- WLD price surges 100% as bullish on-chain signals point to further market strength.

- Open interest hits a record $852.72M as traders keep long positions active.

- Analysts see $1.40 as a buy zone before WLD targets a push toward $5–$6.

Worldcoin’s WLD token has leapt into the spotlight with a powerful rally, gaining more than 20% in a single day and quintupling in value over the past week. At the time of reporting, the WLD price trades at $1.87 after briefly touching $2.21, its highest level in seven months. The surge comes as the project rolls out a landmark technological advancement that has captured investor attention worldwide.

Anonymity Meets Security in Worldcoin’s Latest Upgrade

At the center of this momentum is Worldcoin’s new anonymized multi-party computation (APMC) system. The open-source framework is designed to be quantum-secure and protects numerical code fragments linked to Orb-verified World ID holders.

This breakthrough strengthens security while maintaining user anonymity, a critical element in the project’s global identity vision. The system’s strength lies in its unprecedented performance. Powered by NVIDIA’s H100 GPUs, APMC can process 50 million uniqueness checks every second.

This staggering throughput highlights not only the project’s technological sophistication but also its ability to scale globally without bottlenecks. However, what makes this development stand out is the collaborative foundation behind it.

WLD Price Breaks Key Barrier, Eyes Higher Levels

Riding the wave of renewed optimism, WLD has broken through a multi-month resistance trendline, marking its first decisive bullish breakout since December. The move underscores a revival in market sentiment and suggests potential room for further gains.

The token now eyes the $2.38 level, aligning with the 50% Fibonacci retracement zone, which stands as the next critical barrier. Traders are watching this tier closely, as clearing it could unlock higher momentum. Beyond this point, the range between $3.78 and $4.18 emerges as a significant zone of interest.

WLD Price Chart (Source: TradingView)

This band has historically served as both support and resistance, making it a pivotal marker for the token’s trajectory. A decisive break above this range could cement a stronger bullish structure, potentially paving the way toward $6 and higher.

Yet, the bullish narrative remains tied to market conviction. A reversal could drive the token back to retest the broken trendline as fresh support. Failure to defend this level might erode confidence, exposing lower support zones between $0.83 and $0.57 once again.

WLD Price Chart (Source: X)

Market analyst Ali_charts supports WLD’s bullish views as he projects the token could briefly dip toward $1.40 before resuming its upward march. According to his chart, this zone represents an attractive accumulation area, potentially setting the stage for a surge toward $5.

On-Chain Data Maps the Road to Higher Levels

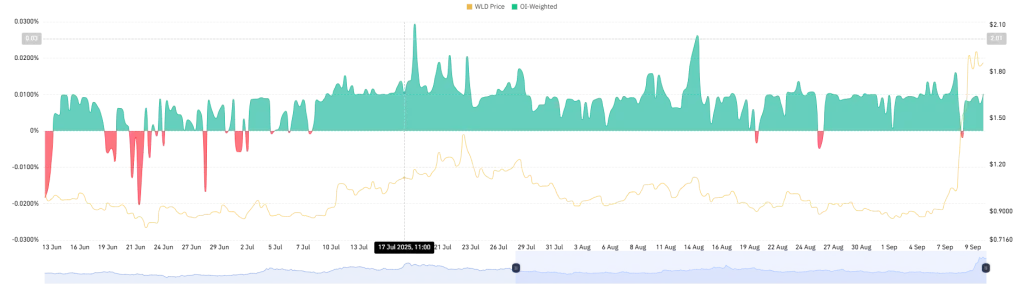

The WLD market has entered a phase of heightened bullish conviction as traders continue to keep positions active despite soaring prices. Data shows the OI-weighted funding rate has held firmly in positive territory since early July, now sitting at +0.0102%. This signals that long traders are paying a premium to shorts, a clear indication of confidence in further upside.

WLD OI-Weighted Funding Rate (Source: CoinGlass)

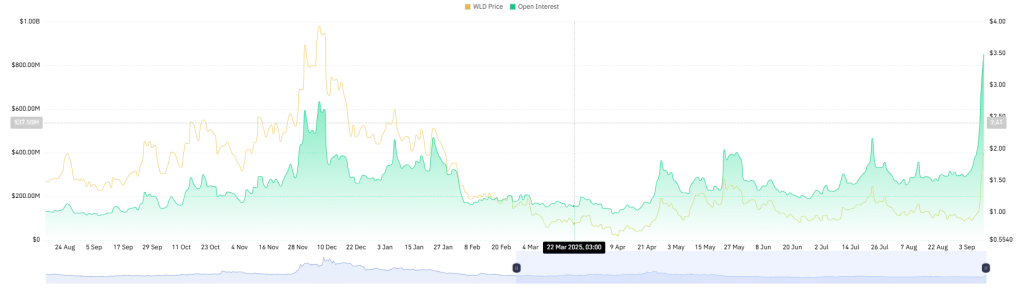

Alongside this, the token’s open interest has surged to a record $852.72 million. The spike underscores increased speculative activity, with traders opting to maintain exposure rather than secure near-term profits. The move reflects a market environment where optimism outweighs caution, reinforcing the broader bullish narrative.

WLD Open Interest (Source: CoinGlass)

However, near-term risks remain. The liquidation map highlights a cluster of long positions worth $9 million positioned around $1.797. This zone could trigger a controlled retracement, often described by analysts as a “healthy reset,” designed to shake out weaker hands before the next leg higher.

WLD Liquidation Map (Source: CoinGlass)

Looking further ahead, the data points to an even more compelling setup. If WLD can sustain momentum and break decisively above the $2 threshold, short positions worth $51.07 million are at risk of liquidation. Such an event could spark an aggressive upward rally, potentially accelerating the token’s path toward higher resistance levels.