What To Know

- XRP exchange reserves spike to 3.3 billion, signaling rising selling pressure.

- Hyblock data shows heavy sell volume, fueling XRP’s recent bearish momentum.

- Analysts warn further downside possible, though crypto’s unpredictability leaves room for reversals.

After a comfortable weekly price push, XRP bears have once again taken over the market. With the latest price drop of over 2% in the last 24 hours, XRP now trades at $3.08 with a market capitalization of over $184 billion. Does this mean investors should remain cautious of a further price decline in the days to follow? Let’s find out…

Selling Pressure is Rising on XRP

CryptoMoonPress tried to pierce through a few reasons behind that sudden, yet rather strange, halt to the recent bull rally. Many traders would point to the broader market volatility as the reason behind the downfall; in contrast, our analysis points to the possibility of a more fundamental cause affecting the token’s movement.

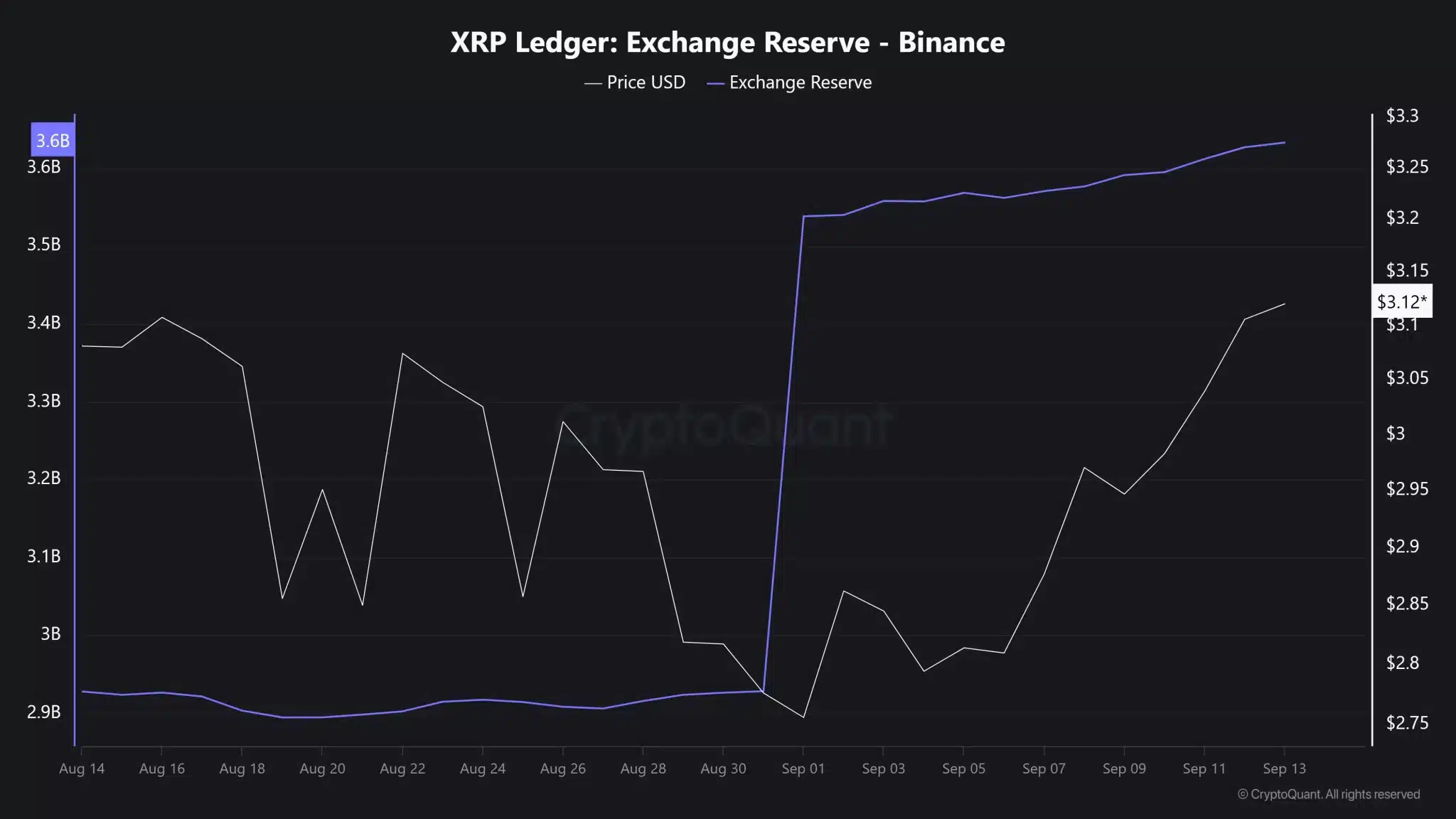

On observing data from CryptoQuant, we noticed a massive rise in XRP exchange reserves during the past month. The reserves had jumped from 2.9 billion XRP to more than 3.3 billion XRP in a few weeks’ time. Such a 400-million-token spike on centralized exchanges cannot be ignored, as it usually points to increased selling pressure.

In layman’s terms, an increase in exchange reserves usually means that more tokens get deposited into exchanges or trading platforms rather than being held in private wallets. This typically spells that the investors and whales are preparing to liquidate their holdings, thus exerting selling pressure on the markets. The more tokens on sale in exchanges, the higher shall be the price drop since supply exceeds demand.

