What To Know

- Ethereum whales accumulate billions despite a 13% weekly price decline.

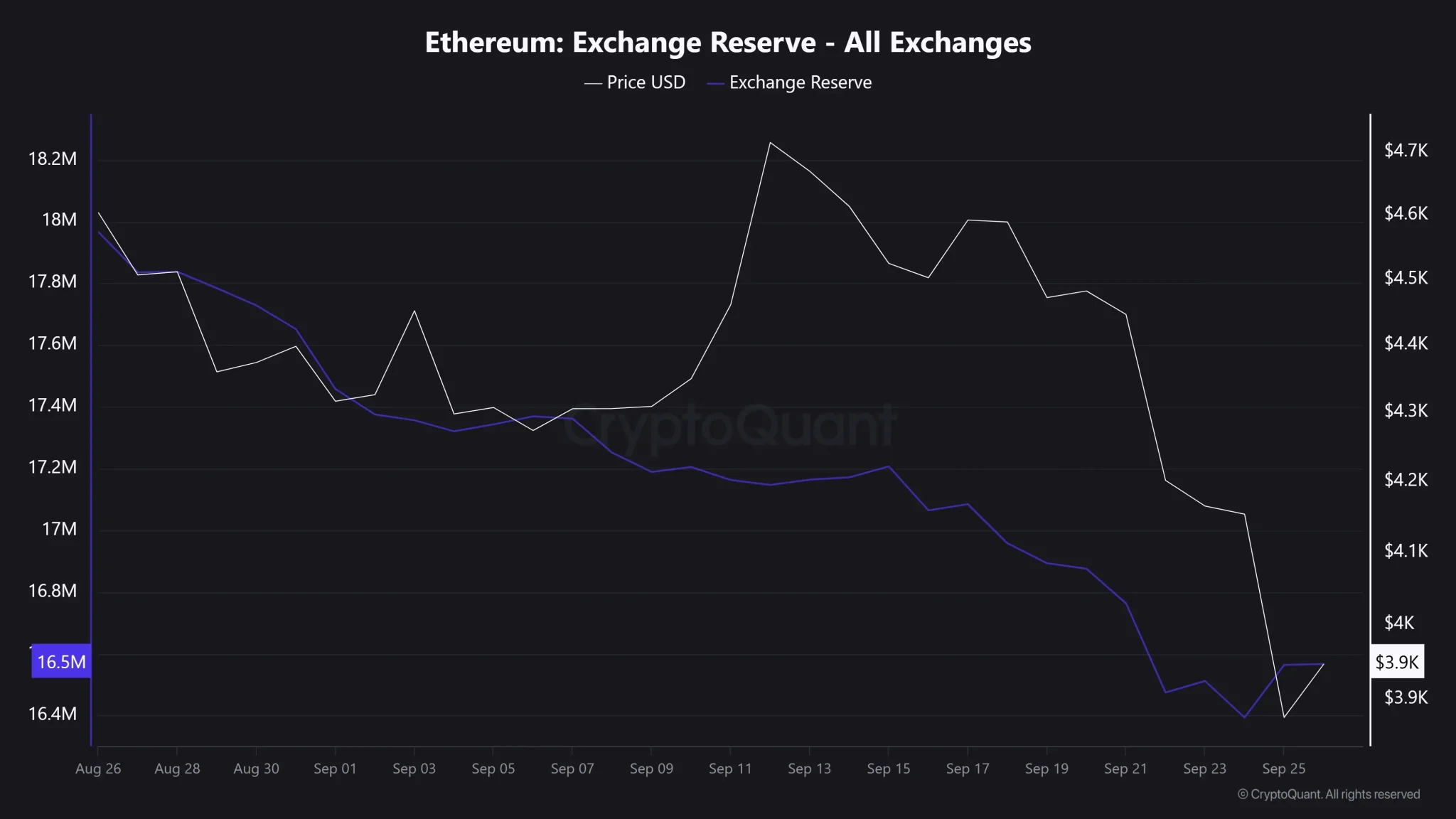

- Falling ETH exchange reserves signal strong investor confidence and reduced sell pressure.

- Technical indicators suggest bullish golden crossover, with key $4,050 resistance ahead.

