

Countries where Plus500 Can and Cannot be Traded

Within a short span of time Plus500 has spread its services worldwide. The platform accepts traders from the United Kingdom, Australia, Singapore, South Africa, Germany, Hong Kong, Sweden, Norway, Denmark, Italy, United Arab Emirates, Kuwait, Saudi Arabia, Qatar, Luxembourg, and various other countries. Plus500 is working aggressively to expand its services to more countries. The countries where Plus500 is not available are Iran, Belgium, Canada, United States, Zimbabwe, Nigeria, Cameroon, India, Thailand, Indonesia, Egypt, Brazil, France, Cayman Islands, Pakistan, and the Philippines.

Account Details

- Plus500 offers simple and easy account types that come with an equally easy and simple account opening process. It also offers one easy-to-use live account for the benefit of its users. This live account requires a min deposit of $100 from the traders to open an account.

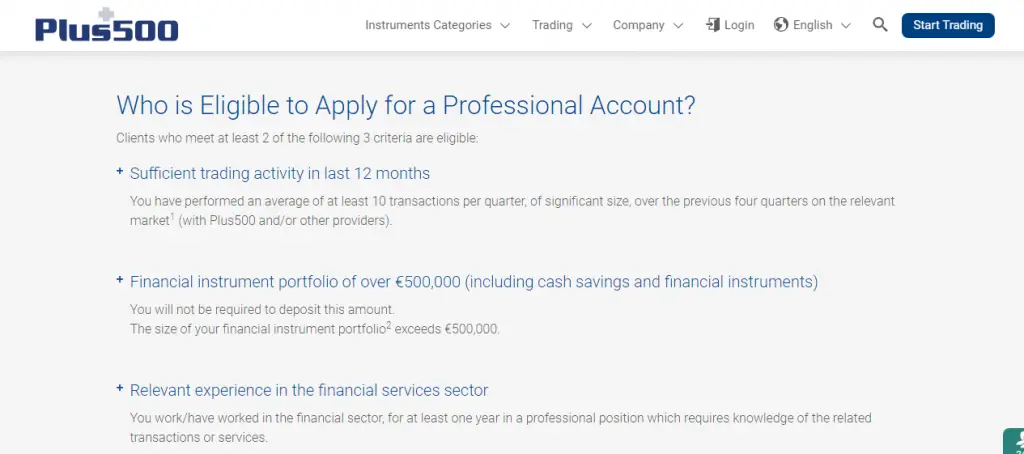

- Plus500 offers one CFD account to all its traders, at the same time it offers the traders a professional account if some of the conditions are met. Further, various services are offered to traders by this CFD broker having a pro account, which is common in today’s trading industry and required by several regulators.

- Leverage offered by Plus500 for the standard account is restricted to 1:30, yet the professional accounts enjoy an up-gradation of 1:300. The Australian entity regulated by ASIC offers leverage of 1:300 for standard account offering the best choice for traders.

Types of Account

Plus500 understands that the requirements and expectations of each trader differ. Plus500, therefore, offers two types of accounts that users can choose from as per their preference and financial status. Traders can either choose a real money account or demo account on the trading platform.

- Standard Account

The standard account offered by Plus500 is a basic live trading account which has a minimum deposit requirement of 100 dollars and maximum leverage of 1:30, where the spread is variable with no commissions.

- Professional Account

To apply for a professional account, existing traders should have done a minimum of 10 transactions per quarter for the past year. The trading activity can be done either through Plus500 or with other brokers. The total investment deposit of the trader must be at least 500,000 Euros. Professional traders can trade with leverage of 1:300 and can also get the benefits that are offered to retail customers at no additional cost. Investors have earned quite a bit of money from Plus500 through this type of account.

