- Bitcoin Rainbow Chart places BTC in BUY zone, signaling strong upside potential.

- Historical patterns suggest Bitcoin market top could arrive by October 2025.

- Short-term indicators hint at bearish momentum despite long-term bullish outlook.

Bitcoin (BTC) investors are currently relaxing as the king of cryptos has been comfortably trading above $100k for over a month now. This has even sparked excitement in the community regarding BTC skyrocketing once again, if market conditions support. The good news is that if historical trends are to be considered then investors might soon witness yet another Bitcoin bull rally.

Bitcoin market top around the corner

As volatility in BTC’s price eased, investors found some relief as the world’s largest cryptocurrency maintained a relatively stable trading range between $112,000 and $118,000 throughout the past week. This phase of consolidation allowed market participants to closely observe Bitcoin’s movements without facing the extreme price swings seen in earlier sessions.

According to CoinMarketCap’s data, BTC was valued at $115,145.35 at the time of writing, boasting a massive market capitalization of more than $2.29 trillion. Such stability in Bitcoin’s price action often signals cautious optimism among investors, who are waiting to see whether the trend shifts bullish or bearish.

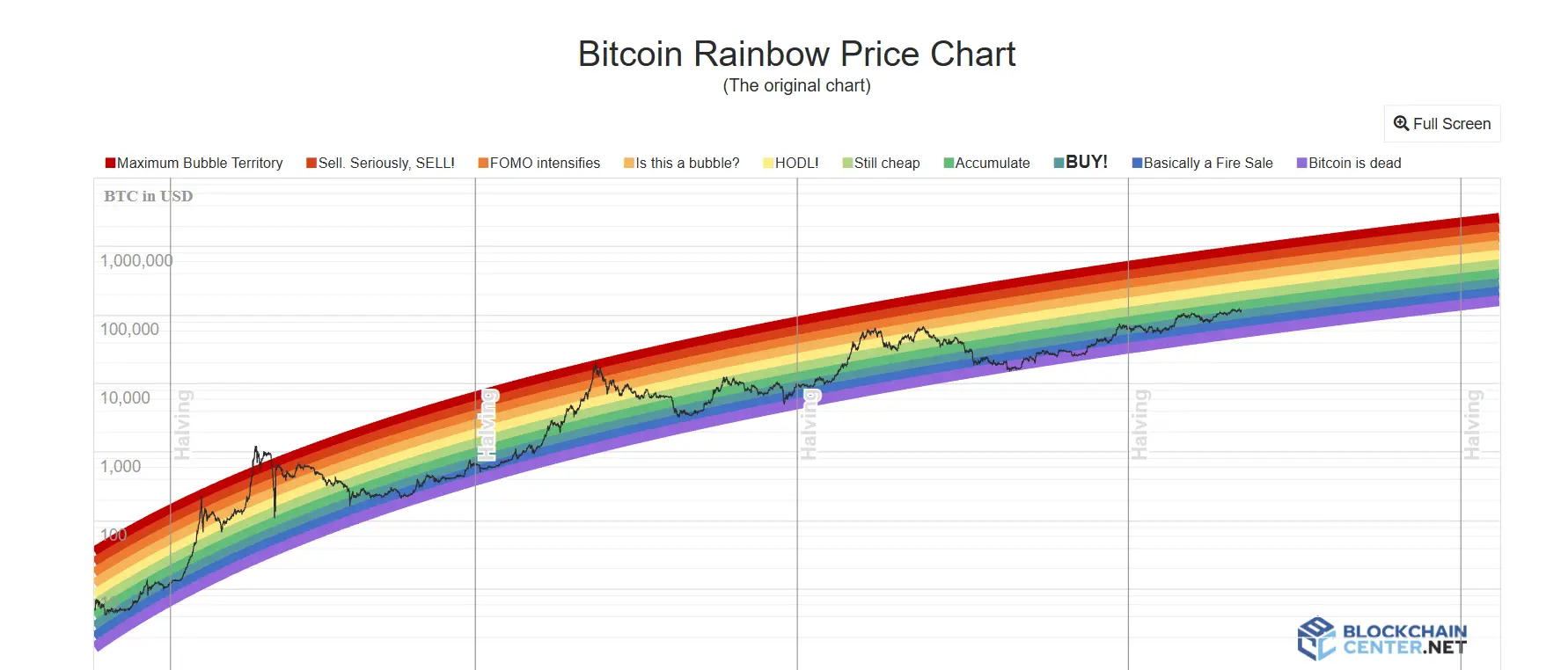

Meanwhile, a crucial Bitcoin indicator has started flashing a strong buy signal, sparking optimism among traders and long-term holders. The popular Bitcoin Rainbow Chart, which helps visualize BTC’s historical price performance against different valuation bands, revealed that the current price level is firmly placed in the BUY zone.

This suggests that Bitcoin is undervalued compared to its long-term potential, making it an attractive entry point. Such signals often indicate a higher probability of upward momentum, hinting that BTC’s price may witness a steady rise in the coming days.

There is more to the story as a well-known crypto analyst, Ali Martinez, recently shared an interesting historical pattern on X. According to him, Bitcoin’s past two market cycles provide valuable insights into what could happen next. Martinez pointed out that in both the 2015–2018 and 2018–2022 cycles, Bitcoin witnessed substantial price growth before eventually reaching its peak in October of the final year of the cycle.

This recurring pattern suggests that Bitcoin’s behavior might not be entirely random, but instead aligned with certain cyclical trends driven by market sentiment, adoption, and macroeconomic factors.

Based on this analysis, if Bitcoin continues to follow the same trajectory as before, the next major market top could be just two months away. That would place the projected peak around October 2025, raising excitement among investors and traders who are closely watching for bullish signals.

If this prediction plays out, Bitcoin could enter a parabolic phase in the coming weeks. This could potentially set a new all-time high. While historical patterns are not guaranteed indicators of future performance, such insights often fuel speculation and optimism in the crypto community, further amplifying market momentum.

What to expect in the short-term

It was interesting to note that while the historical pattern gave a bullish notion for October, things in the short-term didn’t seem much exciting. Bitcoin’s daily chart suggested that the king coin’s price was moving inside a parallel channel, suggesting predictable volatility. On top of that, BTC’s Chaikin Money Flow (CMF) registered a downtick. AA decline in the Chaikin Money Flow (CMF) signals a shift from accumulation to distribution, highlighting growing selling pressure and fading buying interest.

This shift suggests that traders are offloading their holdings rather than accumulating more. As a result, the probability of Bitcoin’s price trending downward increases significantly, hinting at potential bearish momentum in the near term. Therefore, considering all the aspects and historical patterns, it’ll be quite interesting to watch which way BTC heads when we conclude the 3rd and enter the 4th quarter of this year.