What To Know

- Bitcoin holds steady near $117k, testing the crucial $115k support zone.

- Analysts eye $137,300 target if Bitcoin defends its key support level.

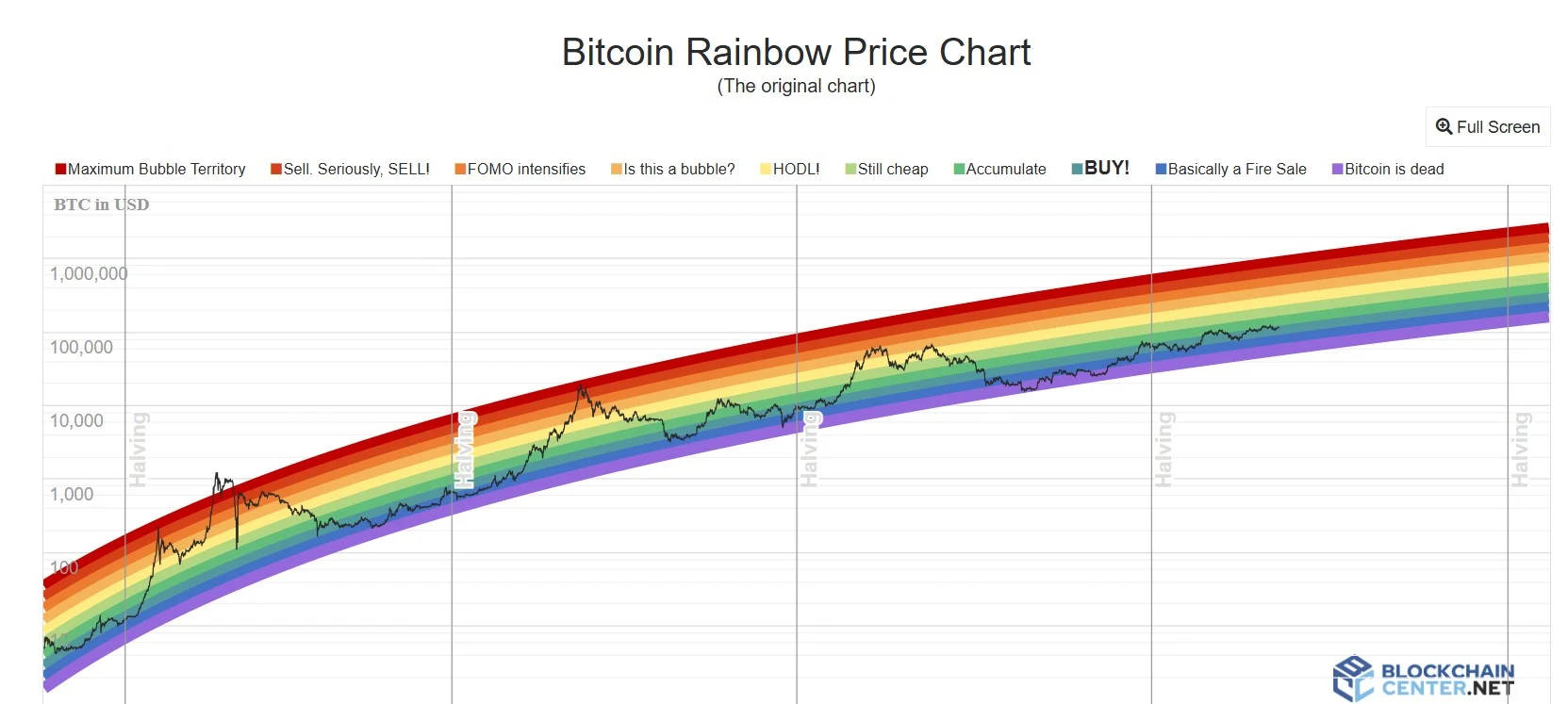

- Rainbow Chart flashes buy signal as funding rates hint at bullish sentiment.

Bitcoin (BTC), the king of cryptos, has been on a conformable ride over the past few weeks as it sits well above the $110k mark. This sustained trend has sparks confidence among investors and have given them confidence to HODL, which can be considered a positive sign for the entire crypto market. In the meantime, a key Bitcoin indicator revealed an interesting zone, which shed light on BTC’s state.

Bitcoin’s crucial $115k support zone

Currently, Bitcoin is riding the waves around $117,000, which, besides ensuring it is well above its immediate support, is an interesting price to talk about. A neutral Fear and Greed Index justifies the neutral market situation; that is, it is neither overly bullish nor bearish at the moment. This neutrality marks a period of consolidation, with investors seemingly unwilling to commit without stronger signals.

Crypto analyst Ali Martinez has pointed out Bitcoin Pricing Bands and emphasized $115,440 as the most crucial support level in the present setup. In his analysis, if BTC can stay above $115,440, the way looks clear for a strong push toward $137,300, the next major resistance zone. The sentiment, however, would abruptly change if Bitcoin were to lose the $115,440 support and would open up a steep correction opportunity in price toward $93,600.

$115,440 is the most important support level for Bitcoin $BTC, according to the Pricing Bands.

– Hold it, and $137,300 is next.

– Lose it, and $93,600 comes into play. pic.twitter.com/zVWLnPKKtd— Ali (@ali_charts) September 18, 2025

Notably, an X user mentioned, “Been watching these bands for months. They’ve been surprisingly accurate at predicting major support/resistance levels.”

Adding more strength to the bullish case is the Bitcoin Rainbow Chart, a popular long-term indicator among many retail and institutional investors. It is now throwing the buy signal, indicating that Bitcoin might be trading in a highly favored zone for accumulation. In the past, such signals have been followed by upward moves, thereby supporting the notion that Bitcoin may manage to hold up its $115K support level and head higher over the coming weeks.

For now, all attention is trained on the $115,000-$115,440 zone, for that will most likely mark the point which will determine whether Bitcoin manages to continue its quest for $137,000 or plunges downwards for a slight corrective phase into $93,600 close.

Moreover, there is now a slight rise in funding rates for Bitcoin, lending further optimism to the larger perspective, as per Coinglass. For the few of you who may not have heard of these, this funding rate is a mechanism in perpetual futures contracts that attempts to maintain an equilibrium between prices in the spot market.

Apart from being a confidence indicator showing clients’ increased optimism with more traders willing to go long, this rate in fact increases when price appreciation is expected in the near term. In such cases, funding fees will be paid by holders of long contracts to holders of short contracts, thereby indicating a demand tilt favoring bullish trades.

A positive funding rate, while confirming confidence, also balances the market from its overenthusiastic side by making it expensive for holding long positions which maybe oversold by too many traders. This makes sure the prices of perpetual contracts always stay very close to Bitcoin’s actual spot price and help eliminate any risk of unwarranted volatility.

To Summarize

Attending to its immediate future, Bitcoin must defend the $115,000–$115,440 support zone. Holding this price will drive the price rally toward $137,300, and losing the price zone will allow a possible correction toward $93,600. The Rainbow Chart currently flashes buy signals along with an uptick in funding rates, while the broader picture remains bullish with some caution on the short term. All eyes remain now on whether it can hold and carve out additional dominance through the weeks ahead.