What To Know

- Spot Bitcoin ETFs amassed a gigantic inflow of $1.2 billion on Monday alone.

- The feat came as the BTC price rallied to a fresh all-time high beyond $126,000.

- BlackRock’s IBIT took the lead with nearly $1 billion in inflows, with Fidelity’s FBTC following suit.

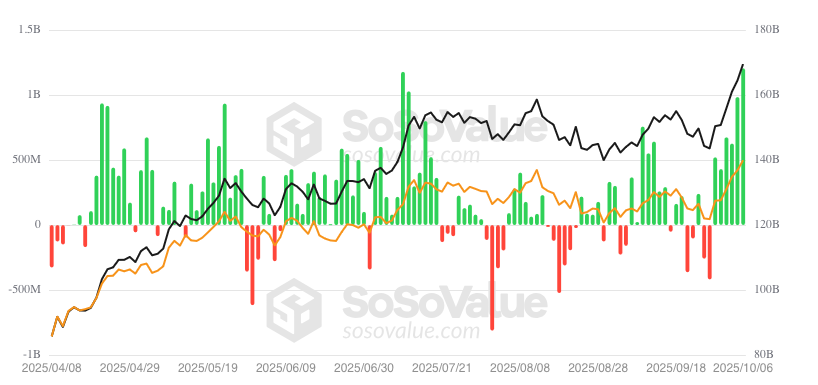

U.S. spot Bitcoin ETFs bagged over $1.2 billion in the latest session, recording the largest-ever influx of 2025. In the meantime, BTC price surged to a new all-time high of $126,000.

Information gathered by Farside Investors shows that on October 6, 2025, the total net flows into Bitcoin ETFs amounted to about $1,205 billion, the highest one-day inflow this year. It marked the sixth day of inflows in a row, and the total now stands at approximately $4.35 billion since the streak started back at the end of September.

BlackRock Bitcoin ETF Shines with Nearly $1 Billion Inflows

The statistics reveal that iShares Bitcoin Trust (IBIT) by BlackRock has been the first to jump on the train and received a new round of capital worth $970 million on October 6 alone. It is the second day of the year that the fund has the greatest inflow, only a little less than its highest point of April 28, 2009, of $970.93 million.

Other significant contributors are the FBTC by Fidelity, which registered $112.3 million and Bitwise’s BITB, which saw an inflow of 60.1 million. Smaller ETF providers like ARK 21Shares Bitcoin ETF (ARKB), BRRR by Valkyrie and HODL by VanEck had inflows between 3 million and 15 million, which were consistent but not huge.

However, GBTC of Grayscale experienced further outflows, losing approximately $30.6 million on the same day. This indicates continued movement of investors towards lower-fee products.

This inflow wave is the biggest since July 10, 2025, when Bitcoin funds registered more than $1.18 billion in daily inflows prior to BTC soaring above $119,000 shortly after. This trend seems to be ongoing with Bitcoin since surpassing new all-time highs exceeding $126,000 amid renewed market excitement through ETFs.

According to the Farside dataset, Bitcoin ETFs have been cumulatively taking on a total of more than $61.2 billion in net inflows to date. The IBIT of BlackRock is the largest fund with a cumulative inflow of over $63.6 billion, Fidelity FBTC with $12.7 billion, and Bitwise BITB with $2.5 billion.

The ‘Uptober’ Hype Takes Over

The latest boom coincides with the well-known Uptober phenomenon, which the traders refer to as the historical show of the bullishness of the market in October related to cryptocurrencies. The price of Bitcoin, which now surpasses several all-time-highs since the month began, is at present trading at around 124,000, and has temporarily reached as high as 126,000.

According to market analysts, the consecutive ETF inflows indicate the accumulation of institutional trust. The cumulative inflows into digital asset investment products have risen to $5.95 billion over the last week, of which Bitcoin funds have constituted about 3.55 billion in this figure.

The current ETF inflow run is after a turbulent September, where there have been contrasting strong accumulation and short-lived outflows. Some ETFs, such as IBIT and FBTC, had a high number of redemptions in September, with IBIT recording an outflow of $276.7 million on September 22 and $300.4 million on September 23. The reversal, however, began late in the month, and since September 29, inflows have splurged in.

ETF inflow activity is still dominated by institutional interest. Investors have placed more capital in BlackRock’s IBIT ETF than in other funds combined. Meanwhile, the FBTC at Fidelity has also been consistent and positively recorded net inflows over the last six trading sessions.

Though smaller funds such as ARK 21Shares and VanEck still hold a minimal portion of the market, their continued presence is an indication of the wider diversification trend among institutional investors.

Also Read: Ethereum Price Eyes $5K as ETF Inflows Soar Past $14B in 2025 Boom