What To Know?

- BRETT plunges 30%, now priced at $0.0387 with $384M market cap.

- Descending triangle signals bearish trend, potential consolidation between $0.038–$0.035.

- High selling pressure suggests further downside risk outweighs near-term bullish reversal.

As the market condition turned bearish, most crypto got severely affected and BRETT was once that felt the wrath the most. After the recent bleeding, the meme coin now stands at a crossroad where there are two possible outcome that we might see as we enter the last quarter of this year. Ergo, CryptoMoonPress dug deeper to find out which outcome is more likely to turn into reality in the near-term.

What Happened to BRETT

The past week has truly been a storm for all BRETT holders, giving us a heartfelt 30% drop in token value and perhaps shearing the souls of concern into the investor community. As of this writing, BRETT is priced at $0.0387, in stark contrast to those recent highs, and with a market capitalization of $384 million, it stands at 139 on the world’s largest cryptocurrency ranking. For a meme coin that once lived off hype and optimism of the market, this drop perplexed many and begged the question for where BRETT truly goes as the year-end nears.

According to the technical team at CryptoMoonPress, which alludes to the daily chart price action, a descending triangle pattern has formed, thus specifying the bearish setting. Such a pattern indicates that the sellers have slowly overshadowed that of the buyers, and if this process continues in the near run, BRETT could witness—or come under—the bearish breakout. In the wake of this situation, the short-term consolidation may set in between $0.038 and $0.035. This phase of consolidation might agitate short-term traders, yet it can eventually come to be a platform from which the token could attempt to lift.

Nonetheless, markets rarely remain one-sided, and meme coins are known for their volatility and capacity to go against technically expected moves when community momentum powers them up. If sentiment shifts and bulls regain control, BRETT might start a recovery. The first big hurdle would be somewhere around the $0.07 resistance zone, serving as both a psychological and technical barrier. A clean break above this level could set the stage for a stronger run towards $0.09, providing potential upside to the optimists.

At this stage, BRETT is hanging in a balance weighed between bearish pressure and the chances of a bullish reversal; the next few weeks will therefore prove crucial for its fate.

Why the Bearish Scenario Seems More Likely

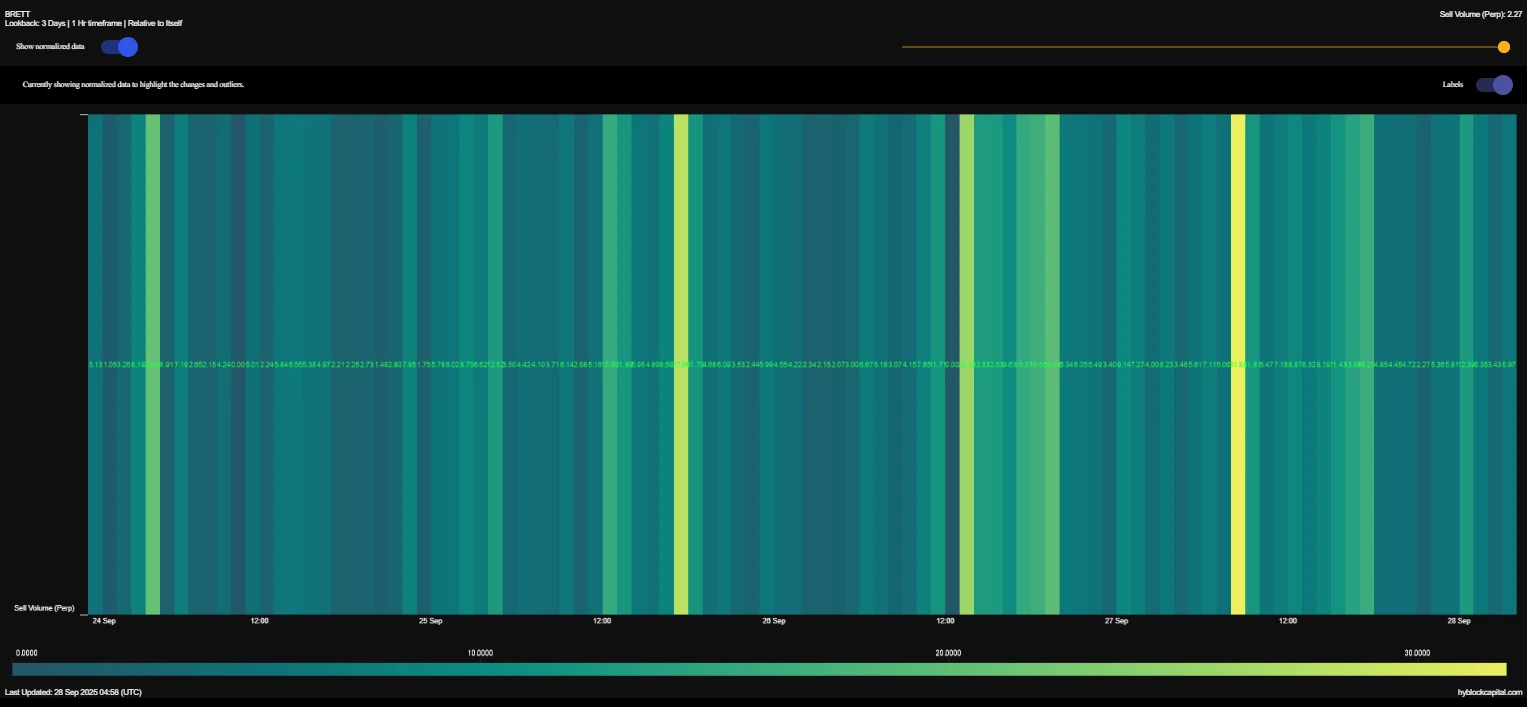

The bullish reversal for BRETT cannot be entirely refuted, yet all on-chain and trading data seem to support the very first outcome-continued bearish momentum, at least in the near term. The most striking manifestation that has lasted over the last few days has been the constant intense selling pressure on the token. Going by the data shared by HighblockCapital, the picture is fairly clear: in less than three days, the sell volume of BRETT reached 100 several times, which has been one-sidedly dominated by sellers on the market.

To put things in perspective, this metric is situated on a scale where values close to 100 represent selling pressure and those near zero reflect stronger buying activity. Thus, BRETT, having touched this extreme end of the scale a few times, could be indicative of investors rushing to sell their holdings amid the recent downtrend and lack of any immediately positive catalysts. Historically, especially for meme coins, this level of sell-side activity has been closely followed by price declines, chiefly because they are more sentiment-driven as compared to their fundamental counterparts.

If this selling pressure continues, it surely will not be long before the token drags itself into the consolidation range between $0.038 and $0.035 as per our previous analyses. Though these doldrums may discourage short-term traders, they may still serve to shake out weak hands to enable strong long-term holders to take over in deciding the next bearing of the market. For now, however, the bears have an upper hand as BRETT’s immediate short-term view remains skewed toward further downside risk than an immediate bounce-back.