- Investigators traced stolen funds to five wallets, leading to the freeze of nearly $50M in USDT.

- Tether froze $49.6M in June 2024 after APAC law enforcement flagged wallets tied to pig butchering.

- Pig butchering scams surged 40% in 2024, draining billions and showing a sharp global rise in fraud.

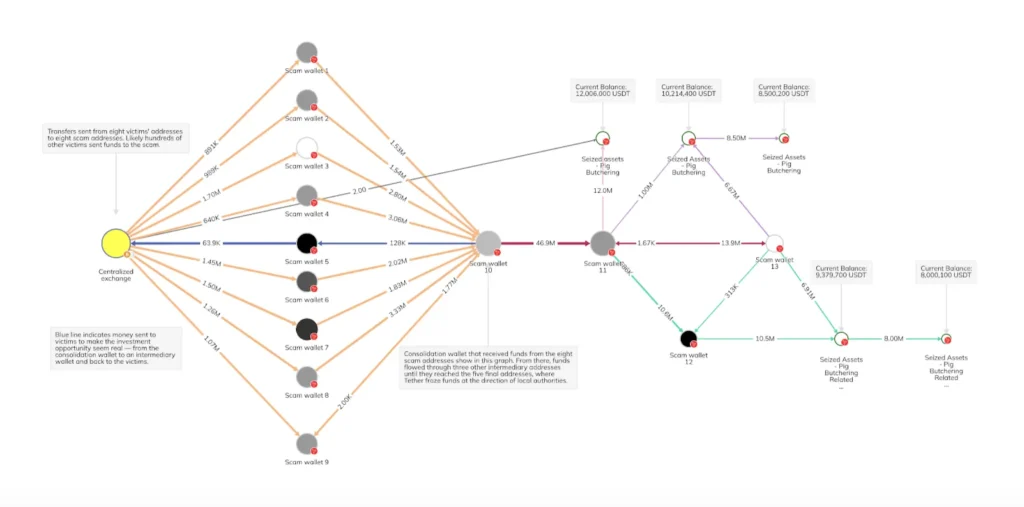

Nearly $50 million tied to a “pig butchering” scam has been frozen following a coordinated effort between Chainalysis, Tether, Binance, and OKX. The scam, also known as romance baiting, has emerged as one of the fastest-growing crypto fraud tactics worldwide. Using blockchain analysis and direct cooperation with Asia-Pacific (APAC) law enforcement, investigators traced the stolen USDT to just five wallets and stopped the perpetrators from laundering the funds into fiat.

According to Chainalysis, its Crypto Investigations Solution revealed that the scammers operated between November 2022 and July 2023. They persuaded victims through romantic and casual contact, gradually building trust before urging them to invest in fraudulent schemes. Transfers from hundreds of victims were funneled through intermediary wallets, with perpetrators even sending small amounts back to maintain an illusion of legitimacy.

Tether confirmed that it froze $49.6 million in June 2024 at the request of regional authorities. “Unlike other cryptocurrencies like ether and bitcoin, Tether has the technical ability to freeze known illicit funds,” said Paolo Ardoino, CEO of Tether. He further stressed the company’s dedication to working with law enforcement agencies worldwide to return stolen assets and combat crypto-related crime.

How Investigators Traced and Blocked the Scam Funds

Chainalysis explained that investigators mapped transactions, leading to a consolidation wallet holding $46.9 million in USDT. From there, the funds moved through three intermediary addresses and into five final wallets. The pattern of deposits and withdrawals fits the structure of pig butchering scams, where criminals often make small repayments to victims to reinforce trust.

Victims’ Transfers. Image: Chainalysis.

Victims’ Transfers. Image: Chainalysis.

Exchanges Binance and OKX played a crucial role in analyzing the wallets, providing intelligence that was passed on to law enforcement. “Our collaboration with these organizations highlights the essential role of public-private partnerships in subverting criminal operations and working toward compensating victims,” said Erin Fracolli, Binance Global Head of Intelligence and Investigations.

A senior blockchain investigator at OKX emphasized that victims of such scams are often unfairly blamed. “It’s not based on someone’s intelligence, but rather on their vulnerabilities, and scammers are adept at figuring those out,” the investigator said.

Chainalysis Report: Rising Threat of Pig Butchering Scams

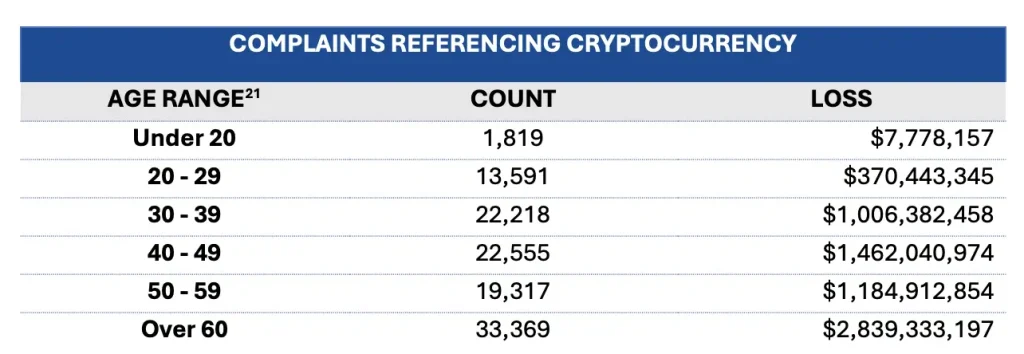

Pig butchering scams have grown into a global criminal enterprise, combining investment fraud with human trafficking. Chainalysis reported that romance baiting losses rose 40% year-on-year in 2024, with the number of deposits increasing by over 200%. The FBI Internet Crime Complaint Center recorded more than $5.8 billion lost in crypto investment scams last year, with romance scams accounting for a growing share.

Complaints Referencing Cryptocurrency Source: FBI IC3 report.

In November 2023, Tether and OKX worked with the U.S. Department of Justice to freeze $225 million in USDT connected to an international human trafficking syndicate in Southeast Asia. That case, later joined by Coinbase, resulted in the largest crypto seizure in U.S. Secret Service history after a judge authorized the funds’ forfeiture and burn.

Chainalysis noted that pig butchering scams often rely on trafficked workers forced to operate out of compounds across Southeast Asia. These individuals are lured with false job offers, then held captive to run scam operations. The dual impact—financial devastation of victims and exploitation of trafficked individuals—makes these schemes particularly damaging.

The Broader Impact of Industry Collaboration

The successful freezing of nearly $50 million in illicit funds underscores the importance of collaboration between crypto exchanges, blockchain intelligence firms, stablecoin issuers, and law enforcement. By sharing real-time intelligence, the industry can disrupt organized scam operations before criminals convert assets into fiat.

“Furthering the security of the larger blockchain ecosystem is our number one priority,” Fracolli of Binance said. “We promptly share our knowledge and expertise with law enforcement, government agencies, and other exchanges to stop the spread of crime with a crypto nexus.”

As scams continue to evolve globally, experts agree that advanced blockchain analysis tools and public-private partnerships are the strongest defenses. The latest operation demonstrates how technology, combined with cooperation, can protect vulnerable individuals and send a clear message to fraudsters: stolen funds are no longer beyond reach.

Read More: Tether to Launch USDT on RGB, Expanding Stablecoins to Bitcoin