- NYC Token surged to a $600M market cap before crashing by over 80% within 30 minutes of its launch

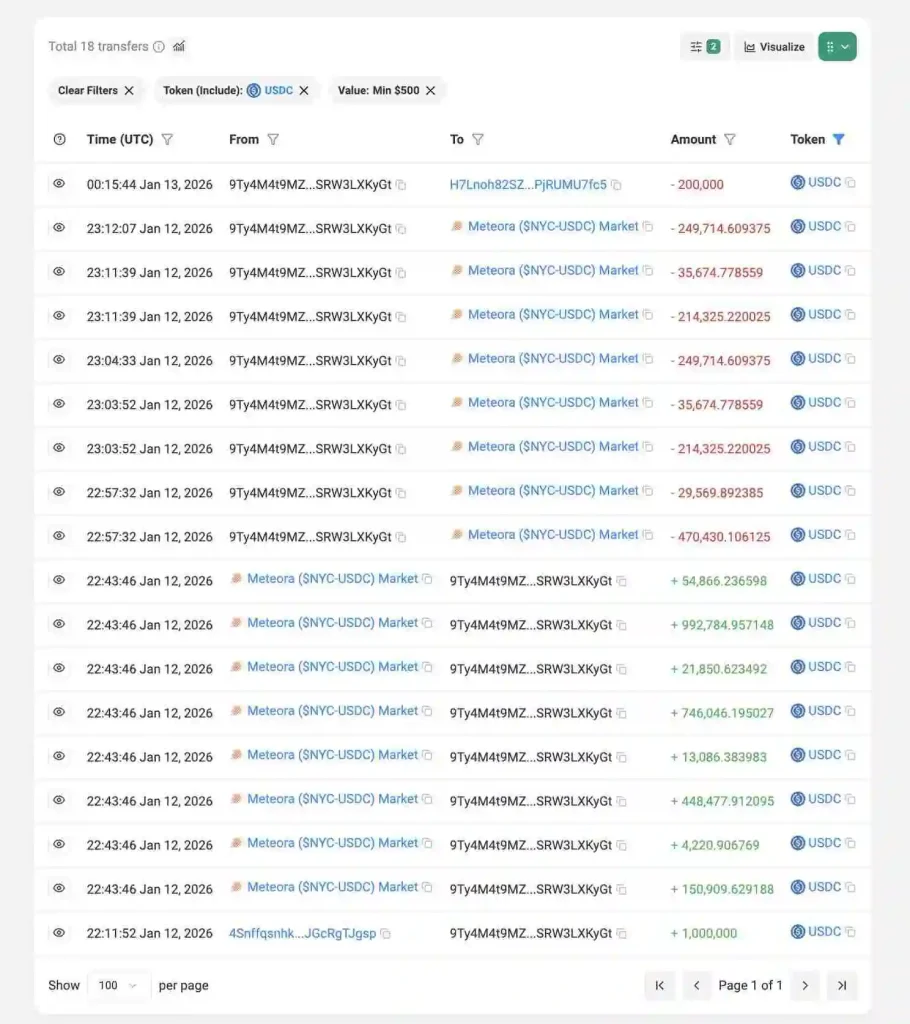

- On-chain data shows approximately $3M in liquidity removed near the peak, raising manipulation concerns

- Eric Adams gave no clear details on fund control, founders, or nonprofits tied to the token’s proceeds

Former New York City mayor Eric Adams is facing renewed controversy after a crypto token he promoted collapsed shortly after launch, triggering allegations of a multimillion-dollar rug pull. Once praised for the public adoption of Bitcoin and blockchain tech, Adams is now traders’ and analysts’ target, questioning the structure and execution of the so-called NYC Token.

The incident represents a huge turnaround for a person who had previously been a champion of the digital currency. The token’s launch, which was labeled as a charitable and educational effort, became a ground for denouncing the situation when the steep rise in price was followed by the equally steep fall, losing hundreds of millions of dollars in just a few minutes.

Eric Adams’ NYC Token: A High-Profile Launch With a Social Pitch

According to reports, ex-mayor Eric Adams unveiled the NYC Token on Jan. 12, presenting it as a crypto-based funding mechanism for social causes without raising taxes. In public statements and social media posts, he said proceeds would support efforts to combat antisemitism and what he described as rising anti-American sentiment.

Proud to launch @buynyctoken, a new token built to fight the rapid spread of antisemitism and anti-Americanism across this country and now in New York City.

Now live at https://t.co/zowY9Ri3aK pic.twitter.com/qBMzV88Tmj

— Eric Adams (@ericadamsfornyc) January 12, 2026

The initiative also claimed to fund blockchain education programs, scholarships, and awareness campaigns, particularly for underserved communities. According to the project’s website, the NYC Token was deployed on the Solana blockchain with a fixed supply of 1 billion tokens.

It stated that 70% of the supply was placed in an “NYC Token Reserve” and excluded from the planned circulating supply. However, the site did not disclose the identities of the project’s founders, the nonprofit entities involved, or detailed mechanisms for fund custody and oversight.

Market Surge Followed by Sudden Collapse

The token launch was immediately the center of attention due to Eric Adams’ widely known persona. The trading activity, which started right after the launch, took its market capitalization to almost $600 million within a few minutes. Nevertheless, the uptrend did not last long.

Roughly 30 minutes after launch, the token’s value plunged by about 81%, cutting market capitalization to around $100 million. The sudden move wiped out close to $500 million in paper value. Blockchain data shared by traders indicated that one wallet, identified as Dr6s2o, recorded losses of approximately $473,500, representing a decline of more than 63% in under 20 minutes.

Eric Adams(@ericadamsfornyc), the former mayor of New York City, launched a memecoin $NYC and removed liquidity at the price peak, pulling 3.18M $USDC from the liquidity pool.

Many traders panic-sold, with trader Dr6s2o losing $473.5K(−63.5%) in under 20 minutes.… pic.twitter.com/SeMD4Aqllf

— Lookonchain (@lookonchain) January 13, 2026

Hence, the collapse sparked widespread backlash across the crypto community, with many labeling the incident a classic rug pull. Crypto analysts on X alleged that about $3.4 million in liquidity was removed shortly after trading began.

Similarly, the on-chain visualization platform Bubblemaps highlighted what it described as unusual liquidity movements. Its analysis showed a wallet linked to the token deployer removing roughly $2.5 million in USDC near the market peak.

Former Mayor Eric Adams’s $3M NYC Token Rug Pull (Source: X)

After the price fell by more than 60%, approximately $1.5 million was later reintroduced. Bubblemaps said the pattern resembled liquidity behavior seen in the widely criticized LIBRA token launch. Other analysts pointed to the project’s apparent centralization, arguing that control over liquidity and supply posed elevated risks for retail participants.

Vague Explanations and Growing Scrutiny

Eric Adams addressed the token during a televised interview, offering broad comments about blockchain’s transparency while citing examples such as Walmart’s supply-chain tracking. During the appearance, he repeatedly referred to “block change technology,” drawing further criticism online.

He did not clarify how NYC Token funds would be governed or how beneficiary organizations would be selected. The controversy also revived confusion between the NYC Token and New York City Coin, a separate project launched by CityCoins earlier in Eric Adams’s mayoral term. That earlier token was later delisted by major exchanges in 2023 due to low liquidity.

With the increasing scrutiny, the NYC Token incident has turned into a cautionary case study on the dangers of celebrity-led crypto launches. For Eric Adams, the fallout underscores how quickly a pro-crypto reputation can unravel when transparency and execution fall short under market pressure.