From the past few years, emerging technology cryptocurrency has been one of the important topics for regulators due to the growing public interest. The main reason for the growing public interest is of its high value since 2017. The value of the leading cryptocurrency had reached its peak in 2017 and continues to surge in 2019 as well.

Few countries have banned cryptocurrency trading, but there exist few countries, gone a step ahead to legalize companies to pay salaries of employees in digital currency. Cryptocurrency trading involves multiple risks. Traders need to plan effectively and choose a reliable platform like Bitcoin Trader. To know more about this promising platform read through Bitcoin Trader Platform Review. New Zealand is one of the nations to start legalizing crypto payment from 1st September 2019 onwards.

Workers to receive salaries in Bitcoin

New Zealand’s Inland Revenue Department published a statement stating digital currencies can be used to pay employees’ salaries in the nation.

As per the report, employers will have numerous cases, wherein they can pay workers’ salaries in cryptocurrencies. The instruction on the income tax process of digital currency shall be applied to crypto payments that belong to the regular salary of employees and are constant at a specific rate.

It should also be noted that the rule applies only to salary or wage workers, self-employed workers are not permitted to take benefits including payment for services and bonuses, gratuities and commission.

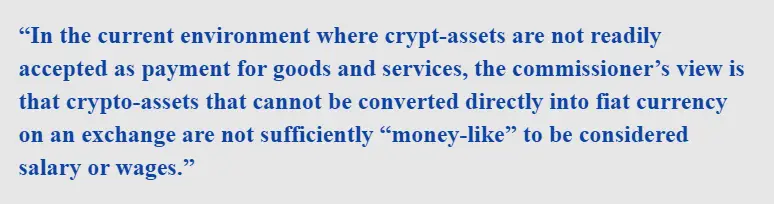

Moreover, for a cryptocurrency based salary to be taxed, the rule mentions that the digital currency paid to workers should not be ‘subject to a lock-up period’ and should be converted directly into traditional fiat currency, further briefed saying,

‘Money-like’ digital currencies are those currencies that offer a P2P system instead of assets that operated similar to shares, vouchers, and debt securities.

The new ruling consists of several more requirements like the initial one is the digital currency value must be linked to one fiat currency or more fiat currencies. Apart from this, there is one more condition that will allow workers to receive their payments in Bitcoin. For the wage to be taxed, the tax authorities consider that the digital currency should operate as a currency.

It should also be noticed that the digital currency payments will be viewed as ‘PAYE payments.’ PAYE is a system in New Zealand that directly tax workers from their wage or salary. In short PAYE system means ‘you pay as you earn.’

As per the document, the new rule will commence from September and will last for 3 years.