- Bloomberg analyst warns shutdown could delay crypto ETF approval timelines.

- SEC adopts generic listing standards and removes the need for 19b-4 ETF filings.

- ETF eligibility requires six months of CFTC-regulated futures trading for crypto assets.

The fate of several pending cryptocurrency exchange-traded funds (ETFs) now hangs in the balance as uncertainty grows in Washington. Bloomberg Intelligence analyst James Seyffart has warned that a looming government shutdown could complicate the approval process for these long-awaited funds.

His remarks add to a series of developments at the Securities and Exchange Commission (SEC), which recently introduced a new regulatory framework that reshapes how crypto ETFs reach the market.

Shutdown Adds Complexity to SEC Decisions

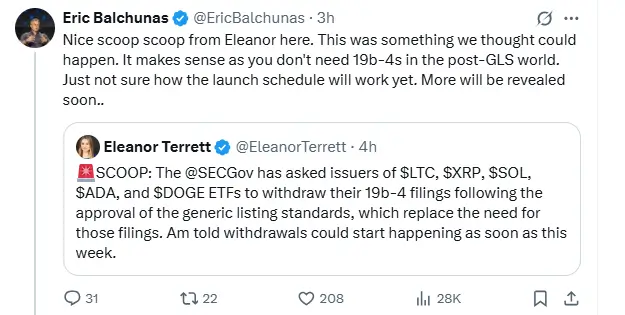

In an X post, Seyffart cautioned that the potential government shutdown could affect the timeline for ETF approvals. His colleague Eric Balchunas admitted that he remains unsure how the launch schedule will unfold, though he expects further clarification from the SEC.

Crypto ETF Approval in Doubt as U.S. Shutdown (Source: X)

The timing is critical. Data from prediction platform Polymarket indicates a 79% chance of a shutdown by October 1. Lawmakers face a deadline to pass a temporary funding bill, and failure to act would freeze many government operations. The ripple effect is already visible. The markup of the CLARITY Act, a crypto-related legislative proposal, was postponed due to the looming funding lapse.

Seyffart noted that the pending ETF applications have had their prospectuses on file for months. The issue now lies less in the passage of time and more in the SEC’s Division of Corporation Finance formally approving the products. Without that sign-off, the approval process cannot advance, regardless of deadlines.

SEC Shifts Framework with Generic Listing Standards

Even as analysts weigh the impact of a shutdown, the SEC has moved to streamline the ETF process. Fox Business journalist Eleanor Terrett reported that the Commission directed issuers of Litecoin, XRP, Solana, Cardano, and Dogecoin ETFs to withdraw their 19b-4 filings.

These regulations come into effect after the adoption of generic listing standards, where issuers need not submit individual filings for each crypto ETF. Previously, under the 19b-4 regime, the exchange was required to obtain permission from the SEC to list and trade ETF shares, and as a result, an extended review period could last up to 240 days.

Under the new standards, a framework has been created to list commodity-based ETFs, including those based on digital assets. The aim is to level the playing field for crypto ETFs with other commodities, in the interest of reducing roadblocks, lag time, and paperwork.

Eligibility Requirements Under the New Rules

While the generic listing standards simplify the path to market, they impose strict eligibility requirements. Chief among them is a rule that the underlying asset must have futures contracts traded for at least six months on a Commodity Futures Trading Commission (CFTC)-regulated exchange.

This condition stipulates that the asset must have a sufficient market history and be covered under the regulatory purview prior to the listing of the ETF shares. For crypto products, it is an attempt to strike a balance between innovation and investor protection.

While the SEC still retains the ability to approve S-1 filings, which comprise the prospectus of the fund, the elimination of 19b-4 reviews constitutes a procedural change of some magnitude.

Industry watchers have also noted that the SEC has withdrawn the delay notices that it issued earlier for these ETF applications. Such notices are no longer a requirement under the new regime, as the Commission can approve the funds at any time they meet the requirements.

Conclusion: Crossroads for Crypto ETFs

Together, the looming government shutdown and the SEC’s regulatory shift place crypto ETFs at a critical crossroads. In some areas, political gridlock threatens to stall progress. In others, regulatory reforms promise to speed up listings by scrapping the outdated steps in the process.

For investors and issuers, the developments illustrate the challenges and opportunities that stand between the crypto product space and the mainstream finance arena. If the new standards are implemented as intended, the ETF market may expand more rapidly than currently anticipated. But as Seyffart emphasized, much depends on the SEC’s internal sign-off process and whether a shutdown delays the agency’s ability to act.