- Mysterious entity accumulates 171,015 ETH worth $667M across six wallets

- Institution receives funds from FalconX, Galaxy Digital, and BitGo platforms

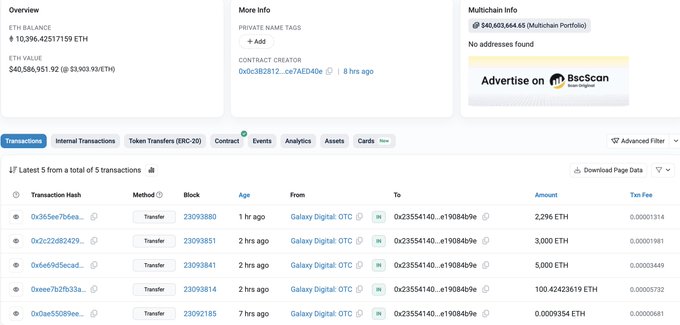

- Latest transaction shows 10,396 ETH ($40.6M) moved in past two hours

A mysterious institution has quietly accumulated 171,015 ETH valued at approximately $667 million over the past four days through coordinated transactions across multiple wallets.

This Ethereum news reveals the entity created six new wallets to receive transfers from major institutional platforms including FalconX, Galaxy Digital, and BitGo.

The latest activity shows 10,396 ETH worth $40.6 million transferred from FalconX within a two-hour window, indicating ongoing accumulation efforts.

Corporate Treasury Landscape Shows Massive ETH Adoption

Recent Ethereum news highlights BitMine Immersion Technologies leading the corporate treasury sector with 833,137 ETH valued over $2.9 billion accumulated in just 35 days between June 30 and August 4, 2025.

The Las Vegas-based company, led by Fundstrat’s Tom Lee and backed by Peter Thiel, Bill Miller III, and Cathie Wood, aims to control 5% of total ETH supply.

SharpLink Gaming ranks second with 521,900 ETH worth over $2 billion, executing aggressive accumulation strategies since June 2025.

The company completed a single transaction of 77,210 ETH for $295 million that exceeded Ethereum’s monthly issuance, while securing an additional $200 million investment in August 2025.

The Ether Machine holds 334,757 ETH valued over $1.3 billion, surpassing even the Ethereum Foundation’s holdings through strategic purchases including 15,000 ETH worth $57 million in July 2025.

Strategic Accumulation Methods Reveal Institutional Sophistication

Latest Ethereum news shows BTCS Inc. has expanded holdings to 70,028 ETH worth approximately $275 million through its “DeFi/TradFi Accretion Flywheel” strategy combining traditional and decentralized finance mechanisms.

The company filed for a $2 billion share sale to fund additional ETH purchases, demonstrating commitment to continued accumulation.

The mysterious institution’s use of multiple wallets and institutional counterparties suggests compliance with internal risk management protocols or regulatory requirements.

Transactions through FalconX, Galaxy Digital, and BitGo indicate access to institutional-grade trading infrastructure and custody solutions.

Market Impact of Concentrated Institutional Holdings

Current Ethereum news from Strategic Ethereum Reserve data shows 67 entities holding over 100 ETH each in treasury positions, creating concentrated institutional ownership patterns.

BitMine’s 0.69% supply share and SharpLink’s 0.43% share indicate growing corporate control over Ethereum’s circulating supply.

The rapid accumulation pace by major holders could reduce available ETH supply for retail and smaller institutional investors. Combined holdings of top treasury companies exceed several billion dollars, creating substantial buying pressure on Ethereum markets.

Institutional accumulation strategies often involve long-term holding periods that reduce market liquidity and potentially increase price volatility.

The concentration of holdings among relatively few entities creates systemic dependencies within Ethereum’s ownership structure.

Infrastructure Partnerships Enable Large-Scale Accumulation

Professional cryptocurrency trading desks enable institutions to execute large transactions without causing adverse market impact through sophisticated order management systems. The ability to move $40.6 million worth of ETH in single transactions shows access to deep liquidity pools.

Institutional custody solutions from BitGo and similar providers offer security features and insurance coverage that traditional financial institutions require for cryptocurrency holdings. These infrastructure partnerships reduce operational risks associated with large-scale digital asset accumulation.

Continued institutional accumulation represents major Ethereum news that could fundamentally alter the network’s ownership distribution.

Corporate treasuries with multi-billion dollar holdings create new stakeholder categories with different incentives than traditional retail investors.

The recent accumulation suggests additional institutions may be building Ethereum positions through similar methods.