What To Know

- XRP struggles with weak momentum as daily trading volume drops 19%, signaling dwindling investor interest.

- Analysts warn XRP could test critical supports near $2.7–$2.78 before any sustainable recovery attempt.

- Rising NVT ratio and declining Long/Short ratio highlight increased downside risk for XRP’s short-term outlook.

XRP, one of the most popular cryptocurrencies, has taken a sideways path over the las few days. This didn’t excite investors, considering the might and popularity of XRP, resulting i n a double-digit decline in daily trading volume. On top of that, top analysts are now predicting that things can get worse in the coming days. The token might find support soon at a lower level many didn’t expect at a time when several cryptos are booming. Ergo, let’s take a closer look at what is XRP is doing to find out what to expect from it in the near future.

XRP to Drop Further In the Coming Days

After experiencing a relatively stagnant performance, XRP has been unable to produce any significant movement in annual and hill trends. A mere 0.8% rise is what has been logged in the token’s fortunes over the past week, with a paltry 0.4% movement recorded on a daily basis. These slight fluctuations emphasize the lack of momentum XRP is facing in contrast to the stronger activity witnessed by top-rated assets in the broader crypto market.

Its price stands currently at $3.01, while it shoulders a market cap that has crossed $180 million. However, the sentiment is negative as the daily trading volume has plummeted 19% sharply. This is a telling sign of the dwindling interest of investors, and such declines in activity generally happens before the retracement of prices.

Bolstering this cautious outlook, popular crypto analyst Ali Martines recently stated on social media that XRP can find support at $2.78. His views coincide with the building expectations that the token may temporarily test structures of unwelcome lows in view of current price action.

The technical read also suggests that before it possibly slips to around $2.9, XRP will get a short small bounce in the near term, finding first support near $2.7. This support may keep it from plunging hard for a while, but if the selling pressure stays on, it may just not be sustained enough to keep an upward course.

$XRP could find support around $2.78! pic.twitter.com/XJMUIc8JYU

— Ali (@ali_charts) September 17, 2025

The narrowing trading range, compounded with dwindling participation from investors, clearly paints an image of uncertainty. In such settings, failure to cling to pivotal support transforms the downhill possibility for XRP into an accelerated one, potentially shoving it below $3 as the new psychological barrier. For bulls, however, this would translate into pumping strong volume against the prevailing sell-off to nurture a healthier consolidation for the token. For now, all eyes remain on the $2.7–$2.78 zone, as it likely becomes the deciding arena for XRP in the shorter term.

What to Expect Next?

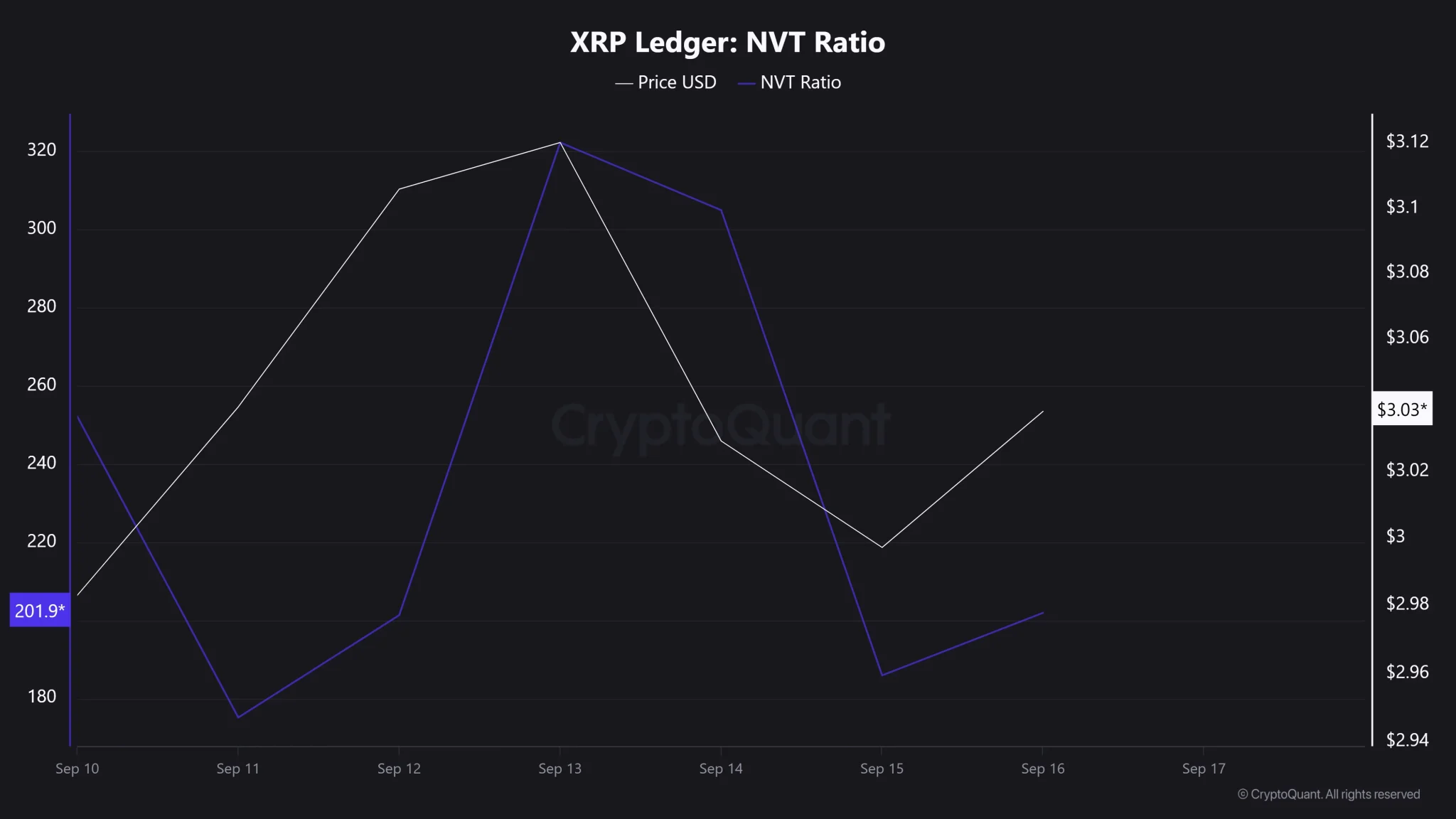

On-chain statistics are also indicating a further downside risk for XRP. According to CryptoQuant’s data, after the recent dip, a discernible surge was observed in the Network-to-Value ratio of XRP. Usually, a rising NVT ratio signals that the asset is becoming overvalued with respect to the activity in transactions occurring on its network.

In other words, if the price of a token is raising more quickly than the usage of the network, a price correction is often looming. Historically, spikes in NVT have often been followed by price drops, so this adds to the ever-growing cautious sentiment toward XRP right now.

The shrinking Long/Short ratio of XRP also adds to the bearish vibe as it shows the trend whereby more traders have recently been going short-a-classic in any fluctuation toward downside signals declination in trader confidence in near-term upside potential of the token, giving it further possibility to liquidate towards the $2.7 region.

Without some sudden influx of trading volume and network activity, it will likely be a bearish pressure on the top end. All said, while still considered major by altcoin standards, the technicals and on-chain metrics of XRP currently point toward a correction before a palpable recovery can materialize.