- Polymarket integrates Chainlink data to speed up and secure prediction market outcomes.

- Chainlink oracles provide real-time data, reducing reliance on social voting in Polymarket.

- Polymarket expands in the U.S. after QCEX deal while LINK price climbs above $24.

Prediction market platform Polymarket has joined forces with Chainlink to strengthen the accuracy and speed of its market resolutions. The partnership integrates Chainlink’s data standard and automation tools, a move set to reduce settlement risks while making real-time markets more reliable. Polymarket has already launched the integration on the Polygon mainnet, creating live asset prediction markets around crypto trading pairs.

The integration combines Chainlink Data Streams, which deliver low-latency and verifiable price feeds, with Chainlink Automation for on-chain settlement. This means asset pricing markets, such as Bitcoin prediction markets, can now be resolved almost instantly, eliminating the need for manual or delayed outcomes.

Chainlink’s Oracle Tech Enhances Polymarket’s Resolution Process

At the core of this joint effort is Chainlink’s decentralized oracle network, which is already trusted to secure nearly $100 billion in total value for DeFi. By using independent, enterprise-grade node operators, Chainlink eliminates single points of failure and ensures applications operate as intended.

With tens of trillions of transaction value processed, its infrastructure is widely regarded as the industry standard. On the other hand, integrating this technology marks a major leap for Polymarket. Until now, the platform has often relied on community voting for certain market outcomes.

With Chainlink’s deterministic data inputs, objective markets such as asset prices can be resolved using cryptographic truth instead of social mechanisms. Both companies also confirmed that work is underway to expand this framework to handle more subjective prediction markets, reducing reliance on human intervention.

Chainlink co-founder Sergey Nazarov described the partnership as a decisive moment. “Polymarket’s decision to integrate Chainlink’s proven oracle infrastructure is a pivotal milestone,” he said, emphasizing that tamper-proof computation transforms prediction markets into “reliable, real-time signals the world can trust.”

Polymarket Expands Reach as It Reenters U.S. Market

The partnership also comes at a pivotal time for Polymarket. Since its launch in 2020, the platform has grown rapidly into one of the largest hubs for real-time information markets. Its recent $112 million acquisition of QCEX, a CFTC-licensed exchange and clearinghouse, has paved the way for its reentry into the U.S. market.

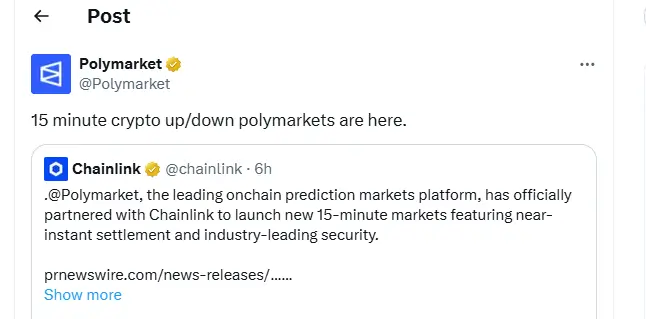

Polymarket is also branching out through new collaborations. It recently announced a partnership with 𝕏 to deliver personalized prediction insights and market recommendations directly to users. On its official X account, Polymarket highlighted the launch of “15-minute crypto up/down polymarkets,” signaling how quickly the Chainlink integration is already reshaping user experience.

Polymarket Joins Hands with Chainlink (Source: X)

The integration further cements Chainlink’s growing footprint across financial infrastructure. Earlier this year, the U.S. Commerce Department partnered with Chainlink to deploy GDP data on-chain, highlighting the network’s role in bridging traditional and decentralized markets.

Meanwhile, Chainlink’s native token, LINK, reacted positively to the news. According to TradingView, LINK was trading around $24.99 at press time, gaining more than 4% in the last 24 hours.

Conclusion

By pairing Polymarket’s fast-growing user base with Chainlink’s proven oracle infrastructure, the collaboration promises to redefine how prediction markets operate. Faster resolutions, cryptographic truth, and reduced settlement risks position both platforms at the forefront of blockchain-based finance. With live markets already active on Polygon and U.S. expansion underway, this integration signals a new chapter for decentralized prediction markets.