- Whale nets $148M profit after selling 4.99M HYPE at an average price of $45.82.

- HYPE rebounds 7% from its $43.50 low, market cap climbs past $ 15.8 billion.

- Token trades at $47, with resistance at $49 and support at $42–$39.

Hyperliquid’s native token, HYPE, is bouncing back after a sharp 10% slide shook traders just yesterday. The drop was triggered by whales unloading over 5 million tokens, causing the price to tumble before sentiment began to shift.

Today, confidence is returning. HYPE is changing hands at $46.95, a 7% climb from its $43.50 low. The token’s market cap has also grown to $15.8 billion, rising more than 4% in the last 24 hours. Meanwhile, trading volume slipped 3% to $391 million, hinting that momentum may be cooling even as prices recover.

The rebound highlights the token’s resilience, but uncertainty lingers. Will fresh demand push HYPE higher, or will another wave of whale selling test its strength again?

Whale Nets $148M Profit from Exit

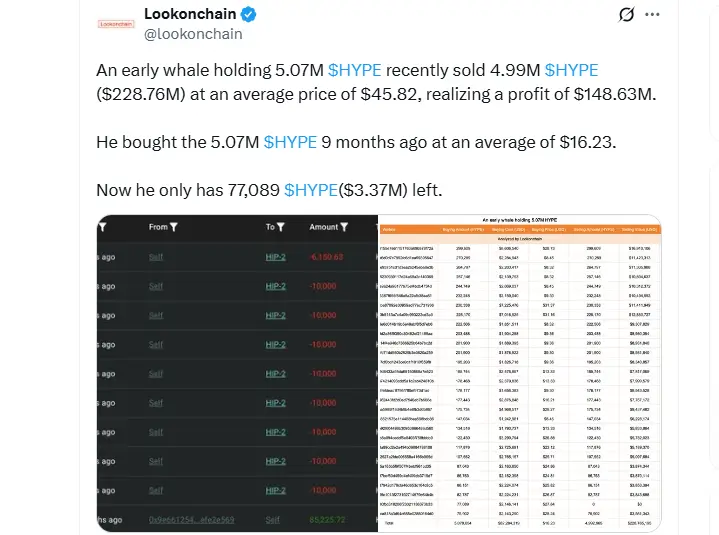

On-chain data shared by Lookonchain reveals that the sell-off was not a random liquidation but a carefully timed exit. According to reports, the whale first accumulated 5.07 million HYPE tokens nine months ago at an average of $16.23 per token, investing just over $82 million.

Fast forward to this week, the same wallet offloaded 4.99 million tokens at an average of $45.82, booking a massive $148.63 million profit. The sales were executed in multiple tranches ranging between $44.57 and $44.92, a clear strategy to reduce slippage and maximize returns.

Whale Dumps 5M HYPE Token (Source: X)

Following this move, the whale now holds only 77,089 HYPE, worth approximately $3.37 million at the time of writing. This steep reduction signals a near-complete exit from a position once considered one of the largest early bets on Hyperliquid.

Ordinarily, such a large-scale dump could have sparked panic. However, HYPE’s rebound shows growing depth in its market structure. Buyers quickly absorbed the pressure, lifting the token back from its $43.50 low to just under $47.

HYPE Price Action: Key Levels to Watch

The HYPE token is moving within an ascending broadening wedge, holding steady after bouncing from its recent dip near the support line. At the moment, the altcoin is trading around the 38.20% Fibonacci retracement level at $47, a zone that also aligns with the Murrey Math “Bottom of the Trading Range.”

This dual confirmation makes the current level a crucial area for traders assessing the token’s next move. Price action shows a potential climb toward the 50% Fibonacci retracement at $49, which coincides with the Murrey Math major support and resistance pivot point. This area forms a temporary barrier that could determine whether HYPE sustains momentum.

HYPE Price Chart (Source: TradingView)

Should it break through, the path higher leads toward the key resistance band between $57 and $59, labeled by Murrey Math as a strong pivot reverse zone. From today’s levels, this would represent an advance of roughly 21% to 26%. On the other side, immediate support rests between $42 and $39.

This area, described as a key support zone, remains critical for maintaining market confidence. Any move beneath this level could signal renewed weakness and open the way to deeper price corrections. Meanwhile, the Relative Strength Index is currently near 47.9, reflecting neutral conditions and suggesting that the market is balanced between buyers and sellers.

Liquidation Patterns Hint at Market Tension

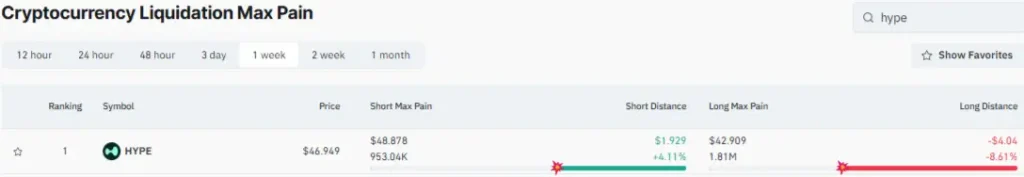

Yet, liquidation data points to an edge for the bulls. The chart shows HYPE needs only a modest 4% move higher to $48.87 to trigger short liquidations worth $953,000. By contrast, the token would need to drop nearly 8% to $42.90 to wipe out $1.81 million in long positions.

HYPE’s Cryptocurrency Liquidation Max Pain (Source: CoinGlass)

This setup creates conditions for a potential short squeeze, as the smaller upside move could force sellers to cover quickly. Such a shift would accelerate bullish momentum and reinforce the rebound narrative already forming in the market.