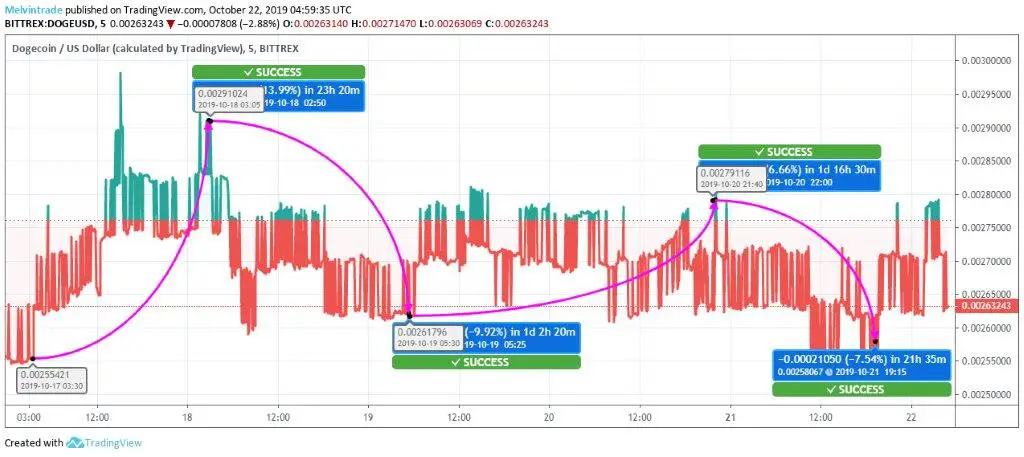

- Dogecoin price continues to be below the baseline on account of mounting bear pressure as seen from the 5-day price chart

Dogecoin (DOGE) price has been presenting a dismal picture ever since the bears have entered the crypto market in July. Nothing much has improved for the coin even now as the price is mostly below the baseline. The DOGE community should not expect much in this volatile crypto market scenario. The price trend for DOGE over the past 5 days shows the price moving in the range between $0.0026–$0.0029.

Dogecoin Price Analysis:

DOGE price has been in the doldrums since the bears set their foot in the crypto market as seen from the 5-day price chart. The coin started trading on a low note at $0.0026 on Oct 17. It started moving above the baseline and reached $0.0029 on Oct 18, marking an upward movement of 13.99%. The bear pressure being too strong to handle, the price again slipped to $0.0026 on Oct 19, the slippage being to the tune of 9.92%. The price fluctuation continued for DOGE and it moved upwards to $0.0028 on Oct 20, the upward movement was to the extent of 6.66%. The price once again went below the baseline at $0.0026 on Oct 21, the downward swing was to the extent of 7.54%. Though the price of DOGE is still below the baseline price, it has moved slightly upwards to $0.0026, which shows a recovery to the extent of 4%.

Doge price has taken the bearish way since the volatility has struck the crypto market. The price is expected to continue with this bearish trend for the short-term as the market continues to reel under bear pressure. Analysts feel this is the right time for long-term investors to make their investments and the coin has the capacity to bounce back when the crypto market is expected to have a bullish turn by the year end. Investors should look more at the future viability of the coin rather than the current crypto market volatility. Day traders may not have much scope for making gains as the price is being continually under bear pressure.