- XRP’s multi-year breakout puts $6 as the first major checkpoint in its bullish roadmap.

- Fibonacci levels point to $5.96, $8.99, and $16.17 as key upside milestones in this rally.

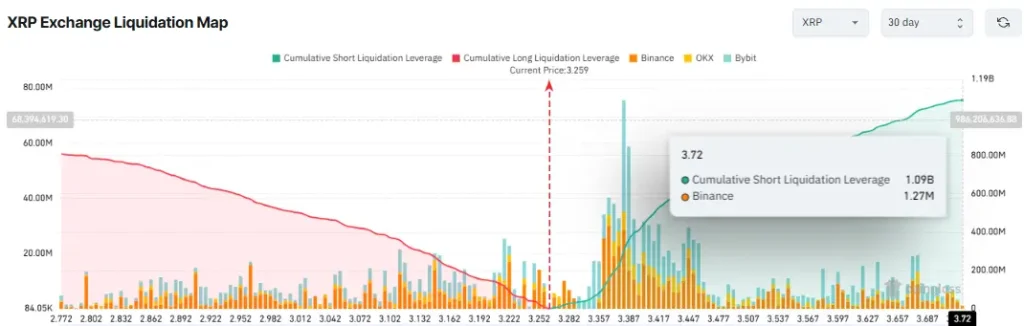

- Cumulative short liquidations at $3.72 total $1.09B, posing a key squeeze risk point.

XRP has entered a new market phase after breaking out of a symmetrical triangle pattern that has shaped its price since early 2018. The move, which took place in November 2024, marked the end of a prolonged consolidation period and signaled the start of a fresh bullish structure.

Technical analysis shows the breakout came with strong momentum, lifting XRP above resistance levels that had capped its price for years. Fibonacci extensions now outline a potential roadmap, with $5.96 as the 1.272 target, $8.99 at the 1.414, and $16.17 at the 1.618.

The $6 level is viewed as the first major checkpoint in this rally’s progression, making it the immediate target for traders watching the trend unfold. The chart pattern mirrors the early stages of XRP’s most powerful historical rallies.

XRP Price Chart (Source: X)

In past cycles, similar long-term compression breaks have triggered rapid expansions, often driving prices through multiple Fibonacci levels before slowing. This structure suggests that XRP’s current path may follow the same staged climb, starting with the $6 zone before testing higher ranges.

At the time of analysis, XRP traded at $3.24, meaning a move to $6 would represent an 85% increase from current levels. The whole target range extends toward $12.60, which would be nearly a 290% gain if achieved.

Price Structure Points to Macro Bull Cycle

XRP’s latest breakout mirrors the early stages of its most explosive rallies, pointing to the onset of a macro bull cycle. Historical patterns suggest that once the token escapes prolonged consolidation, bullish momentum can extend for months, often driving prices into uncharted highs.

In the 2017–2018 cycle, for instance, XRP traded within a symmetrical triangle before breaking out in late 2017. The move triggered a rapid surge exceeding 1,140%, pushing prices above $3.30. A similar setup unfolded between 2018 and 2020, where an extended consolidation ended in mid-2020.

XRP Price Chart (Source: TradingView)

This breakout fueled a steady climb of more than 925%, with prices peaking in April 2021 at $1.96. Now, XRP has completed a breakout from a six-year consolidation range that began in 2018. This structural shift is significant—not just another cyclical rally but the transition into a broader macro phase.

The current weekly chart data shows that the breakout aligns with the 2024–2025 rally zone, with the price already peaking at $3.66 after an over 500% gain from its base level. If historical fractals hold, the token’s trajectory could extend toward the $6 mark, with room for higher highs should momentum persist.

The scale of the breakout, combined with the length of the preceding consolidation, places the asset in territory where prior gains have been both sharp and sustained. For long-term holders and trend-following traders, the pattern presents a compelling case for continued upside in the months ahead.

XRP Volatility Looms as Traders Watch Squeeze Zones

XRP’s derivatives market is primed for potential fireworks as short positions pile up near critical price levels. On-chain data shows cumulative short liquidations peaking at $3.72, where nearly $1.09 billion could be wiped out if the price surges through. Yet, the most concentrated single pressure point lies lower, at $3.382, holding $302.61 million in short exposure.

XRP Liquidation Map (Source: CoinGlass)

These clusters form a clear roadmap for possible squeeze zones. A clean move past $3.382 could unleash the first wave of forced buying, while a breakout above $3.72 would trigger a much larger liquidation cascade.

XRP Open Interest (Source: CoinGlass)

Open interest remains elevated at $8.74 billion as of August 14, 2025, supporting this setup and signaling that traders are heavily positioned for volatility. Should bullish momentum combine with these liquidation triggers, XRP’s path toward its $6 target could accelerate far faster than many anticipate.