What To Know

- Bitcoin must break $112K resistance to confirm the next bullish rally.

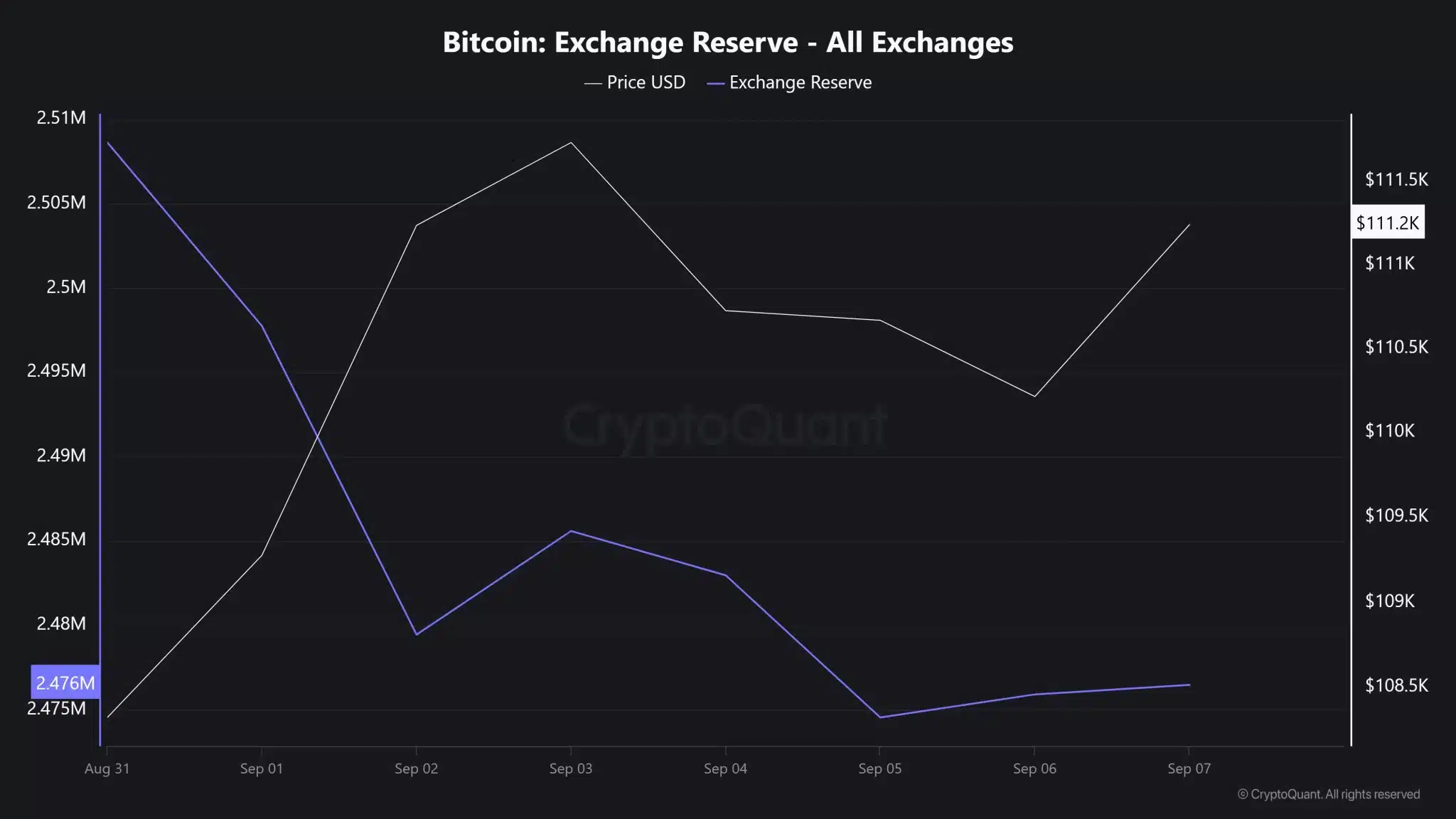

- Declining exchange reserves signal rising buying pressure and reduced selling supply.

- Futures market shows strong selling pressure, creating short-term risks for BTC.

Bitcoin (BTC) has managed to remain above the $100k mark for quite some time now. Though it has been comfortable in that position, it has lost the upward momentum. This has sparked speculations about whether the king of cryptos has the potential to kick start a bull rally in the near future. Meanwhile, an analysis has pointed out an interesting development, which sheds light on what is required from BTC to start a rally.

Bitcoin Must Break This Resistance

Michaël van de Poppe, widely recognized crypto analyst, stopped by with some positive vibes about Bitcoin (BTC), a favorable setup with one that rekindles momentum in the market. BTC, in his words, has formed another higher low while continuing to maintain supports at the very important $110,000 zone.

This is generally considered bullish, indicating that buyers have come in to protect the key zones and that the greater bullish structure is still in place. Van de Poppe further stated that should Bitcoin forge beyond that $112,000 resist, it could very well instigate another bull run, with confirmation of strength upon the high and the entrance of sidelined investors who were waiting for that.

Such a move might attract institutional traders and retail participants alike, further fueling momentum. In technical terms, higher lows combined with stable support reflect growing confidence among market participants, reinforcing the notion that Bitcoin’s long-term structure remains bullish despite short-term volatility. Overall, this analysis underscores that Bitcoin’s next big move may hinge on its ability to conquer the $112K level, potentially ushering in another strong upward rally.

Looking Forward

Given the latest data obtained from CryptoQuant, Bitcoin’s exchange reserve has persistently been on a downtrend over the past week, now standing at around 2.4 million BTC or one of the least in the recent past. A falling exchange reserve characteristically signals that investors are withdrawing their holdings from centralized exchanges into private wallets, with strong retinal holding sentiment and less immediate selling pressure.

This trend is often interpreted as rising buying pressure, as fewer coins available on exchanges mean a tighter supply, which can drive prices upward. Historically, such declines in exchange reserves have preceded bullish price movements, as scarcity dynamics come into play.

With Bitcoin currently holding strong above key support levels, the combination of lower reserves and growing demand significantly increases the probability of BTC breaking past the $112,000 resistance. Should this breakout occur, it could act as the spark for a new bull rally, attracting both institutional and retail investors.

There is a Catch!

Though the aforementioned analysis and BTC’s exchange outflow looked promising and gave a notion of a possible bull rally, not everything was working in the king coin’s favor. For instance, upon closer inspection of CryptoQuant’s data, CryptoMoonPress found that BTC’s taker buy/sell ratio remained negative.

For beginners, this indicator measures the cumulative difference between market buy and market sell volumes over a 3-month period. This meant that selling pressure was high in the futures market, which can hamper BTC’s price going up in the coming days.

Conclusion

The path for Bitcoin to begin a bull rally looks set but is not without barriers. Formation of higher lows and shrinking exchange reserves lend attractive reasons for BTC to break above $112,000 resistance and paved the way for a strong causing upward momentum.

Yet, caution remains necessary as the quite negative taker buy/sell ratio in the futures market keeps sell pressure on, which may stall the price increase momentum, at least for now. The panic days, for investors, will be the realization of whether Bitcoin is able to hold onto $112k or not; depending on this, the coin will either find itself in another new bullish phase or move towards an extended consolidation period characterized by drop in market certainty.