What To Know

- Avalanche surges 27% since breakout, reaching $32.8 with $13.8B market cap.

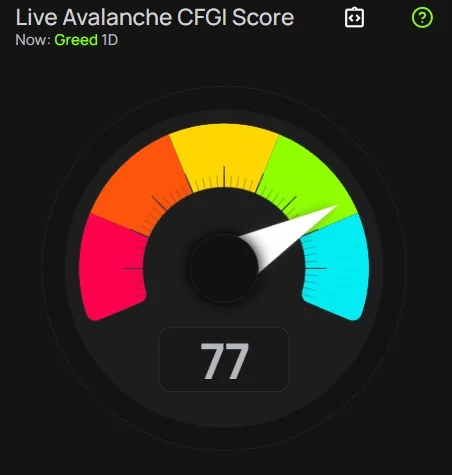

- Fear and Greed Index at 77 warns of potential correction ahead.

- Overbought signals and bearish rising channel hint at possible 30% AVAX decline.

Avalanche (AVAX) broke above a bullish pattern a few days back, and since then the token’s price has witnessed substantial growth. To be precise, AVAX’s price has grown over 27% since the breakout, giving hope to investors for more gains in the weeks to follow. However, every coin has two sides and so does this. Such meteoric rises often is followed by price corrections. Ergo, let’s see whether Avalanche investors should now also practice caution after this steep price hike.

Why Caution is Advised!

Starting with respected crypto analyst, World Of Charts was among the first to give credence to this bullish breakout of Avalanche earlier this month, on 10 September. At the time, AVAX was technically showing strong signs of a breakout pattern, and indeed, the breakout had occurred within less than a week. Since then, Avalanche has climbed by nearly 27%, thus being named one of the fastest-apparent big-cap tokens in the past few weeks.

$Avax #Avax Running In 27% Profit So Far https://t.co/onrxZELqKY pic.twitter.com/zEp9CmQj2l

— World Of Charts (@WorldOfCharts1) September 18, 2025

Momentum appeared to be building. Just in the last week alone, Avalanche registered a further 12% gain while bearing a 120% surge in trading volume, something that clearly marks investor interest and excitement. The altcoin market has given Avalanche a rather big market capitalization of $13.8 billion now at about $32.8.

On these clouds ushered upwards by fantastic highs, analysts and trades are now beginning to throw in some red flags against the ability of such rapid gains to stand. The Fear and Greed Index, which is one of the most important sentiment indicators, is now at 77, hence placing the AVAX market firmly in the “Greed” zone.

Historically, with markets heavily leaning toward greed, the prevailing conditions tend to begin a phase of correction as an overconfidence sets amongst traders and inflows become more speculative than fundamental buying. Simply stated: the greater the greed, the bigger the sudden risk of a pullback.

Adding to the picture is the CryptoMoonPress technical in-house analysis, which has discovered a bearish rising channel forming on AVAX’s price chart. Rising channels usually get formed on uptrends, but if the price breaks downward from the lower boundary of the channel, they often resolve in a bearish manner. This means that the steep climb of the price would be followed by a big corrective phase, which will wipe out part of the recent gains.

Moreover, the bearish sentiment is the presence of overbought momentum indicators. The Relative Strength Index, which measures the magnitude of recent price changes, finds AVAX clearly in the overbought zone.

This means the asset has peaked, having been bought on mass for a very short period, and now faces a price cooldown. The Chaikin Money Flow indicator, which measures the flow of money in and out of a security, is also giving a warning of the overbought condition, which hints that the intensity of buying seen now may not hold in the immediate future.

Considering the possibility of the bearish signals manifesting leading sellers to take the reins, AVAX would then be looking down the barrel of a major correction. Analysts have the keen eye on the critical support range of $23 to $16.2, which may come into play post a bearish breakout from the rising channel. This would infer something more than a 30% drop from its current levels; hence, investors are advised to remain cautiously optimistic.

In a Nutshell

In conclusion, the 27-percent gains recorded since September 10 suggest Avalanche’s very strong bullish momentum and investor confidence while heightened sentiment, bearish rising channel, and overbought technicals advise for caution. The short-term corrections are highly probable before AVAX forms a stronger base for sustainable gains. At the moment, the key question in investors’ minds remains whether Avalanche can remain flat above $30 or if it is going to take a break from delving into the depths of the $23-$16.2 vicinity.