- BTC began Monday at nearly $119,294 before hitting $122,335, extending last week’s strong rebound.

- ETH led weekly inflows with $268M, driving assets under management to a record $31.9 billion.

- XRP is consolidating within a bullish pennant, a pattern often linked to upside breakout potential.

BTC, ETH, and XRP are entering the week with strong momentum that could push them toward new all-time highs. Bitcoin began trading on Monday at nearly $119,294 and peaked at $122,335, extending gains from last week’s rebound after briefly touching the $119,920 zone on August 3.

ETH reclaimed its $4,000 level for the first time in almost three years before moving past $4,300. XRP also strengthened, aiming for its July 18 peak of $3.66, supported by renewed institutional participation following a key legal development involving Ripple and the US Securities and Exchange Commission.

Rising demand, strong technical positions, and renewed investor confidence are shaping what could be a decisive week for these top cryptocurrencies. Could this be the moment they push past historic peaks and set new benchmarks? Let’s find out.

Institutional Inflows Drive Confidence

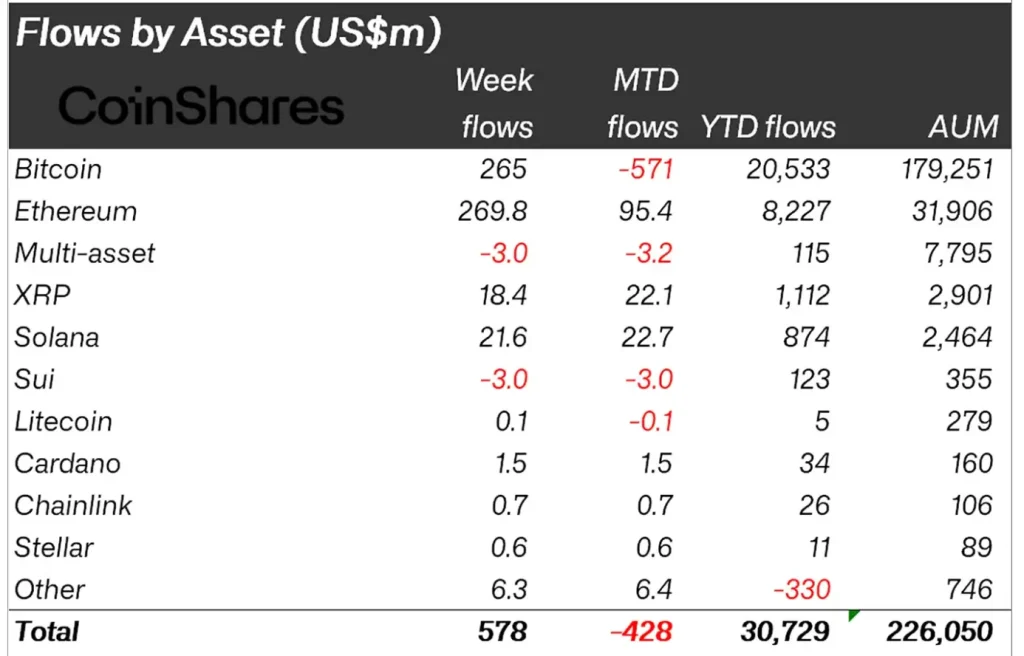

Fresh capital is flowing back into digital asset investment products, lifting sentiment across the market. CoinShares reported $578 million in inflows last week, with Ethereum products leading at $268 million. This brought ETH’s total assets under management to $31.9 billion, representing 82% growth in 2025 so far.

Bitcoin products drew $265 million in new investments, while Solana and XRP attracted $21.6 million and $18.4 million, respectively. Much of this activity followed a major policy change in the US that allows cryptocurrencies in 401(k) retirement accounts.

According to CoinShares, $1.57 billion entered the market in the second half of last week alone, which they linked to the retirement plan announcement.

“In the latter half of the week, however, we saw US$1.57B of inflows, likely spurred by the government’s announcement permitting digital assets in 401(k) retirement plans,” the CoinShares report highlighted.

BTC Edges Closer to Its All-Time High

BTC has surged out of a descending channel, breaking through a bearish pattern that had kept prices capped in recent weeks. The move shifts market sentiment toward optimism, placing the cryptocurrency within reach of its all-time high near $123,218.

The climb is accompanied by stronger trading volume, which indicates that buyers are accumulating positions. This form of volume accumulation during the up-price movement is usually an indicator of investor confidence and a likelihood of continued gains.

BTC Price Chart (Source: TradingView)

Momentum indicators are also backing the bullish argument. The Relative Strength Index is on an upswing, indicating the presence of more buying pressure and a positive trend. Having cleared major resistance points, Bitcoin seems ready to challenge the $123K mark, and traders are now keenly observing whether new records might be set.

ETH Pushes Higher as Volume Signals Strong Demand

After breaking above the March high of $4,096, ETH is holding that level as immediate support while trading near $4,294. Rising trading volume is accompanying the move, pointing to an accumulation phase that reflects strong bullish sentiment.

As buyers become more committed, ETH is approaching its all-time high of $4,868. Above that level, the following possible targets can be observed at Fibonacci extension levels of $5,156 and $5,577.

ETH Price Chart (Source: TradingView)

Nevertheless, the Relative Strength Index is at the 70 level on the weekly chart, which is a sign of overbought status. This portends strong momentum but also indicates that temporary declines may develop in case profit-taking starts.

XRP Holds Support With Breakout Potential Ahead

On the 4-hour time frame, XRP is forming a bullish pennant pattern, which is commonly associated with bullish breakouts. This structure comes after a rally seen last week, where the token escaped a falling wedge structure only a few hours after the Ripple-SEC case was dropped. The legal resolution added new confidence to the market, which stimulated new interest in buyers.

XRP Price Chart (Source: TradingView)

At the moment, XRP is trading at the 0.5 Fibonacci retracement level, which has been known to act as a support zone. Holding this level may be the precursor to another upward thrust, this time toward the mid-July high of $3.66.

An actual breakout of the pennant pattern indicates the resumption of the broader uptrend, setting the stage to climb even higher in the near term. In addition, the Relative Strength Index (RSI) is trading at approximately 51, with its signal line at approximately 53, further reinforcing balanced momentum but leaving some space to expand bullishly as long as buying pressure intensifies.