Even in a turbulent market, marked by a relentless torrent of volatility, a counterintuitive signal-of-strength formation has started to emerge: whales are buying Ethereum (ETH). The price changes are enough to send a shiver down the spine of any retail investor; these big-volume holders are aggressively buying ETH, a signal of their deep-seated conviction in its long-term worth.

Calling this “buying the dip” before a massive rally is mostly justified. Ergo, CryptoMoonPress planned to investigate whether this bullish whale accumulation would translate into price hikes for Ethereum in the coming weeks.

Ethereum Whales in Action

The second-largest cryptocurrency, Ethereum (ETH), saw a 13% plunge last week, yet the whales and institutional investor worlds still strongly focus on it. ETH is trading for $3,942.07 at press time and has over $375 billion in market capitalizations as per CoinMarketCap, making it one of the most dominant economic assets in the world of digital economy.

What makes this situation more interesting is that alongside this price drop, the huge whale accumulation continues to go on behind the scenes in large volumes. With 15 wallets involved, 406,117 ETH worth $1.6 billion were bought in Kraken, Galaxy Digital, BitGo, and FalconX, all within two days, data from Lookonchain, a popular X handle involved in tracking blockchain activity, suggests.

This follows a previous report where Lookonchain captured 11 wallets buying up 295,861 ETH worth $1.19 billion in one day from these sources. The steady accumulation by these big players tells that they see big profits on ETH’s growth and long-term viability despite short-term volatility.

Whales keep accumulating $ETH!

15 wallets have received 406,117 $ETH($1.6B) from #Kraken, #GalaxyDigital, #BitGo, and #FalconX in the past 2 days.https://t.co/YXZyneFrFR pic.twitter.com/T2YDClezW9

— Lookonchain (@lookonchain) September 26, 2025

From an application perspective, Ethereum also possesses inherent strength in its ecosystem activity. Currently, the price of ETH stands at about 1.39 times of its ecosystem’s total value locked (TVL), i.e., total value deposited in application contracts running on such chains. Top ranking decentralized applications such as Tether, Aave, Circle, Lido Finance, EigenLayer, SkyEcosystem, Ethena Labs, Ether.fi, Pendle Finance, and Spark Protocol continue to add unparalleled utility to the Ethereum chain.

Ethereum trades at ~1.39x ecosystem TVL.

Ecosystem TVL: sum of funds deposited into the applications on the chain.

Top 10 apps by TVL: @Tether_to, @aave, @circle, @LidoFinance, @eigenlayer, @SkyEcosystem, @ethena_labs, @ether_fi, @pendle_fi, and @sparkdotfi. pic.twitter.com/mSNHYZPFK1

— Token Terminal 📊 (@tokenterminal) September 25, 2025

This whale confidence and ecosystem supremacy combined tell a very interesting story: While short-term market corrections could filter out weak hands, the broader market tone is bullish for Ethereum.

Will This Result in a Price Hike?

One of the biggest bullish signals is the falling exchange reserves of ETH, going from 17.9 million ETH currently to 16.5 million in recent days. When exchange reserves fall, this generally means investors are taking their holdings off centralized exchange platforms to private wallets, staking platforms, or long-term custody offerings.

This is widely bullish in nature, reducing short-term sell pressure on the market, while indicating holders’ confidence in Ethereum’s long-term valuation and hence lower inclination to liquidate their holdings. In other words, while there are very few tokens available for sale, it generates strong upward momentum once demand increases.

On the back of the bullish narrative, CryptoMoonPress noted some encouraging technical indicators on the Ethereum price chart. The MACD (Moving Average Convergence Divergence) indicates, with strong potential, a bullish golden crossover-an event that has by and large been associated with upward price movement in the past.

On the other hand, the Money Flow Index (MFI) has slipped into the oversold territory, which means that most likely, the selling pressure is now exhausted, and with renewed buying momentum, the price could bounce.

Another test for buyers could be the $4,050 resistance level of Ethereum if buying activity actually starts as predicted. A breach above this level could open the door to a fresh bullish move.

Once ETH surpasses the $4,050 threshold, one may expect the token to undergo consolidation between $4,050 and $4,200 before another push higher is attempted.

Such a consolidation phase in the price action would allow the market to digest recent volatility while simultaneously allowing stronger support to be built for the actual next rally of Ethereum. With continued accumulation and technical momentum, Ethereum may well be setting the stage for a more persistent breakout in the near future.