What To Know

- Solana hosts 85 million tokens, showcasing dominance in DeFi, NFTs, stablecoins, and meme coins.

- Despite declining activity, Solana’s fees, revenue, and TVL growth highlight strong DeFi performance.

- SOL price faces $245 resistance, with $223 support offering stability for potential bullish continuation.

Solana (SOL) despite been involved in many controversies regarding network outage, has successfully managed to become a top player in multiple crypto niches. These niches include DeFi, NFTs, Meme Coins, Stablecoins, etc. Recently, the blockchain has achieved yet another milestone, showcasing its robust position in this ever-evolving crypto space. But, will this new Achievement of Solana have any positive impact on the blockchain’s native token SOL anytime soon?

Assessing Solana’s achievement

The dominance of Solana in the world of token creation was brought to the fore by its official X account. It recently revealed a telling figure: of the 100 million tokens deployed across major crypto networks, out of which, 85 million are on Solana.

BREAKING: There are now 100 million tokens total on major crypto networks

85 million of them call Solana home 🤯 pic.twitter.com/BHoO308cze

— Solana (@solana) September 17, 2025

This milestone, without doubt, places the blockchain on the map for token launches, everything from meme coins to DeFi tokens and stablecoins. For Solana, this is more than mere vanity—it stands as a testament to the ease, low fees, and speed of the network that keep drawing developers and projects of all scales to it. It is also a reinforcement of Solana’s distinctive positioning as the experimental chain of choice within the crypto ecosphere.

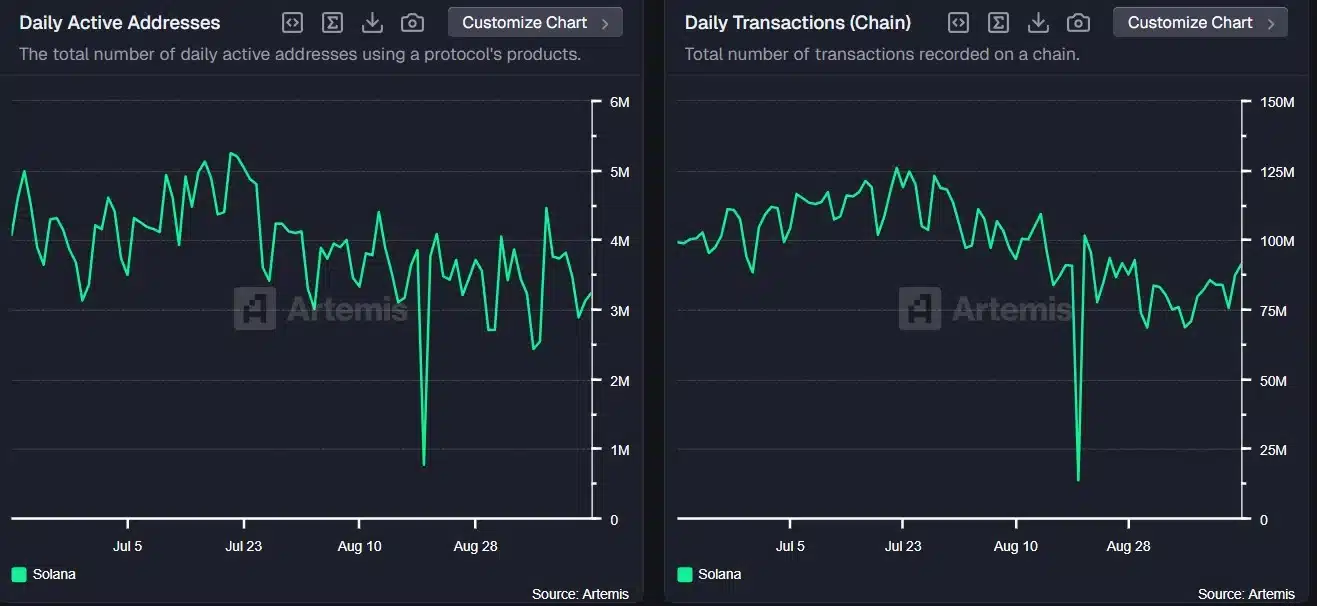

Were more numbers coming in? It would be quite a simplistic view of the narrative. According to data compiled by Artemis and reviewed by CryptoMoonPress, Solana actually saw a slight decline in activity last month. While there was a mild decline in active addresses and daily transactions, the other side of the coin is token creation blossoming. The issue is: how much is the token boom converted productively into network use?

Despite diminished address and transaction activities, Solana fees, revenues, and total value locked (TVL) continued to rise. This suggests that the quality of usage, especially within the DeFi realm, remains from strength to strength. Rising TVL indicates that higher capital deployment goes into Solana protocols, which further promulgates the argument for long-term viability. Ergo, SOL’s actual value is further driven through deeper on-chain engagement, capital inflows, and utility sustained throughout DeFi and other applications.

Will Network Activity Affect The SOL Price?