Plus500 Reviews – Accounts at Plus500

- Demo Account

The demo account offered by Plus500 is unlimited and free, i.e., no minimum deposit is required for account opening. This is because Plus500 wants its new traders to familiarize themselves with the trading platform and the market conditions. Registration with Plus500 is simple and very easy. The users are requested to fill a short form or they can log in with a Facebook or Gmail account; in that case, filling up the form is not necessary. Traders can have immediate access to the Plus500 web trader and they can start with the demo account immediately. Without practicing in a Demo mode, the trader might be prone to take the high risk of losing money. Many trader accounts lose money due to a wrong trading strategy.

Commissions and Fee

Presently, Plus500 offers only spread, which means that they do not charge commission. Plus500 revenue is derived only through its spreads. With Plus500, the spreads are very tight. Some of the brokers use floating spreads, but the variable spreads provided by Plus500 are very low which allows Plus500 as one of the most leading and competitive brokers in online trading.

Plus500 Review – Fees and Charges of Plus500

Fees

Plus500 gets its major share of revenue through spreads charged on more than 2000 instruments. Plus500 trading costs for major currency pairs are competitive. Swap rates on applied on overnight positions; an inactivity fee of 10 dollars per month is charged if there is no activity in the account for more than 3 months.

Additional Fees

The below fees are applied to the traders account based on their trading activity –

- Overnight Funding

An overnight funding amount is added or subtracted from the trading account when holding a position after a certain specified time; it is also referred to as “overnight funding time”.

- Currency Conversion Fee

Plus500 levies a charge for currency conversion fees for all instruments and trades denominated in a currency that is different from the currency traded in the bank account. Also, the currency conversion fees will be seen in real-time into unrealized profit and loss of an open position.

- Guaranteed Stop Order

A guaranteed stop order is a unique order type that is used to manage the risks by ensuring the stop loss level. This is a good feature that makes sure that no trader accounts lose money. Considering whether the trader chooses this feature, it guarantees that the position closes at a certain requested rate, and it is subjected to a wider spread.

- Inactivity fee

A $10 fee per month is levied to the trader if they do not log in to their account for three months. This inactivity fee is charged once a month from that month onwards, so long as no login was done in the account.

Deposits & Withdrawals

- There are several deposit options and withdrawal methods offered by Plus500. Normally, there are no withdrawal and deposit fees. For 5 times in a month, you can withdraw money free of charge; after that Plus500 charges withdrawal fees of $10 for each withdrawal. Withdrawals done by bank transfers attract a charge of $6.

- Plus500 does not levy any charges for a normal withdrawal request or termination of account. However, it charges inactivity fees if the account has been idle for a period of 3 months.

- Every deposit should come from the Plus500 account holder’s bank card or e-wallet account. Plus500 does not accept third party transfers, but transfers done from joint accounts are accepted with supportive documentation.

- The banking aspect of Plus500 is uncomplicated and easy; there are several methods to fund an account, which are given below.

Payment methods offered by Plus500

As mentioned earlier, the Plus500 ecosystem is very simple and straightforward, which includes an easy verification process for opening an account, swift deposits and withdrawals, and equally user-friendly payment methods. You can choose any payment method as per your convenience.

- Credit cards/debit cards

- Visa

- Mastercard

- Bank wire transfer

- PayPal

- Skrill

- Ideal

- Bank transfer

- Bpay

- Sofort

- Giropay

- Trustly

- Przelewy

- Multibanco

- MyBank

Minimum Deposit

If a trader would like to start trading with real money, then they have the option to deposit money in their account. In this way, the trader can trade with their funds in Plus500. Plus500 asks its traders for a minimum deposit of 100 dollars/Euros. This is the lowest deposit amount when compared to the other brokers who have a minimum deposit of 10,000 Euros; in comparison with that, it is a very reasonable deposit amount.

