What To Know

- Bollinger Bands signal SEI volatility as $0.37 resistance becomes key breakout level.

- SEI trades at $0.3277 after 9% monthly surge but weekly chart turns red.

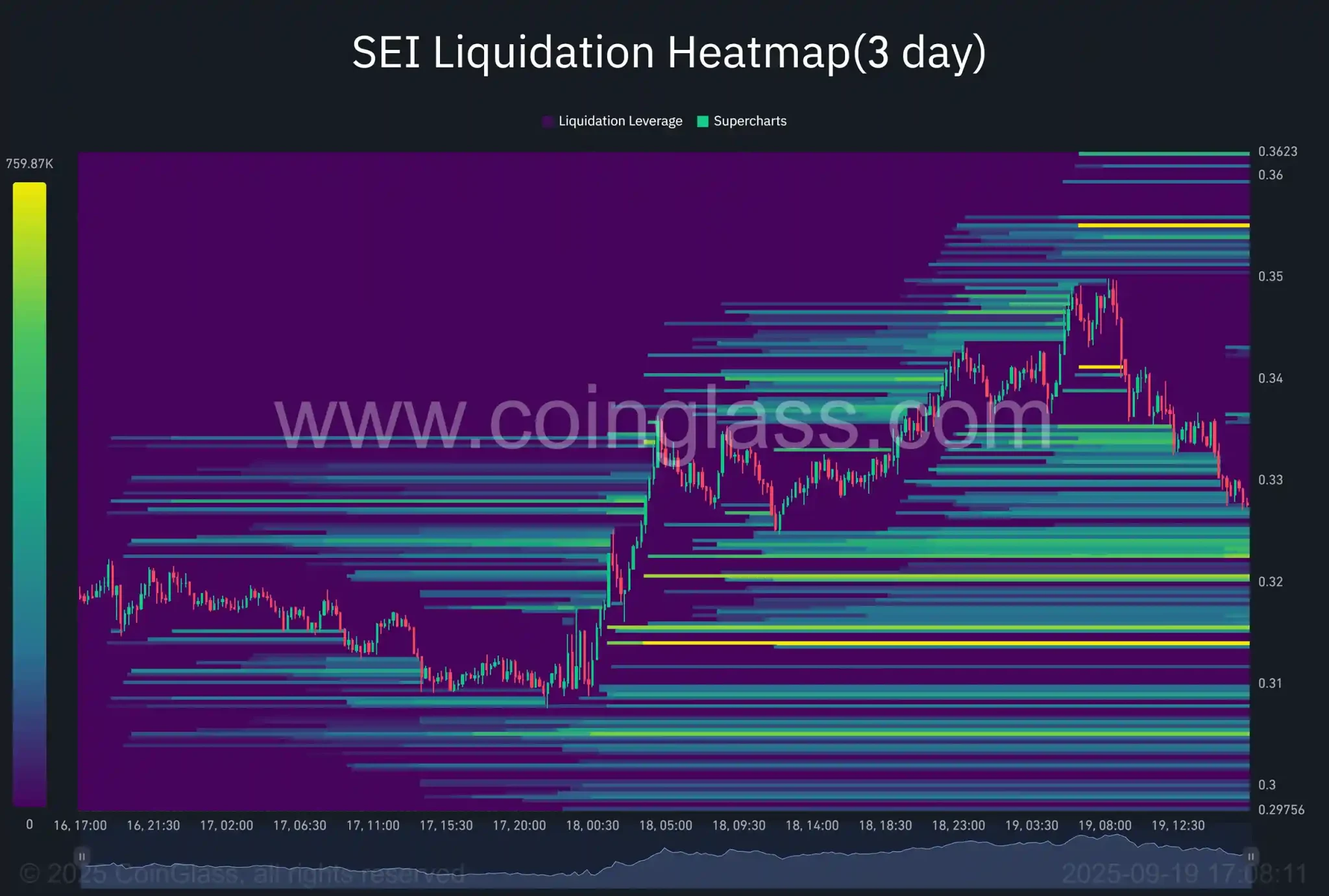

- Liquidation heatmap shows $0.355 resistance ahead; downside risks near $0.32–$0.31 support.

Over the last month, SEI has earned its investors profits as its price has grown at a decent pace compared to the rest of the cryptos. Nonetheless, despite being on an upward trend, the price trajectory has been predictable as it has been moving inside a pattern. At press rime, the token’s price has entered a squeezed zone. Will this translate into several days of slow-moving price movement, or will investors witness a major SEI breakout soon?

What Analyst Says About SEI

Ali Martinez, a popular crypto analyst, pointed out the technical setup of SEI, saying that “volatility is loading”; i.e, the Bollinger Bands are squeezing tight. In case you have never heard of them before, they are an established technical analysis tool that traders use to anticipate market volatility and potential breakout points.

$SEI volatility loading… Bollinger Bands are squeezing tight. Clear $0.37 and momentum shifts higher. Break $0.37 and the move likely runs up. pic.twitter.com/n8P6GZ2sjD

— Ali (@ali_charts) September 19, 2025

The Bands consist of a moving average with two bands placed above and below it: they widen during volatile periods and contract into times of tranquility. When the two bands are squeezing tight, it signals a consolidation phase, and soon the market could witness a sizeable move either upwards or downwards. Ali Martinez was very clear that momentum could quickly shift upwards towards $0.37 resistance level if this token manages to push through, and lift a strong rally behind it.

Recent performance-wise, the stock managed to inch up 9% in 30 days, and even though it rewarded its investors with modest but steady gains, a short-term retracement has been evident in price action. The chart has gone red in the last seven days, indicating mild bearish forces. Currently, at the time of writing this analysis, SEI is trading around the $0.3277 mark, beneath the keenly watched $0.37 resistance level.

Another pattern worthy of note lies in decreasing funding rates for SEI. Funding rates are used in perpetual futures markets to make sure contract prices are maintained in line with spot prices. High funding rates suggest that a greater majority is betting on long positions (expecting the price to go up). Alternatively, a funding rate going down connotes the waning of bullish bets as fewer traders are willing to shell out a premium to keep long positions; often, it is taken as a bearish sign, signifying a waning confidence in short-term price gains.

All in all, SEI now sits at a crossroads. The tightening Bollinger Bands hint at an explosive move ahead, while the dropping funding rate shows fading optimism among futures traders. The next test lies at $0.37, where a breakout could turn everything on its head.

Possible SEI Targets

In an attempt to establish a possible direction of SEI, Crypto Moon Press looked at the token’s Liquidation Heatmap, which provides catchy insight concerning where the largest clusters of trader positions lie. Prices would usually gravitate to these zones as a cascade of liquidation either puts buying or selling pressure.

The data suggest that if the bullish trend continues, the first level SEI could target would be at $0.355, where liquidation would have its highest concentration. The price would likely hold as short-term resistance as traders holding leveraged shorts get liquidated, and their activity causes volatility at the levels. On the other hand, a decisive break above $0.355 could clear the path for SEI to revisit the critical resistance at $0.37 indicated by the analysts.

Bearishly, SEI might find itself pressured on the downside. The heatmap shows that support might be forming at $0.32; however, if this level is lost, the token may face testing from $0.31, a much deeper level where the liquidations may increase the selling pressure. Such a drop would dampen short-term sentiment and may have to be rebuilt by the bulls before any further attempt to recover can be made.