- The fear and greed index moves to 61 as Bitcoin rallies toward 97K after months of fear

- Bitcoin exchange supply drops to 1.18M BTC, marking the lowest level in seven months

- Net holder count falls by 47244 as retail exits positions during recent price recovery

The Crypto Fear and Greed Index moved back into “greed” territory on Thursday, recording a reading of 61 for the first time since October’s $19 billion liquidation event. The shift followed weeks of intense fear that had dominated crypto markets late last year. One day earlier, the index stood at 48, still within neutral territory. However, by press time, it had surged decisively into the greed zone, reflecting a sharp shift in market sentiment.

Bitcoin Rally Pushes Crypto Fear and Greed Index to 61 (Source: Alternative.me)

The rapid change reflected improving price conditions rather than any single trigger. The last major sentiment breakdown occurred on Oct. 11, when $19 billion in liquidations forced traders out of altcoins and into defensive positions. That shock lingered for months.

During November and December, the index slipped into the low double digits several times, marking some of its weakest readings. Trading activity also slowed during that period as volatility remained elevated and confidence stayed thin. The main question for investors right now is, will Bitcoin rally further, or is it just a brief rise before a deeper fall?

Bitcoin Rally Strength Supports the Shift

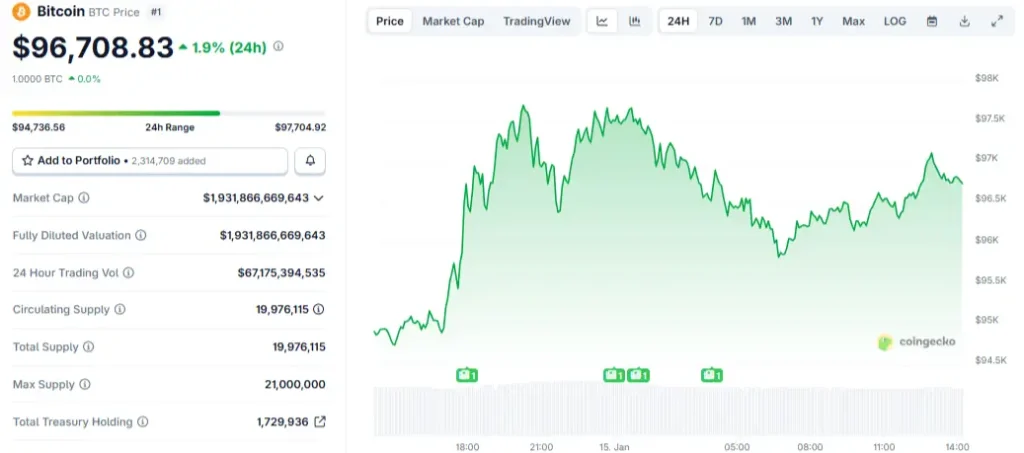

During the most recent trading session, the Bitcoin rally confirmed the rise of market mood and the overall strong demand for the digital currency. Currently, Bitcoin is priced at $96,708, considering the 1.9% increase over the last day. The spread of the trading session was from $94,736 to $97,704, indicating that active trading and the currency’s demand were high.

Initially, the Bitcoin rally started at $89,799 and reached a two-month high of $97,704 on Wednesday. Moreover, its market capitalization increased to $1.93 trillion, which corresponds to the fully diluted valuation. The trading volume for the last 24 hours was approximately $67 billion, indicating that liquidity is still strong.

1-Day Bitcoin Price Chart (Source: CoinGecko)

Metrics related to network supply were constant. The amount of circulating supply was 19,976,012 BTC, which is close to the upper limit of 21 million that has been set. The treasury’s figures revealed that 1,729,936 BTC is in treasuries, which suggests that there has been a continuous long-term and institutional exposure to the market as prices were around the recent highs.

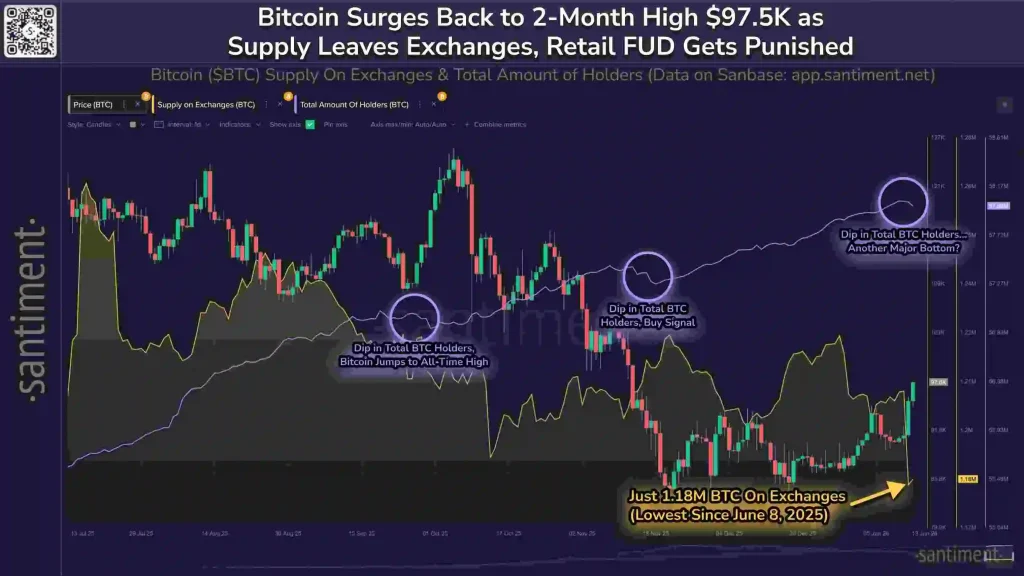

Exchange Supply Falls as Retail Exits

On-chain data from Santiment added further context to the Bitcoin rally. In a post on X, the analytics firm said Bitcoin surged back toward $97,500 as exchange balances declined. Supply on exchanges fell to roughly 1.18 million BTC, the lowest level since June 8, 2025, marking a seven-month low. This gave the market a chance to experience a rebound, thus prompting the Bitcoin rally forward.

Bitcoin Supply on Exchanges and Total Amount of Holders (Source: X)

At the same time, Santiment reported a net drop of 47,244 Bitcoin holders over the past three days. The firm attributed the decline to retail investors exiting positions due to fear and impatience. “Bitcoin has roared back to a 2-month high of $97.5K,” Santiment wrote, confirming the Bitcoin rally.

The platform’s data indicated overlapping historical times when the decrease in total holders coincided with significant price movements. A few such cases happened before the steep price increases, including the earlier peaks. According to the most recent data, the total number of Bitcoin holders was approximately 57.9 million; long-term accumulation and short-term turnover led to Bitcoin rallying to high levels.