Placing orders

The traders can select the following order types –

- Market

- Limit

- Stop

- Trailing stop

Investment Products

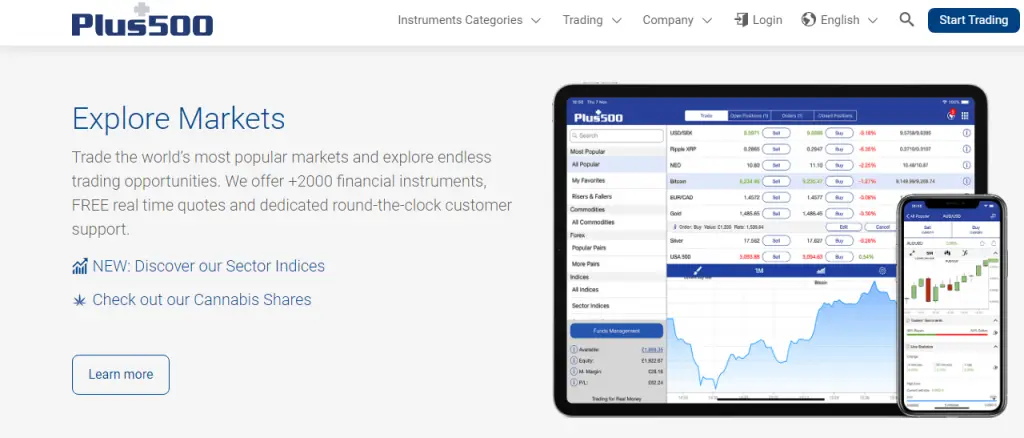

- Our Plus500 review ascertains that it offers a wide choice of asset selection for retail traders through a portfolio of management operations. More than 2000 CFDs are offered across cryptocurrencies, forex market, equity, indices, commodities, options markets, and ETFs. Users can diversify their portfolio and take advantage of the opportunities across the world for trading.

- The wide range of choices of assets offered by Plus500 is very highly useful for professional traders, which allows them to invest in various markets, according to their investment choices. Nonetheless, new traders should be extremely cautious when choosing their assets as it can be confusing. They might also see their accounts lose money if they don’t carefully plan their investment properly.

- Leverage can be described as an amount the trader can increase the value of trade. Plus500 offers maximum leverage of 30:1 for its traders.

Plus500 Reviews – Instruments Available at Plus500

Security

Plus500 pays extra emphasis on the safety and security of clients funds as well their entire ecosystem. To prove the Identity of a trader while login, this security-focused trading platform Plus500 has executed a two-factor authentication (2FA) which involves sending a confirmation code. This is sent immediately to the trader’s email, app, or to phone to verify their identity. This code expires after a few minutes; this is in addition to regular user id and password.

Data Protection

To detect identity thieves, malware and other cyber attacks, all Plus500 platforms and websites are highly protected using a secure socket layer (SSL); this makes sure that all the data entered into the platforms and websites are encrypted during transmission. Traders are ensured that sensitive data such as credit card and debit card details will not be stolen or intercepted by cyber attackers.

Client Funds

Complying with the regulatory policies, Plus500 keeps the trader’s funds in segregated bank accounts; and the client’s funds are not used for hedging. Plus500 uses its funds for hedging; they also offer confirmation that they do not invest in retail client’s funds. If Plus500 goes bankrupt, the financial services compensation scheme (FSCS) located in the UK, may offer each client up to 85,000 Euros.

Advantages of using Plus500 Trading platform

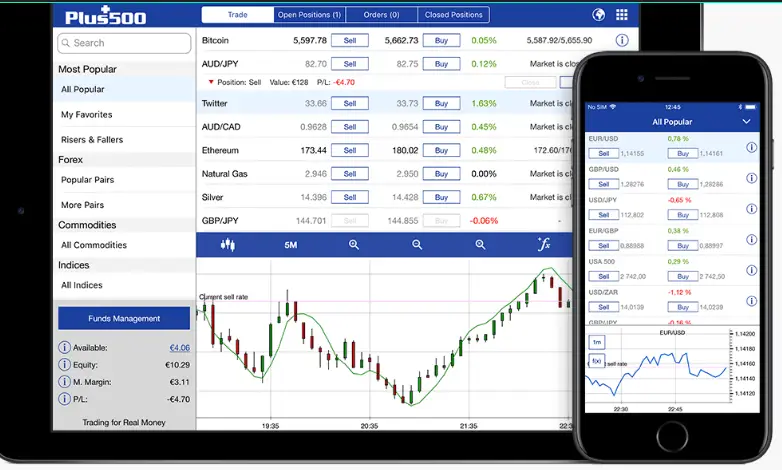

- Our review on the Plus500 trading platform is that it is simple and comprehensive to use. The platform permits its traders to trade in various markets from one screen when offering quotes in real-time.

