What To Know?

- Solana rebounds 4% after 14% weekly drop, trades at $204.93.

- Whales deposit 277,000 SOL worth $54.23M, signaling potential selling pressure.

- Funding rate dips, net inflows drop, raising uncertainty over SOL’s short-term momentum.

Solana (SOL), one of the most popular tokens in the top crypto list, has managed a gentle comeback in the last 24 hours. However, while the recovery was happening, the big pocketed payers made a move. Whenever they act, their actions tend to affect prices of crypto. Ergo, CryptoMoonPress planned to check whether this time whale activity will impact SOL’s price and if yes, then where it is headed.

Solana Whales are Selling

Having endured a rough week, during which Solana was down by nearly 14% in keeping with the general market trend, the token is trying to show some bit of resilience. In the past 24 hours, SOL has regained around 4% of its losses and is now attempting to stabilize the sentiment around its ecosystem.

At the time of writing, Solana was trading at $204.93, giving it a very strong market capitalization of $111.38 billion, thus rank as one of the most expensive crypto assets. While the very recent upswings do provide some relief to retail investors, the unexpected whale activity is causing suspicions and injecting fresh worries over the SOL’s short-term course. According to Lookonchain data, a very well-known blockchain analytics account on X, in the past hours, two whales moved 277,000 SOL, worth approximately $54.23 million, on exchanges.

2 whales deposited 277,000 $SOL($54.23M) to exchanges in the past 3 hours.https://t.co/h8e88TZ9LRhttps://t.co/4yQT3NOSUC pic.twitter.com/8V91nscjDJ

— Lookonchain (@lookonchain) September 26, 2025

Historically, very large deposits tend to herald selling pressure because exchanges are liquidity points rather than places to keep holdings. This movement has special importance given that it signals high-volume holders potentially lacking confidence in the immediate price action of SOL, perhaps setting up for a deeper correction.

For the retail side, this development stands as a stark reminder of how whale moves can shift general market sentiment. While fundamentally, Solana is still strong and its ecosystem attractive to developers and projects, heavy selling from whale holders can undermine recent recovery and could potentially drag prices down in the absence of sustained momentum.

What’s Coming Up Next?

Beyond whale intervention, other metrics concerning Solana (SOL) truly tell us where the token might be heading. The other important factor is the funding rate, which, after a brief surge, has now dipped just a little. To give a better perspective on this, the funding rate is a semi-annual fee whereby clients whose positions are not favorable must pay those whose positions are favorable, in order to keep the contract price aligned with the spot price of the underlying asset. When the funding rate rises, it is because more traders are betting for the upside, reflecting bullishness.

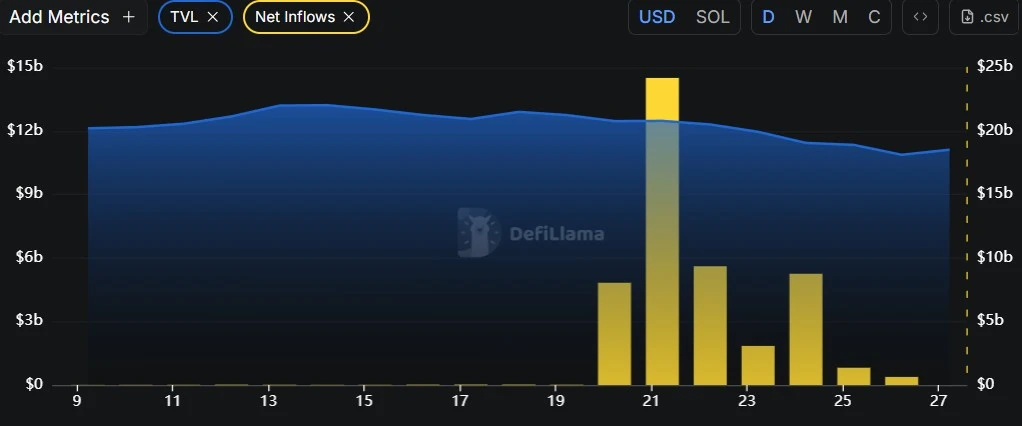

In contrast, a decrease in the funding rate, as witnessed in SOL’s instance, portrays diminishing optimism and almost an equal balance between long and short positions. This can very often imply that the aggressive bullish bets are mooning down, and the asset could either enter a price consolidation phase or face corrections. From another angle, net inflows into Solana have also decreased sharply.

Some more ways the funding rate can be described: The funding rate compensates the buyer or the seller of a perpetual contract and is exchanged directly between traders in an effort to keep the contract price tethered to the spot price of the underlying asset. When the funding rate increases, it is because more traders are betting for the upside, reflecting bullishness. In contrast, a decrease in the funding rate, as witnessed in SOL’s instance, portrays diminishing optimism and almost an equal balance between long and short positions. This can very often imply that the aggressive bullish bets are mooning down, and the asset could either enter a price consolidation phase or face corrections.

While this happened, the net inflows into Solana are sharply reducing. The net inflow is, basically, the arriving of cryptocurrencies into an exchange against those leaving it. With a lower net inflow, fewer tokens are deposited into an exchange; this is usually seen as reduction of selling pressure.

This could be because investors are holding tokens in private wallets and are not preparing to sell, but when analyzed with a weakening funding rate, things look quite inconsistent. Less inflows reduce the chances for an immediate dump, on one hand. On the other, without that momentum stemming from speculative leverage, SOL might not be able to regain any strong short-term uptrend.