What To Know

- Bitcoin mining difficulty hits 142.3 trillion, signaling record competition.

- Reduced miner inflows ease selling pressure, boosting bullish sentiment.

- Rising hashrate strengthens network security but challenges smaller miners.

The Bitcoin mining industry has been a thriving industry since long as several have been making profit through it and many aspire to enter it. Since it’s a major aspect of the Bitcoin network, it often has major impacts on the king of crypto’s price. Recently, the mining industry hit a new record, which gave a notion of a price movement going forward. Therefore, CryptoMoonPress planned to investigate further.

Assessing Bitcoin Mining Status

Recently, mining difficulty has very much been subject to unforeseen increments in the month of September, having reached an unprecedented value of 142.3 trillion. Difficulty is regarded as one among the most crucial indicators in the ecosystem of Bitcoin, while also indicating how difficult it is to carry out the addition of new block to the blockchain and the reward assignment.

Bitcoin Mining Difficulty Reaches Record High Again in September

The difficulty of mining Bitcoin (BTC), a key metric that measures how challenging it is to add new blocks to the blockchain, has surged to a record high of 142.3 trillion as of Friday. …https://t.co/4rya6a0L2j pic.twitter.com/ZGfG4aBlF0

— Crypto Breaking News (@CryptoBreakNews) September 20, 2025

In parallel, Bitcoin hashrate also hit a new record, touching 1.4113 ZH/s, showing just how much computational power is securing the network today. What this really means is that miners are facing competition at increasingly higher levels-from individual competitors to massive institutional players now pouring in resources to exercise revenue from Bitcoin.

While this signals robust network security and an acknowledgment of the network itself, it also calls for a bigger question: with soaring difficulty levels, would smaller or less efficient miners continue to show interest? For those suffering higher costs of electricity and having outdated equipment, their profitability might actually get squeezed out, forcing them to leave the network and make a living for themselves into other blockchains or altogether different industries.

Conversely, for miners enjoying cheap electricity and state-of-the-art rigs, high difficulty is actually favorable on their part because less competition could in effect aggrandize earnings toward the stronger few. In either case, that milestone certainly draws an intricate picture: a more-shaped and secure Bitcoin network but with a potential to have less decentralization since smaller participants could get out of the running because of putting costs.

Will Miners Affect BTC Price?

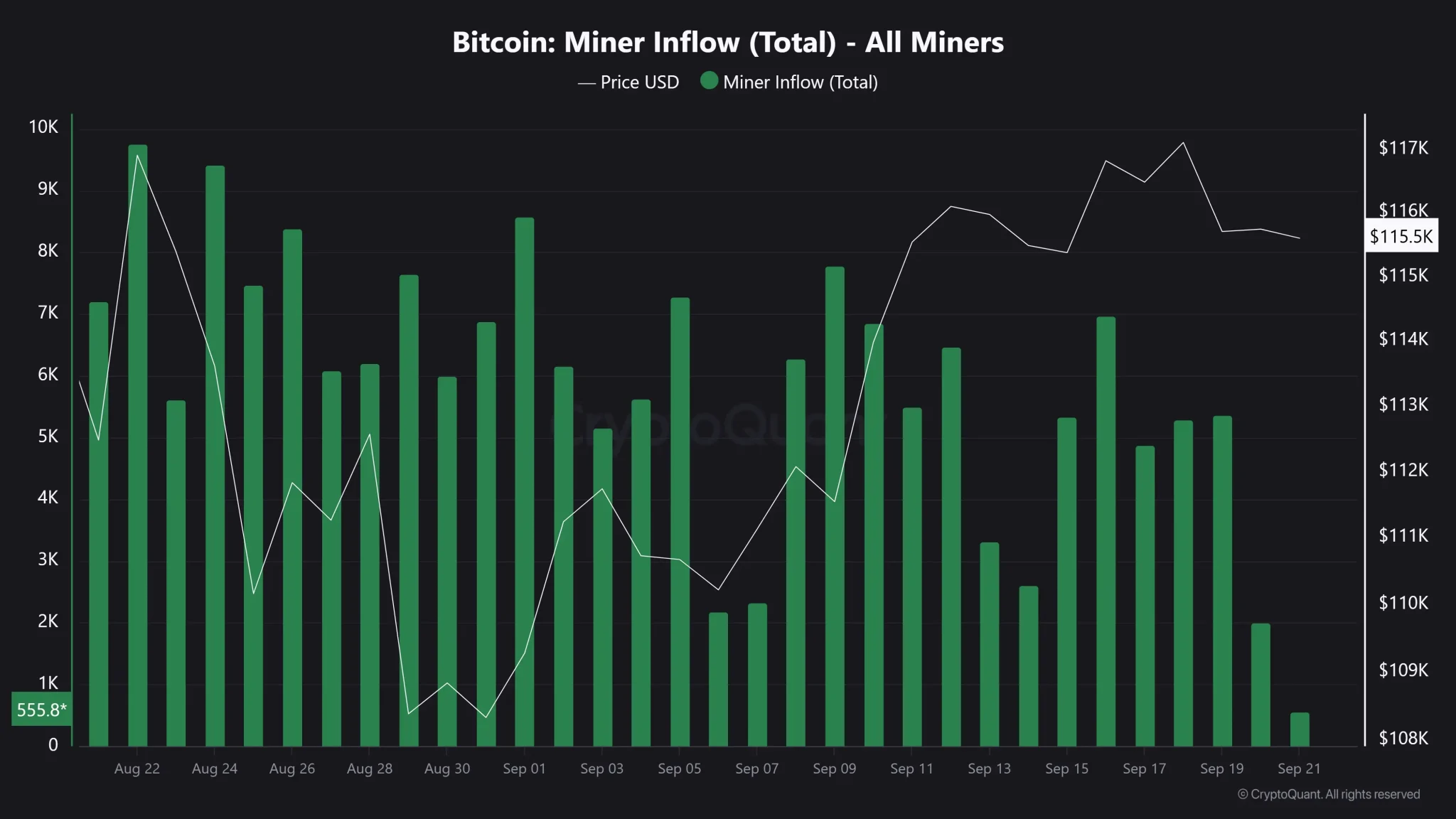

The development of miner inflows keeps significant implications for the market sentiment. CryptoMoonPress has recently found that, according to the latest updates from CryptoQuant, the inflow from Bitcoin miners has reduced in the past week. In layman terms: miner inflow refers to the amount of BTC sent from miners to either an exchange or wallet, with an apparent connotation of potential selling activities.

A reduction in such inflows usually means less selling pressure, which implies fewer keepers of freshly mined coins that would otherwise be dumped into the market. Such a trend could be perceived as bullish simply because it shows miners-the backbone of the Bitcoin network-are confident about the future price trajectory of Bitcoin and would rather keep their reserves by themselves than go ahead to sell them off immediately.

Historically, in such phases of accumulation by the miners, prices remain either stable or move upward, primarily due to a potential supply squeeze. Should fewer coins be available for buyers, prices rise even if demand remains steady. Demand rising even further would only push prices higher. This very dynamic deepens the prospect of a Bitcoin bull-run in the near future.

But, nevertheless, one must keep a heart of caution: if suddenly, miner outflows spike, it might point to changes in sentiment or the need for liquidity, possibly weighing on Bitcoin’s price for a short run. To sum it up, a consistent decline in miner inflows tends to be bullish, reinforcing the idea that miners are firmly holding, supporting the long-term narrative of Bitcoin’s strength and resilience.