- One of the advantages of using the Plus500 platform is its usability. The platform allows its traders to trade safely and earn money by trading in various financial instruments such as commodities, forex, ETFs, indices, stocks in one trading platform.

- The Plus500 trading platform is available in three different versions. There is a mobile version, a downloadable version, and a web-based version. The web-based version allows the traders to access their accounts through any computer. The downloadable version can be saved to the personal desktop or laptop. The mobile version allows traders to engage in mobile trading from their mobile device.

Trading Platforms

- Plus500 offers a proprietary trading platform, which is user-friendly yet, very swift and efficient. The trading platform is available in 32 different languages.

- The Plus500 trading platform is accessible in several formats like Windows 10 trader, web trader, Android app, iPhone /iPad, and Windows phone app. Plus500 WebTrader platform is easy to access from any web browser. Also, it comes with advanced charting where the trader can add their indicators, choose different chart views like candlestick and bar charts, and can trade directly from their charts.

- Plus500 offers traders only proprietary trading platforms. When compared to its competitors who have Metatrader suite of platforms. Our Plus500 review reveals that the platform is designed to have new traders in mind and it is best known as the user-friendly platform in the trading industry.

- On the advantages for beginner traders is, they can place trades and navigate through different assets very easily. One of the disadvantages of Plus500 is it does not support automated trading, third party plugins, and critical trading functions for experienced traders.

Plus500 Review – Trade with Plus500 from Any Device

Various Trading Platforms Offered by Plus500

- iPhone / iPad

- Windows Phone App

- Android App

- Windows 10 Trader

- WebTrader

Mobile Trading

- Plus500 offers a unique trading platform for mobile app users. The mobile platform is available on IOS, Android, and Windows phones.

- The mobile version of the trading platform is available for traders, who would like to trade the markets just by using their smartphones or mobile instruments. The mobile trading app is provided free of charge and can be downloaded directly from the Apple app store or Google play store.

- The mobile app is fully functional and provides all trading options that the web-based versions have. It is a single click download and trading through the app is very quick and simple. Also, the feel and the look of the web-based platform and mobile platform are the same; by making the transition among the two platforms easier.

- Both IOS and Android versions maintain the same low trading fees, rates, and spreads, etc and trading portfolio is retained around all platforms.

Plus500 Review – Plus500 Mobile Trading

Features of Mobile app –

- Easy to trade

- Free push and email notifications on market conditions

- Alerts on price movement and percentage changes

- Linking of bank accounts and tracking of finances is easy

Trading Features

- A guaranteed stop feature can be used to stop a trading position at a specified price. It is usually done to prevent any further losses. Yet, this feature is not accessible for every instrument.

- Trailing stop feature locks in the profit and closes order when the market changes direction; if the market is in good condition, the order remains open. It limits losses and takes over the profits. One of the disadvantages is that the closing market prices are not guaranteed.

- “Close at profit” and “close at loss” price levels – this feature enables the trader to set the precise price at which the trade position should close, either make a profit or limit loss. If the market suddenly drops or goes up higher than the set level, slippage might occur and the closing price will not be precise.

Alerts

- Plus500 trading platform offers features like real-time quotes through SMS, email, and push notifications which are based on price movements, trader sentiment, and change percentage. This price and percentage are already determined by the trader.

- The trader can set an alert to be notified when a specified trading instrument reaches a certain price or when the price changes with a certain percentage.

