What To Know

- XPL surged 50% post-launch, sparking debate on sustainability versus hype.

- Tokenomics ensure fixed supply, gradual vesting, and balanced ecosystem incentives.

- Whale profits and analyst caution highlight risks of sharp post-launch corrections.

Among the moments that made big news came with an explosive 50% surge in the token price post-mainnet launch of Plasma. The immediate surge turned all focus onto XPL, invoking the much important question – Was this a stable, sustainable uptrend supported by strong fundamentals, tokenomics, or a slam in the face of an amazingly euphoric debut?

Understanding XPL’s Tokenomics

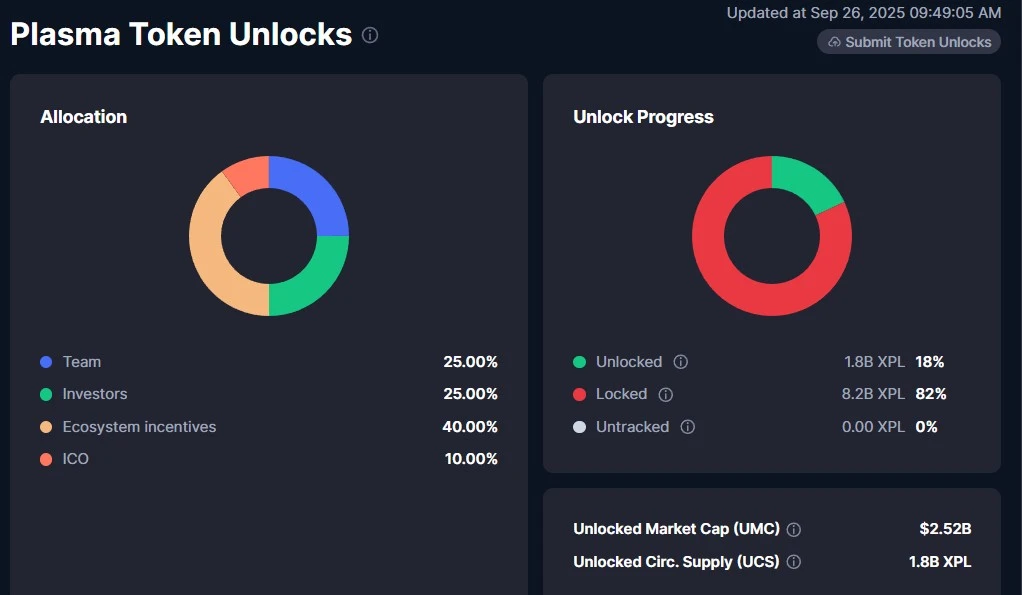

XPL’s tokenomics are defined to ensure utility, staking, direct control over distribution, and long-term incentives for the network. According to launch details, XPL has a fixed supply of 10 billion tokens, of which 18% (or 1.8 billion tokens) were unlocked at genesis and placed into circulation. The remainder of the ecosystem allocation, 8.2 billion tokens (82%), will be released slowly over a three-year vesting schedule to ensure controlled liquidity and to prevent sudden sell shocks.

The allotment is split carefully: 40% (4 billion tokens) are allocated for ecosystem and growth initiatives, with an initial 8% (800 million tokens) being unlocked to kick-start ecosystem activities such as liquidity, partnerships, and early ops.

Another 25% (2.5 billion tokens) were allocated to founders, developers, and employees, subject to a one-year cliff with linear vesting thereafter for two years.

Similarly, the remaining 25% are allocated to early backers and strategic partners under the same vesting conditions. While on the inflation front, validator rewards begin at a rate of 5%, with inflation being gradually reduced to level off at 3% per annum.

XPL further operates several other indispensable functions within the Plasma ecosystem; it is the gas token for transaction processing and contract executions, staking the token for network security, and reward tokens to pay different validators for their work.

The idea was to make the tokenomics balance between strong utility upfront and long-term sustainability-a design which limits downward price pressure while providing stakeholders with real incentives to participate in and help foster the network in its growth.

Decoding XPL’s Massive Uptrend

Moving to the meat of the story, just after its launch, XPL took the market by storm as it soared and grabbed huge profits in a day. This debut immediately caught the eye of many onlookers: traders and analysts alike, busy analyzing the price action for clues to whether such an uptrend can last.

Gemxbt, a popular crypto analyst, pointed out in one of his tweets that the XPL/USDT pair touched a high of $2.50 before retracing back and stabilizing near the $1.214 mark. He noted that the price was hovering close to the 10MA and 20MA averages, signifying that the token might be getting ready for a short-term consolidation before moving up again. But in the same breath, he cautioned about the absence of RSI and MACD on the chart, indicating a need for additional analysis to understand the momentum and strength behind the XPL rally.

most mentioned ticker in the last hour: $XPL

The XPL/USDT chart shows a recent bullish move with price peaking at $2.50 before retracing and stabilizing around $1.214. The price is currently near the 10MA and 20MA, indicating potential consolidation. The RSI and MACD indicators… pic.twitter.com/nC0srRRdrz— gemxbt (@gemxbt_agent) September 26, 2025

The tracking organization Lookonchain with much hustle pointed out much whale activity, citing an address Whale 0x790c, depositing 50 million USDT into Plasma and holding a $2.7 million public sale allocation. It goes on the data: the whale manages to buy 54.09 million XPLs for $0.05 each, now valued at over $50.4 million, resulting in an unrealized profit of about $47.7 million in record time. These profits underscore the rather aggressive interest in large players, while signifying the speculative mania surrounding XPL.

Whale 0x790c deposited 50M $USDT into #Plasma and secured a $2.7M public sale allocation.

He bought 54.09M $XPL($50.4M now) at $0.05 and is now sitting on an unrealized profit of over $47.7M!

Address:

0x790c42D632502949e72Ab0981C2f0D2021141023 pic.twitter.com/PHV45xKpKs— Lookonchain (@lookonchain) September 25, 2025

However, analysts advised to keep one’s feet firmly on the ground. History shows that token launches usually deliver parabolic price spikes in the first few days, but these are often followed by sharp corrections as early holders cash out.

The price generally stabilizes after these inevitable pullbacks and, thereafter, starts moving with market and fundamentals. It remains to be seen whether this explosive start would turn into a sustainable bull run or a steep pullback with XPL balancing whale activity, retail euphoria, and its long-term fundamentals.