What to Know:

- Tether has acquired another 8,800 BTC today, according to on-chain data.

- This acquisition comes as corporate Bitcoin treasuries gain momentum with Michael Saylor’s Strategy in focus.

- However. Tether is yet to post an official release to determine the actual nature of the on-chain transactions recorded today.

Tether, the developer of the USDT stablecoin, has massively increased its stake in Bitcoin with a new acquisition valued at more than $1 billion. The acquisition, which saw a transfer of 8,889 BTC, supports the stablecoin issuer’s position as one of the most high-profile corporate owners of Bitcoin.

Tether’s Growing Bitcoin Treasury Holdings

After the recent transfer, the Bitcoin treasury of Tether holds 87,475 BTC, according to on-chain analytics by Arkham Intelligence. This long-term accumulation is indicative of the firm’s overall shift to support its reserves using a basket of “hard assets.” In addition to Bitcoin, Tether has also amassed large reserves of gold and invested in industries that have little to nothing to do with crypto, such as farmland and farm produce.

In the first half of this year, the company disclosed holding over 100,000 BTC and 50 tons of gold at the time. It also made significant purchases in mid-2025, with XXI, a Bitcoin treasury management company, by transferring over 15,000 BTC between June and July.

Whilst in the agri sector, Tether owns Adecoagro, a large Latin American agribusiness with a holding of 70% in the firm with more than 210,000 hectares of farmland in Argentina, Brazil, and Uruguay. The most recent $1 billion transaction on the chain has not been officially validated by the company.

Although it is widely understood by analysts to be yet another intentional acquisition, the transfer might also be attributed to other treasury transactions. Moreover, the stablecoin comapny has not made an official disclosure regarding the nature of the recent transactions.

Company’s Strategic Diversification Via BTC

The increasing investment in Bitcoin by Tether indicates the desire to diversify beyond the use of conventional cash reserves and U.S Treasuries. The company leaders have continuously reiterated a strategy that revolves around the acquisition of assets that have scarce value.

This strategy was previously covered in 2025 when Tether publicly broke down its hard asset portfolio in a disclosure including Bitcoin and gold holdings. Through its exposure mix in both commodities and digital currency, the company seems to be in a position to withstand volatility in the financial market as well as the crypto market.

The aggressive purchase of Bitcoin also highlights the increased utilization of the asset by corporate treasuries as a long-term store of value, in similar scripts developed by companies such as Strategy.

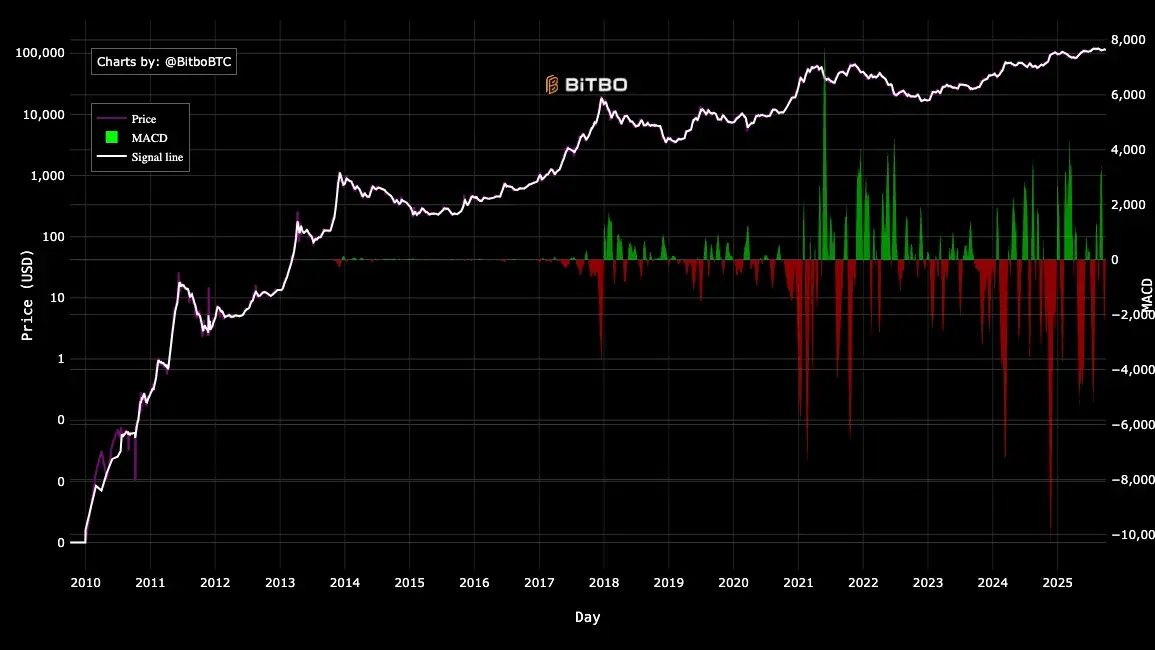

Bitcoin’s Technical Picture

The moment when Tether made this move worth a billion dollars in Bitcoin coincided with the period of active trading of the asset. Since reaching a historic all-time high of $124,000 on August 14, Bitcoin has not been able to overcome resistance close to the $120,000 range.

Analysts observe that the trading volumes surged each time support was retested around $110,000, which is giving it a solid foundation despite profit-making. The important technical indicators are that the market is in a consolidation stage.

Bitcoin has now recovered beyond its 50-day EMA of 113,369 after plunging to a low of $108,000 earlier. However, the Relative Strength Index is in a neutral situation at 53.56, and the MACD is negative and at -256. Meanwhile, the next hurdle that traders will be targeting is at $115,000, which is the 23.6% Fibonacci retracement.

On-chain metrics are a cause of concern as well. The MVRV ratio is approaching 3, which is a typical indication of possible overvaluation in the short term. On the other hand, the NVT ratio is close to falling below 30, which could indicate a massive rally, according to historical trends.

Institutional Inflows into ETFs

The company acquisition is in line with institutional excitement about Bitcoin. There have already been over $57.29 billion in inflows into BTC spot exchange-traded funds since launch, according to Farside Investors. On September 29, net ETF inflows were 521.95 million, and Fidelity FBTC attracted 298.7 million, and Grayscale GBTC attracted 26.9 million. The IBIT of BlackRock has also outdone Deribit in the options open interest, which has raised its liquidity provision.

Bitcoin is in the limelight as the inflows of ETFs continue. The ability of large-scale corporate purchases to boost the crypto above its current price ceiling of $120,000 is a close observation by market commentators due to the combination of the two factors, as well as additional institutional fund buying, in order to push BTC to greater heights.

Also Read: Crypto Market Adds $110 Billion in 24 Hours, Bitcoin and Ethereum Drive Rally