What To Know

- Record ETH outflows signal growing investor trust and accumulation.

- Falling exchange reserves indicate rising buying pressure on Ethereum.

- Altcoin Season Index shows Bitcoin dominance delaying Ethereum’s major rally.

Like most cryptos of late, Ethereum (ETH), the king of altcoins, has also remained stagnant over the past week as it moved sideways. This sluggish price momentum might have had an impact on investor sentiments, which resulted in a 9% drop in its 24-hour trading volume.

However, while the king of altcoins laid low, a key ETH metric registered a massive movement, which indicated massive rising trust among investors in Ethereum. Let’s find out what’s happening.

Are Investors Putting Their Trust on Ethereum?

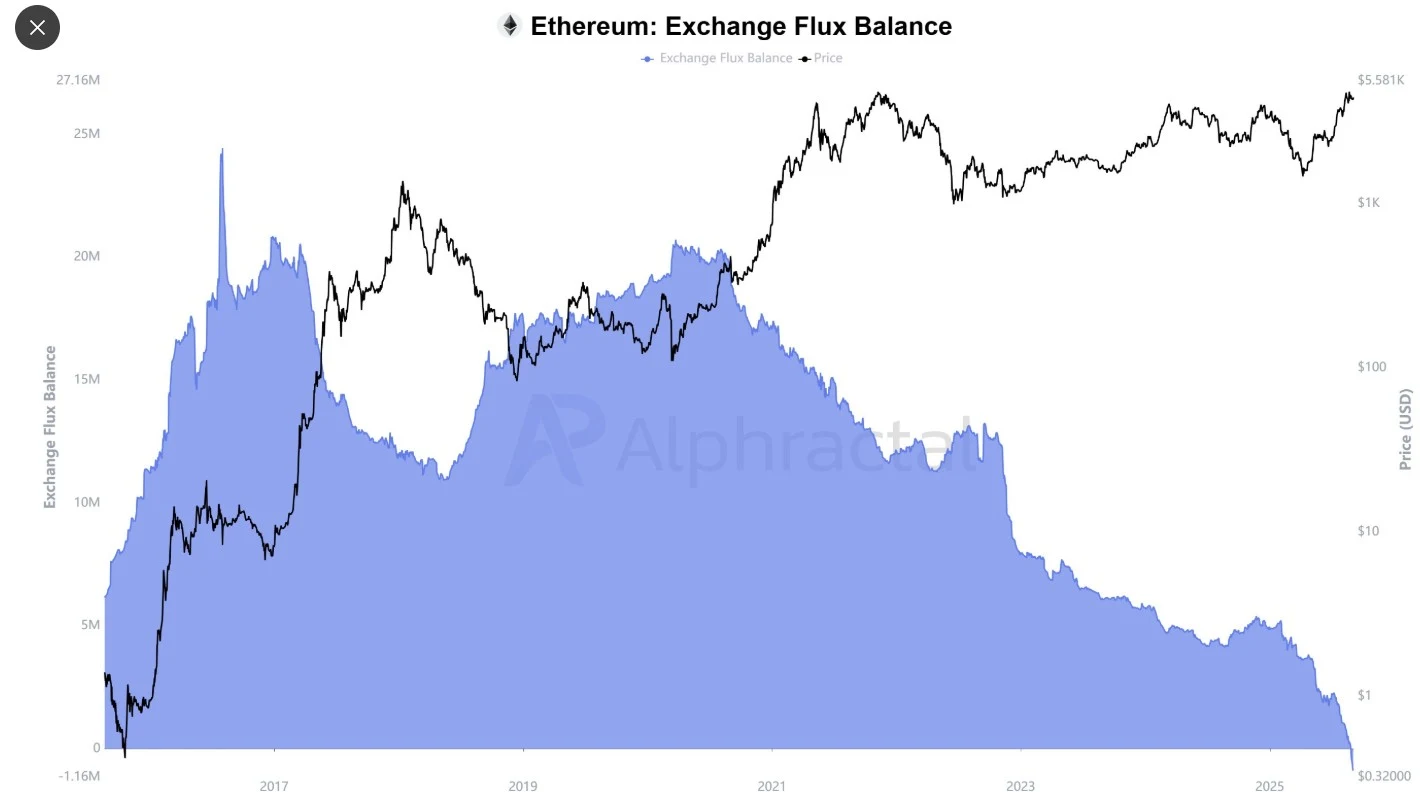

Ethereum has recently hit a historic milestone that could shape its price trajectory in the near future. ETH’s Exchange Flux Balance has turned negative, signaling a significant shift in investor behavior.

As per a tweet by Joao Wedson, founder and CEO of Alphractal, a popular data analytics platform, the Exchange Flux Balance is a metric that measures the cumulative netflow of assets across all exchanges by calculating daily inflows and outflows. A positive balance indicates more deposits than withdrawals, usually pointing to increased selling pressure. Conversely, a negative balance shows more withdrawals than deposits, suggesting that investors are pulling assets off exchanges—often interpreted as a sign of accumulation and long-term confidence.

With billions worth of ETH flowing out of exchanges, not-so-trivial holders are choosing to store tokens in private wallets instead of leaving them readily available for trading. This behavior is a sign of increased trust in the long-term potential of Ethereum, with investors appearing less interested in selling off for short-term gains. Instead, they are more focused on holding through market cycles.

Historically, such accumulation patterns would mostly precede price rallies, considering the scarcity generated by low mining supply on exchange platforms could create demand. Gelling with this notion, a negative Exchange Flux Balance for Ethereum amid a general bullish ethos in the crypto market has led many analysts to believe that this is an early sign of a big upward price movement for ETH.

In short, this surge in outflows underlines growing confidence in Ethereum’s future, strengthening the narrative that the second-largest cryptocurrency might be gearing up for a substantial rally soon.

What Other Metrics Suggest

CryptoMoonPress’ assessment of Ethereum’s current position also revealed a similar scenario, where confidence among investors was seeming to build. As per CryptoQuant’s data, ETH’s exchange reserve has been falling since April 2025.

Since then, it has declined dramatically, and at press time, the ETH exchange reserve stood at 17.3 million ETH. This suggested that buying pressure was rising, a clear indicator of a possible bull rally in the weeks or months to follow.

One Obstacle Remains

Though the aforementioned data set looked pretty optimistic for ETH’s future, there lies a problem. The Altcoin Season Index raised a red flag. For beginners, the Altcoin Season Index is a key market indicator that points out whether Bitcoin or altcoins are dominating the market. A value above 75 indicates a clear altcoin season, whereas a number closer to under 25 suggests Bitcoin dominance. At press time the indicator had a value of 59, signaling that it would take longer for Ethereum to kick start a major bull rally.

In a Nutshell

In conclusion, record withdrawals of ETH and falling exchange balances symbolize investors’ confidence being accumulated–both are bullish signals in history. The altcoin season index suggests that Bitcoin still remains in control, yet the upward trend in ETH fundamentals must not be ignored.

Given proper market conditions, we could be looking at a strong rally built on outflow trends from recent days. While investors seem to speculate more on the long-term potential of Ethereum, this makes the asset a window to watch quite closely.