The question most investors are trying to figure out now is whether the growth Solana has shown in network adoption and token creation will be translated into meaningful price gains for SOL. On the encouraging side, the token gained some good momentum upfront, surging 6% just over the past week.

At $234.46 at the time of writing, SOL commands a huge market cap of $127.3 billion, cementing its position among the few largest cryptocurrencies. Another basis for momentum comes in the form of rising volume of trading as that speaks of elevated interest and liquidity binding the markets together, which are much-needed ingredients for rally sustenance.

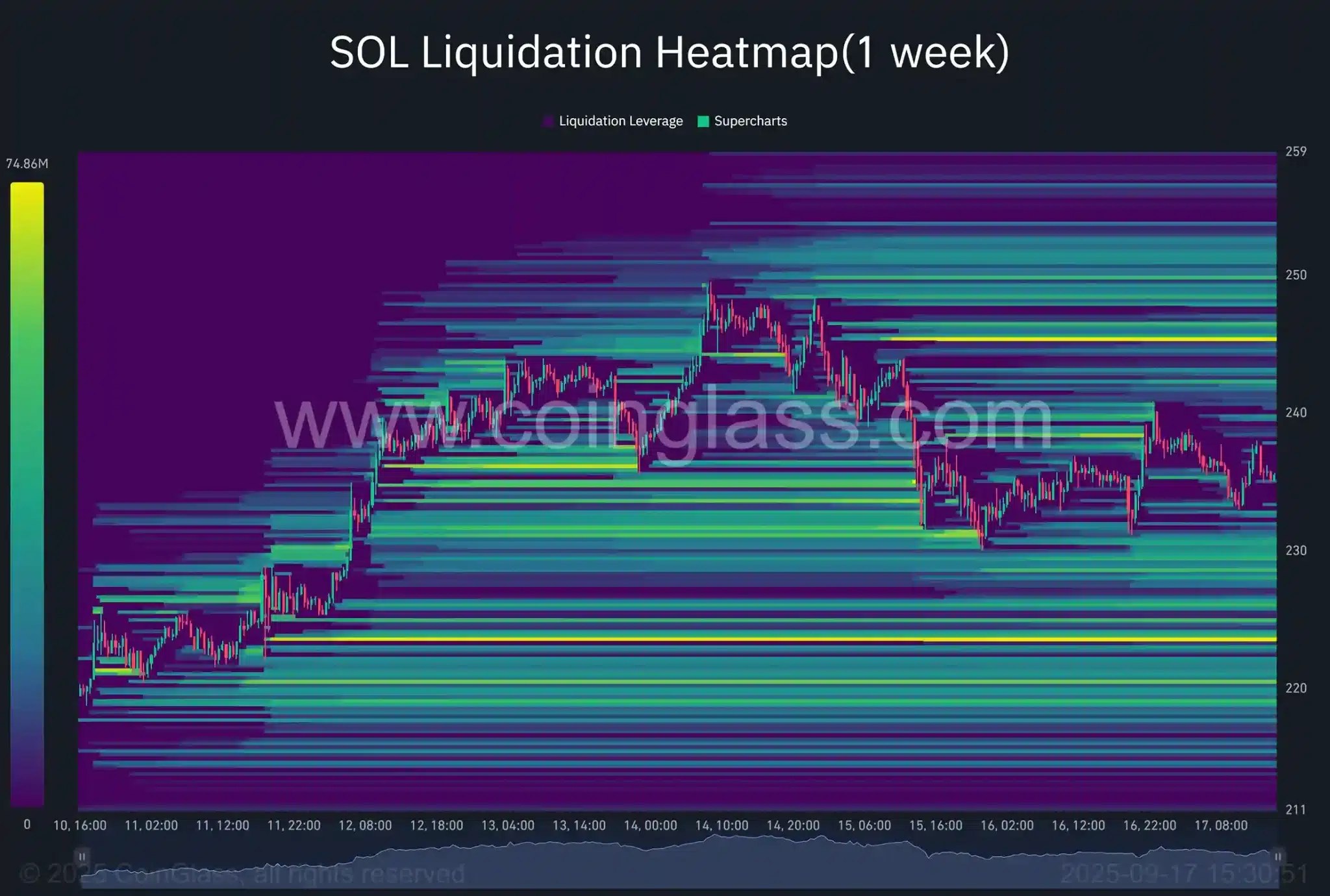

However, technical indicators show some near-term caution. According to the liquidation heatmap, the price of SOL faces serious liquidation pressure around $245, creating short-term resistance. This implies that with the price coming at that level, sellers forced to exit leveraged positions would create selling pressure to temporarily curb SOL upward movements. However, in case of a price correction, immediate support coming from $223 would hold as a cushion for the bulls to reposition.

Generally, from a macro perspective, the fundamentals are potent with network expansion and increasing adoption levels, but it will mainly come down to whether SOL can make a good run at the $245 level, cracked it, and then hold momentum above it. A breakout would be attractor enough for increasing investor confidence, whereas fallback to support would keep SOL in a healthy position for ultimate outgrowth.