- Grayscale registers new trusts as it moves closer to BNB and Hyperliquid ETF plans.

- Filing signals rising demand for regulated access to BNB and Hyperliquid markets.

- Major ETF issuers now compete to launch the first BNB and Hyperliquid products.

Grayscale has taken a fresh step in its expansion beyond Bitcoin and Ethereum-linked products by laying the legal groundwork for two new exchange-traded funds tied to BNB and Hyperliquid. The digital asset manager, which oversees about $35 billion in assets, registered statutory trusts in Delaware, a procedural move that typically precedes a formal filing with federal regulators.

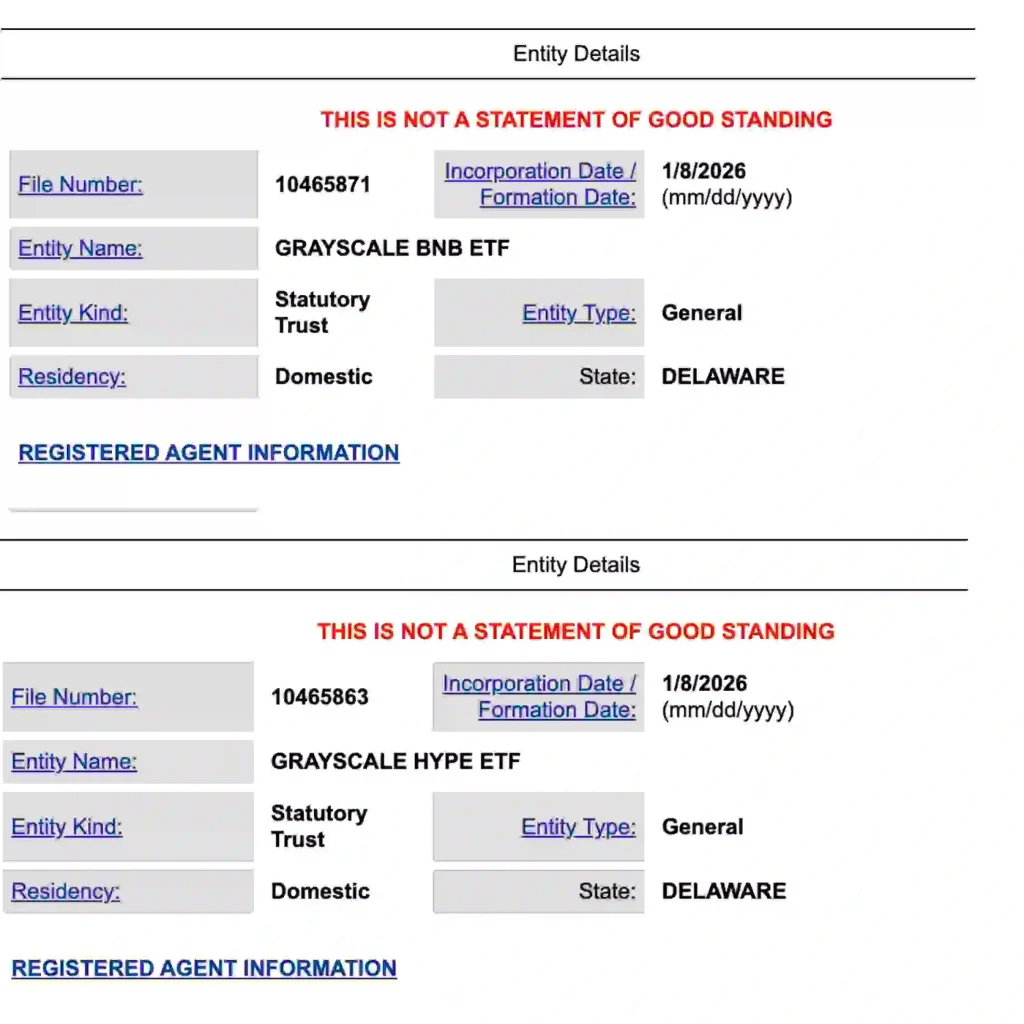

Grayscale’s BNB and HYPE ETF Filing. (Source: State of Delaware Official Website)

The filings position Grayscale among a growing group of asset managers racing to broaden crypto exposure through regulated vehicles. While the registrations do not constitute approval or even an application with the U.S. Securities and Exchange Commission, they signal intent. Historically, such trusts are established to create a legal shell that can later be converted into a spot- or derivative-based ETF once regulatory disclosures are complete.