This trend also explains why XRP, despite having been trading with good momentum earlier, could not hold onto the highs. Market psychology tends to change at these stages as retail traders show caution seeing such reserves spike, while the institutional player usually waits for clearer signals before they jump back into the markets. Thus, the twin forces of rising exchange reserves and fluctuating sentiment can very well have brought about XRP’s recent correction.

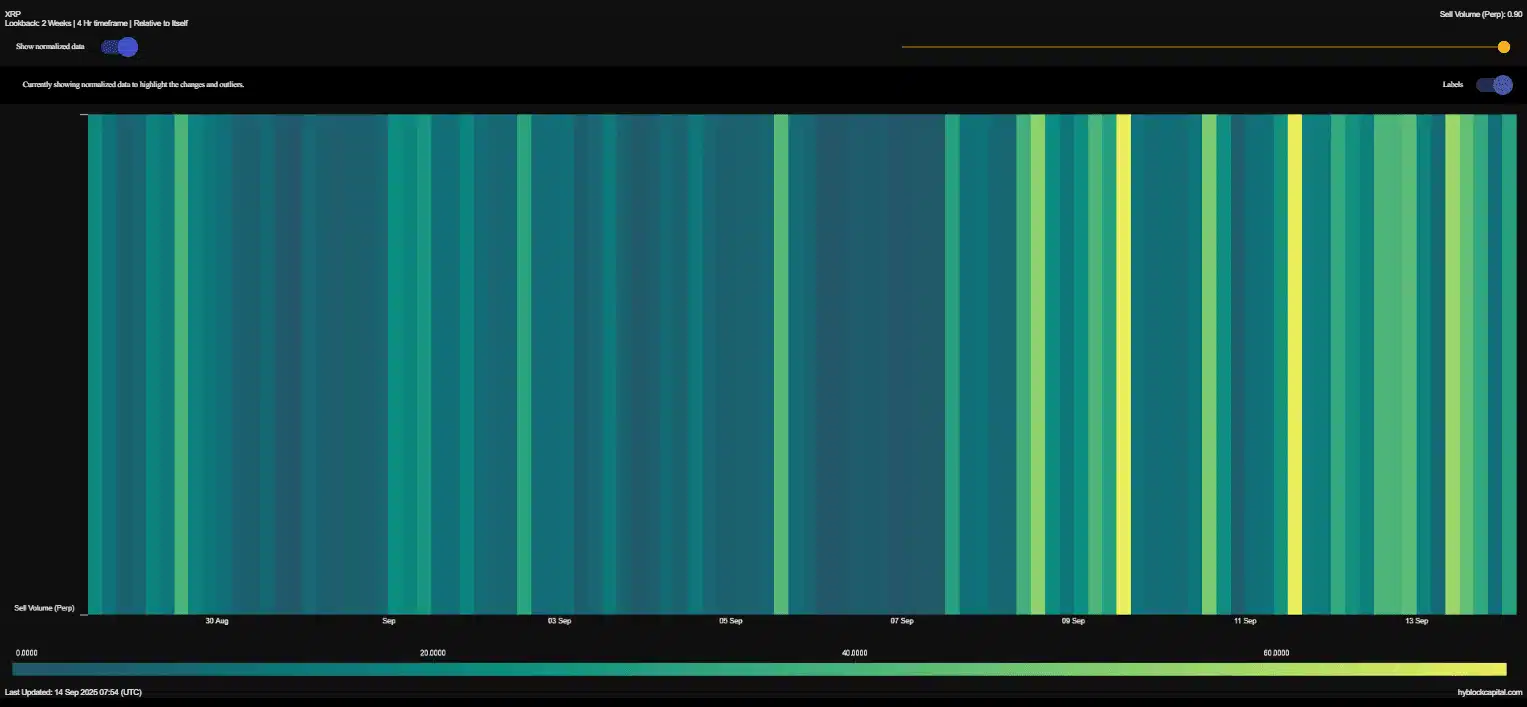

Additionally, the study potentially arose as a coordinated effort analyzing data from Hyblock Capital. According to the platform’s metric on sell volume, recently, that is, over the past three days, XRP holders have actively sold or offloaded their holdings. The indicator went to heights never seen in recent times, with the index values approaching 100. For context, a price sell volume index approaching 100 signals very strong market activity in selling, meanwhile, prices acting lower than this figure point towards an equal or buy market.

This heightened selling activity suggests that many traders may be locking in profits or exiting positions amid uncertainty, thereby amplifying downward momentum. Such data not only validates the observed price decline but also provides a clearer picture of the underlying investor behavior driving XRP’s recent correction.

To sum up

The conclusion drawn from the price drop of XRP is that the downturn was not entirely due to normal market volatility. With exchange reserves going to unusual height and sell volume readings at high levels, there is a clear indication of high selling pressure. This does not ensure that the correction will go on for any longer but does urge caution towards investors as they manage risk.

Considering reserve levels continuing upward and sentiment staying negative, an additional downside movement may be anticipated. On the flipside, due to the fast and random nature of the crypto market, sudden reversals can occur at any time. By means of on-chain data and market signals, trades must be held in check beforehand.