- 200,000 Ethereum withdrawn from exchanges, signaling rising investor confidence.

- Whales accumulate 500,000 ETH in 48 hours, reducing market supply.

- Ethereum faces strong $4.8k resistance; breakout could ignite bullish rally.

Ethereum (ETH) has been trading comfortably above the $4k mark for quite some time now. Though this looks optimistic, it has failed to meet investors’ expectations, as it failed t touch the $5k mark, which, if achieved, could kick off an altcoin rally.

The good news is that the storyline can change soon as buying pressure on the king of altcoins has increased substantially over the last few days. Ergo, let’s take a closer look at Ethereum’s current state to understand whether this rising buying pressure could translate into a bull rally.

Ethereum–Buying sentiment is rising

As mentioned earlier, the king of altcoins, Ethereum (ETH), has managed to sustain its price above the $4,000 mark for an extended period, signaling strong bullish momentum. At the time of writing, ETH was trading at $4,772.75, boasting an impressive market capitalization of more than $576 billion. This surge comes on the back of a remarkable 30% price increase in the past month, further fueling optimism among investors and market participants.

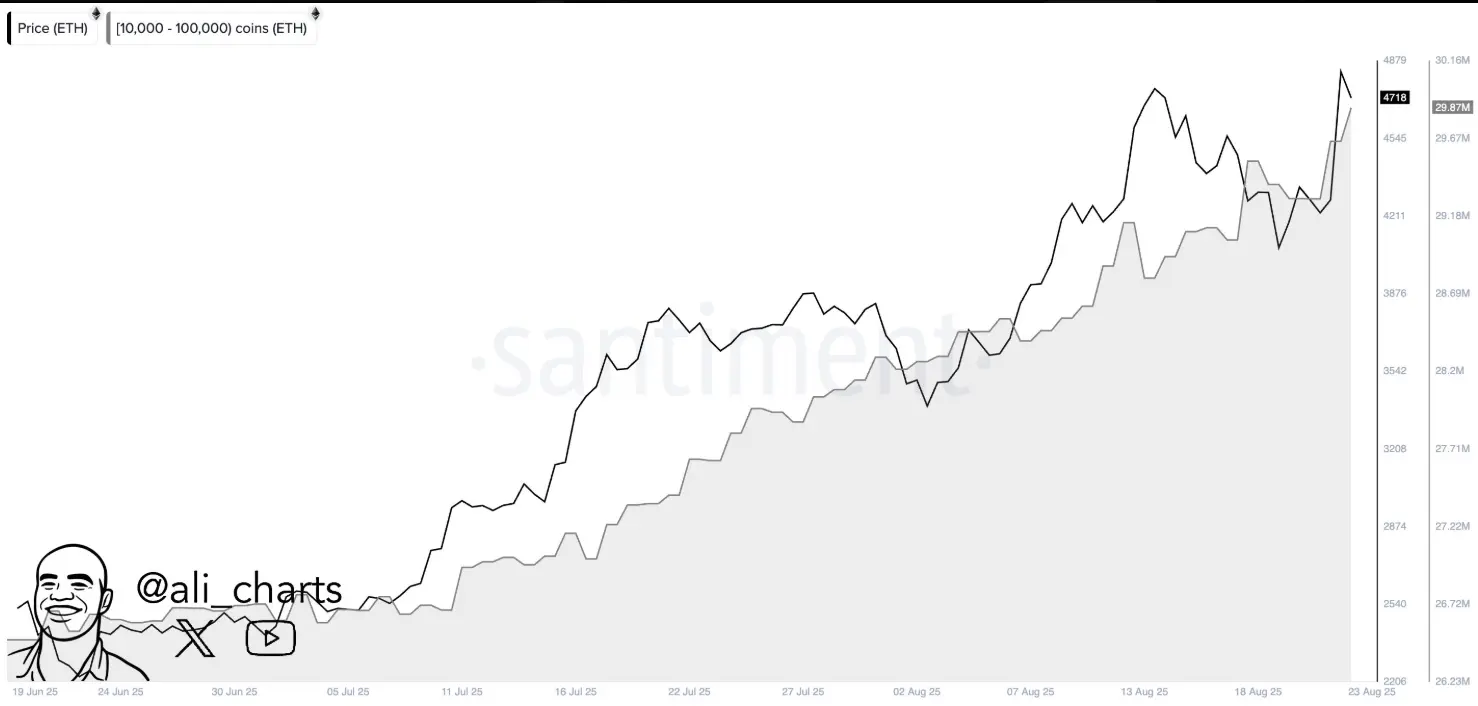

While this upward momentum has been building steadily, analysts have also highlighted an intriguing market development that could further strengthen ETH’s bullish outlook. Renowned crypto analyst Ali Martinez revealed on X that a significant amount of Ethereum has been withdrawn from crypto exchanges.

In just 48 hours, nearly 200,000 ETH left exchanges, suggesting that large investors and institutions might be moving their holdings into long-term storage. Such massive outflows typically reflect strong confidence and reduced selling pressure, often preceding further upward rallies.

ETH Whales are also making their move

Apart from retail investors showing confidence, the big-pocketed players of the crypto market, often referred to as whales, were also demonstrating strong interest in Ethereum (ETH). This indicates that not just small traders but also large institutional investors and high-net-worth individuals are positioning themselves heavily in the asset.

Ali Martinez further highlighted this trend in a recent tweet, revealing that nearly 500,000 ETH were accumulated by whales in just 48 hours. Such massive accumulation within a short span not only signals strong conviction among large investors but also reduces available supply, potentially fueling ETH’s bullish momentum.

What to expect in the short-term?

The overall market sentiment, coupled with Ethereum’s (ETH) recent price action, hinted that the possibility of a bullish rally remains strong. Investor confidence appears to be growing steadily, supported by consistent accumulation and reduced selling pressure. However, given the notoriously volatile and unpredictable nature of the crypto market, it is difficult to state with absolute certainty whether ETH will immediately break out. To gain more clarity, we turned to the token’s daily price chart to assess what technical indicators suggest.

Interestingly, ETH faced rejection at the $4.8k resistance level not once, but twice, indicating the presence of a strong supply zone. This makes the $4.8k mark a critical hurdle for ETH in the short term. If the king of altcoins manages to decisively breach this barrier with strong volume support, it could potentially ignite a new leg of upward momentum. Until then, investors are keeping a close eye on this key resistance.

Unlike the datasets mentioned above, the technical indicator On-Balance Volume told a different story as it declined. A decline in OBV indicates increased selling pressure, where volume on down days outweighs volume on up days, suggesting a potential for the price to move lower.

The OBV indicator creates a cumulative line by adding volume on days the price closes higher and subtracting volume on days the price closes lower, so a falling OBV signifies a decrease in buying pressure and potential selling pressure. If this results in a bearish takeover, then ETH might as well fall to $4k.