Grayscale’s Delaware Filings Set the Legal Foundation

According to records from the Delaware Division of Corporations, Grayscale registered the Grayscale BNB Trust under file number 10465871 and the Grayscale HYPE Trust under file number 10465863 on January 8. This step is common across the ETF industry, particularly for crypto-linked products that require a clear legal structure before federal review.

However, these trust registrations do not guarantee approval. Instead, they allow Grayscale to prepare for the next stage, which would involve submitting an S-1 registration statement to the U.S. Securities and Exchange Commission. An S-1 outlines how an ETF will operate, including custody arrangements, valuation methods, risk disclosures, and compliance controls.

The timing is remarkable. Recently, the SEC made the decision to allow listing frameworks for standard crypto ETFs, which means that qualified products will no longer be required to file for asset-specific rule changes under Section 19(b). The review process is still tough, though, but it has been made easier in a way that once applications get to the commission, they will be processed faster.

Regulatory Context Around BNB and Hyperliquid

Regulatory issues are still the main concern, even though there has been a change in the procedure. The fate of BNB in the U.S. market is being closely monitored due to the lawsuit against Binance. The eventual decision of the regulators on the BNB classification under securities law could be a decisive factor in the granting or postponement of the ETF linked to BNB.

Hyperliquid, on the other hand, is a different case altogether. The token is mainly involved with the derivatives-focused market infrastructure, which is an area prone to intense scrutiny and thus not very favorable. Any future application would have to clarify how the ETF intends to deal with the exposure, liquidity, and integrity issues connected to such products.

Market observers note that the trusts alone do not resolve these issues. However, they confirm that Grayscale is preparing the documentation required to engage regulators once conditions allow.

Competitive Landscape Intensifies

Grayscale’s move follows similar actions by other asset managers. VanEck, which manages roughly $181.4 billion globally, registered a BNB trust in April and filed an S-1 for a spot BNB ETF in May. VanEck has also confirmed plans to launch a product linked to Hyperliquid.

Similarly, Bitwise has amended its Hyperliquid ETF filing, a step analysts view as positioning the product closer to launch readiness. Meanwhile, 21Shares has gone further by filing for a leveraged product designed to deliver twice the daily performance of a Hyperliquid index.

As of January 6, Grayscale had nine live crypto-focused ETFs on the market. The aforementioned investments granted a stake to major coins such as Bitcoin, Ethereum, XRP, and Solana. Furthermore, the company made an application for ETFs linked to more altcoins, indicating a wide plan for increasing regulated access throughout the entire crypto market.

Market Reaction and CZ’s Response

The Hyperliquid filing was a subject of interest for market players and commentators alike. Some acknowledged that if a Hyperliquid ETF were to get the green light, it would become the most immature asset ever to be structured into a trust by Grayscale, thus changing its pattern of investing in assets with longer trading histories.

Grayscale has officially registered for HYPE ETF

If this proceeds, HYPE would be the youngest asset Grayscale has ever created an ETF/trust for.

Historically, Grayscale has been extremely conservative..

All previously listings were 3–10+ years old before Grayscale touched… pic.twitter.com/yVWwcXvPoP— kirbycrypto (@kirbyongeo) January 9, 2026

Concurrently, Changpeng Zhao publicly distanced himself from reports linking BNB to the new trust. In a response on social media platform X to a report about the Delaware filing, he said he had come to know about the matter through social media and did not confirm any involvement or coordination. His reply made it clear that the filing was a solo initiative by Grayscale, with no public support from Binance’s top management.

I only learned about this on X, right now… 😁👏 https://t.co/GfryX2ywFl

— CZ 🔶 BNB (@cz_binance) January 9, 2026

Taken together, the Delaware registrations mark another incremental step in the normalization of crypto ETFs. While the situation of approvals is still unclear, the filings prove that the asset managers are still in the process of preparing for the influx of digital assets into regulated markets.