What To Know

- SHIB trades at $0.00001283, showing potential to rebound from recent 7% weekly loss.

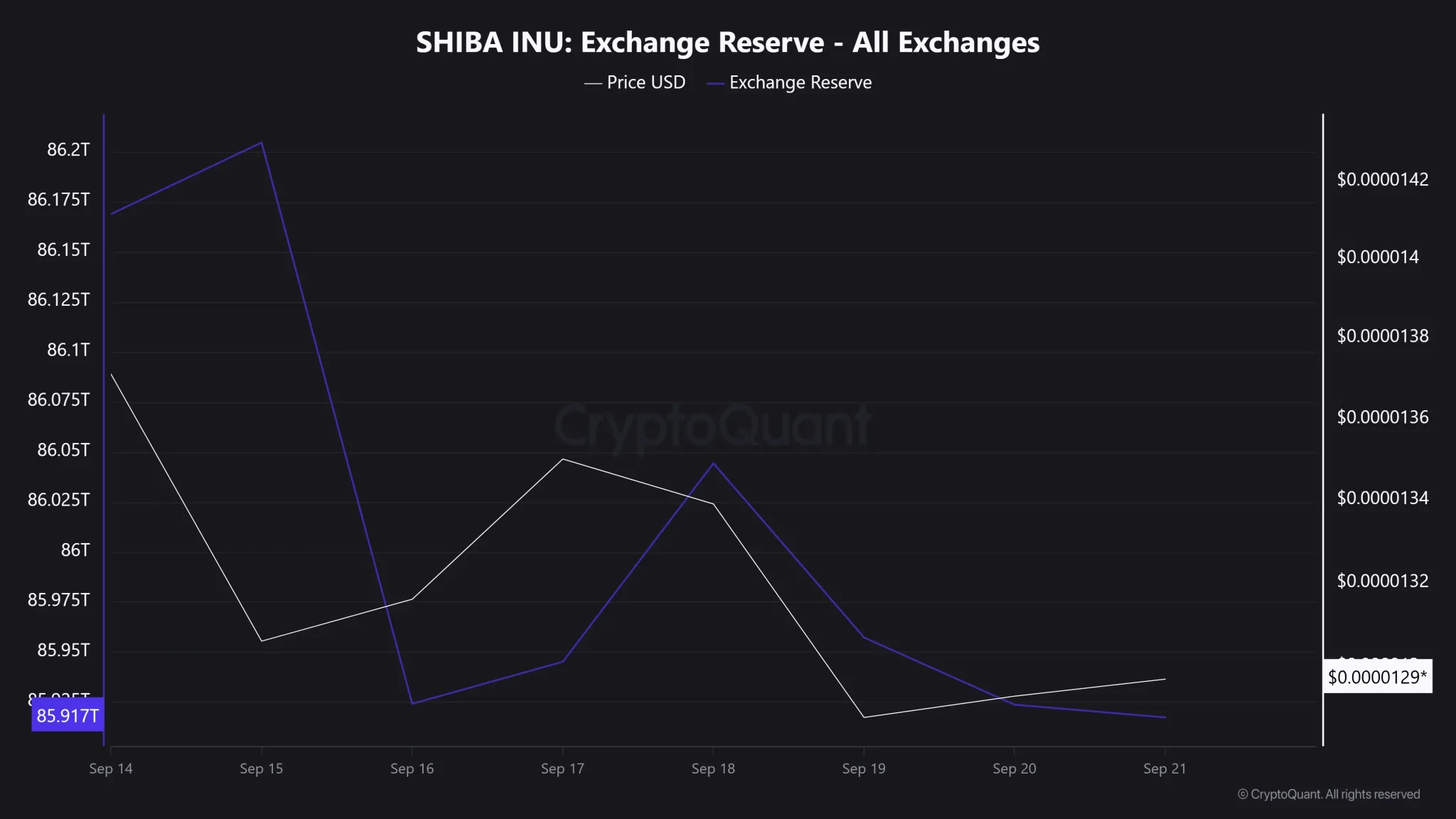

- Exchange reserves fell to 85.9 trillion, signaling increased investor accumulation and bullish sentiment.