- Trader’s sentiment offers an analysis of the trading activities of other Plus500 traders. Traders can be notified when a certain percentage of Plus500 traders buying or selling a particular instrument reaches a certain percentage.

Plus500 Review – Get Alerts on Plus500

Other features

- Some of the features offered by Plus500 are customizable, and it is easy to use charts for technical analysis and these can be saved. There is also an advanced search option available for its traders to find any instrument for reviewing.

- The platform offers charting tools that are not as extensive as MT4 or MT5 platforms. Further, it offers an economic calendar on the portal and the website.

- There is no daily market news or daily technical analysis. However, there are push notifications, emails, and SMS market updates that are offered by Plus500.

Customer Service

- The customer support offered by Plus 500 is available in several languages. The website of Plus500 is available in 32 languages and the support is available 24/7.

- Traders can have access to customer service round the clock through live chat, email support, or Whatsapp. Plus500 offers a FAQ (frequently asked questions) section which covers the most preliminary questions.

- The website covers 32 languages and customer support is also multi-lingual. Social Media support is also offered.

Research and Education

Unfortunately, the Plus500 broker does not offer research. Our review of Plus500 is it has very little to offer for its traders when it comes to research, tools, commentary, and analysis. Plus500 review shows that there are no news feeds, yet they do offer economic calendars which are a great feature. Plus500 does not offer customizable charts when the traders conduct technical analysis on any instrument while considering a trade. It offers a traders sentiment indicator that presents traders on what percentage other traders are buying an instrument like EUR/USD currency pair, and what percentage they are selling them. You need to do your own research. You need to analyze the market trends and consider whether you can afford to take the high risk of losing your money in this highly volatile market.

Drawbacks

- One of the major drawbacks of Plus500 is it does not offer the MT4 platform, which is widely used by the traders. Rather, it offers a proprietary trading platform that is very easy to use and functional. It can be used on all devices like tablets, computers, or smartphones.

- Several brokers provide videos, courses, eBooks, and quizzes, to help traders to learn about the markets in investing their money. Plus500 broker does not offer any of the services. Traders have to be careful in your trading decisions so that their accounts lose money by no means.

- Even though Plus500 is a trusted global brand which offers easy to use the platform, it does not offer trading tools, competitive research, and exhaustive educational resources which can be really helpful to newbies looking to put their money into the market.

- Plus500 broker does not offer any special features. It does not offer automated trading through expert advisors or any other trading algorithms. It neither provides backtesting functionality nor does it allow its traders to manage third-party funds.

- Plus500 broker does not offer educational materials which are a huge disadvantage. Further research materials or technical analyses are provided by this broker.

- Plus500 platform is very easy to use; it offers a great user experience, even the new users can navigate easily. Spreads are very competitive, yet financing rates are high, few advanced research tools might be useful for the experienced traders.

Risk Management Tools

- Trailing Stop

- Guaranteed Stop

- ‘Close at Profit’ [Stop Limit] or ‘Close at Loss’ [Stop loss] rates

Plus500 Reviews – Risk Management Tools of Plus500

Wrap up

Plus500 Pty Ltd has been in the trading business for over a decade, and they have clients around the world. They are properly regulated by the financial authorities in various countries; plus500uk ltd is authorised by Financial Conduct Authority (FCA), in Cyprus by Cyprus Securities and Exchange Commission (CySEC), in Australia by Australian Securities and Investments Commission (ASIC), in New Zealand by Financial Markets Authority (FMA) of New Zealand, and in South Africa by Financial Sector Conduct Authority (FSCA) of South Africa.

The trading platform offered by Plus500 is user-friendly, simple, fast, and secure. This platform can be used across multiple devices and operating systems. It offers a wide range of financial services and financial commodities to trade in, including a number of currency pairs. Plus500 broker is the best for a cost-conscious trader; this broker has very competitive spreads which keeps the costs very low. However, additional features such as auto-trading, MT4, and expert advisors are not available with this broker. It is a financial services provider you should consider.