- Breaking $0.00001428 resistance could push SHIB toward $0.00001707, confirming a strong recovery.

Shiba Inu (SHIB), the world’s second-largest meme coin, witnessed a bloodbath last week as it shed more than 7% of its value. While this looked concerning at the first glance, many analysts remain optimistic and expect the meme coin to rebound soon. Ergo, let’s have a closer look at SHIB’s current performance to gauge the possibility of SHIB recovering losses and registering gains in the fresh week.

Shiba Inu is Setting the Stage

Even with the bearish performance, Shiba Inu’s technicals remain a faint ray of hope. On the daily timeframe, SHIB continues to generate red candles, with the token now trading at $0.00001283.

Yet, according to noted SHIB analyst SHIB Spain, this corrective phase could set the stage for a rebound. The analyst noted that SHIB appears poised to enter a narrow trading zone, which is essentially a band within which the coin consolidates before its next big move. Ideally, it has usually worked out well for SHIB holders. On the last two occasions SHIB entered this same narrowband, it recovered strongly afterward, with substantial upside momentum coming in the following days. If it comes to pass again, then once more SHIB could indeed be on the road to recovery.

$SHIB BREAKOUT INCOMING!

SEND IT 🚀 pic.twitter.com/S1EcTjH1iZ

— Shib Spain (@ShibSpain) September 20, 2025

Adding strength to the bullish narrative, an on-chain data review by CryptoMoonPress has found a noteworthy decrease in the exchange reserves of SHIB. Over the past week, the exchange reserves have fallen from 86.2 trillion to 85.9 trillion SHIB tokens. This decrease is important because at a lower amount of exchange reserves, more investors are moving coin out of exchanges into private wallets, thus reducing the immediate pressure to sell.

Hence, with the reserves falling, traders are buying SHIB at discounted levels in anticipation of a price rally shortly. With this formation of a technical consolidation in the well-tested recovery zone and falling exchange reserves, investors seem to be gaining more confidence. Therefore, if buying pressure builds further, SHIB might be able to overcome its recent losses sooner and start rebounding, hence transferring short-term bearishness into bullish momentum.

Shiba Inu’s Next Possible Move

Future-wise, Shiba Inu price action appears to be passing through a make or break point. On a macro view of the daily chart, according to CryptoMoonPress, SHIB should break through immediate resistance at $0.00001428 to confirm bullish reversal. The price level has mainly stood as a barrier to the upside, thus a valid close above it would lead SHIB toward the beginning of its recovery. Should the bulls barricade the resistance and push the price further, the token might range comfortably between $0.00001428 and $0.00001552, consolidating for its next leg up. Once broken, this kind of resistance would send SHIB sprinting toward $0.00001707, representing a strong rebound from recent lows to the good graces of investor excitement.

In the market, there are risks too. Suppose a bearish sentiment actually prevails, and the token fails to hold the current levels. In that scenario, the token could slip further to $0.00001185: the next support level, potentially creating trouble for short-term traders. These next few days will thus be important for SHIB, as its capacity to either climb above resistance or wither through bearish pressure will make the difference of whether the meme coin sides with charts of recovery or slips into the deeper correction.

Conclusion

Shiba Inu remains in a pivotal zone. SHIB trades in a technically consolidative yet historically resilient support zone, with falls in exchange reserves and renewed investor interest suggesting recovery. A break beyond 0.00001428 must act as a signal tag toward 0.00001707 for a strong rebound to take place. Any failure to hold the current levels might lead toward the downside of 0.00001185. Investors should keep a keen eye on these important levels, as the days ahead shall determine whether SHIB reverts the short-term bearish sentiment into renewed bullish momentum.