- Rising ETF inflows strengthen Ethereum’s path toward the $5,000 target.

- The massive ETH staking of Grayscale points to the increasing confidence of institutional investors.

- Technical indicators favour the further rise of Ethereum.

Ethereum price has maintained its upward momentum this week, mirroring the strong bullish trend across the cryptocurrency market. The ETH price hovered above the $4,600 level, and traders are now watching for a possible move toward the $5k. The optimism has been driven by the increasing institutional interest and inflows in ETFs, which contribute to the impressive recovery of Ethereum and the market mood.

Here’s Why Ethereum Price Is Up.

Ether price increased by 2.45% in the past 24 hours, which was more than the slight increase of 0.4% in Bitcoin. The spot Ethereum ETFs of Grayscale launched staking rewards, bringing in more than 176 million new inflows. This change has increased the confidence of investors and given more reasons to own ETH.

Technically, Ethereum has surpassed the key point of resistance in its price at $4,700, strengthening the favorable momentum. Meanwhile, the Bitcoin supremacy dropped to 58% permitting the capital to revamp in alternative coins. Having a good ETF backing and new technical power, the Ethereum bullish trend seems to have a future in case the market momentum remains.

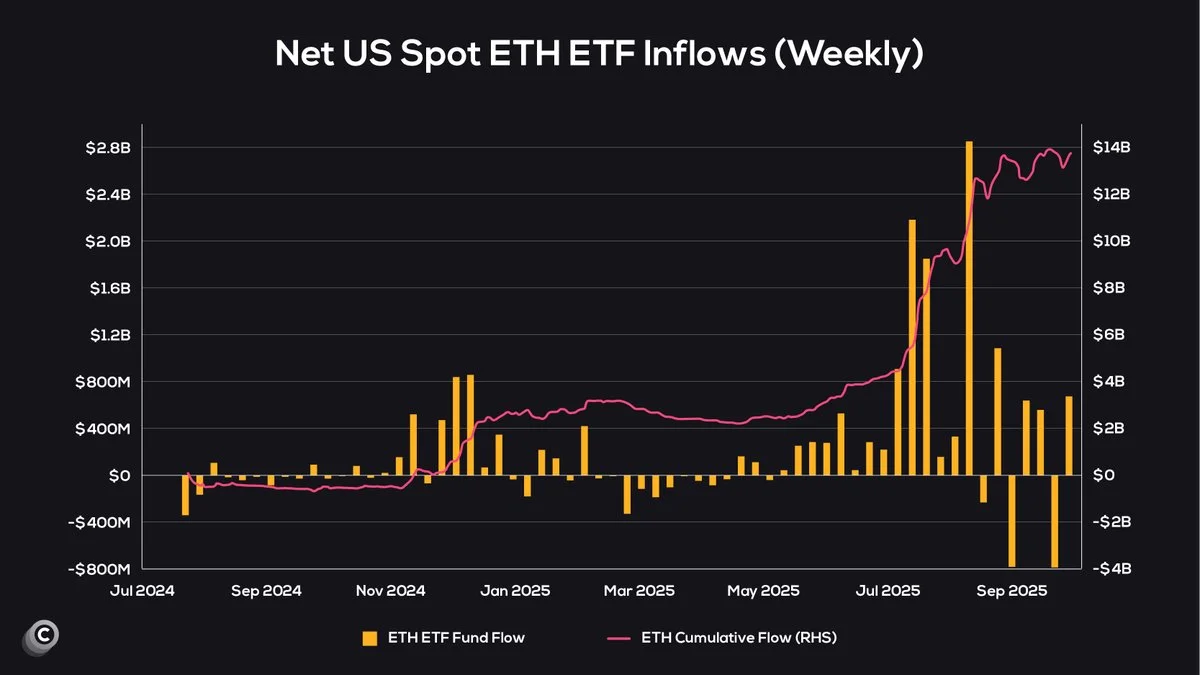

Ethereum ETFs Hit $14 Billion as Institutional Investors Pile In

Ether exchange-traded funds (ETFs) are in a period of robust institutionalization following a muted initial year at the end of 2024. U.S spot Ethereum ETFs have already reached almost $14 billion of overall inflows, which is an indication of a steep increase in investor confidence. This is how the momentum started to build up around mid-2025, when institutions started exposing themselves more to Ethereum-backed funds.

The data chart that comes with it depicts that the inflows have been increasing at a very fast rate, and some of the weeks have witnessed more than $2 billion of new capital. The wave represents one of the biggest waves of Ethereum-based investment products adoption.

Grayscale Stakes 32,000 ETH Worth $150M

The Ether ecosystem has received a significant input with Grayscale staking 32,000 ETH, and this is equivalent to approximately 150.56 million.

Grayscale(ETHE and ETH ETF) staked 32,000 $ETH($150.56M) today.https://t.co/OcQGQe8US6 pic.twitter.com/lQLIWl8yQX

— Lookonchain (@lookonchain) October 7, 2025

On-chain information provided by Look on chain indicates that the Grayscale Ethereum Trust (ETHE) and the Ethereum Mini Trust (ETH ETF) are also making a number of staking transactions. A batch had approximately 3,200 ETH, and several transfers took place in the past several hours.

Will $5,000 Be the Next Target?

ETH is steadily gaining strength, and it is holding above the level of $4,600, with resistance being tested at the level of $4,800.

The Relative Strength Index (RSI) stands at 62, hovering in the overbought region, although it has yet to signal a reversal. The Moving Average Convergence Divergence (MACD) indicator is still in the bullish scale. The MACD line is above the signal line, and the bars in the histogram are positive, which indicates the persistence of buying.

Should the ETH price manage to propel above $4,800, it might target the next significant resistance level of $5,000. Strong resistance above this point would have a typical close likely to draw more bullish traders, which could push ETH to $5,200 in the near future.

However, if the price faces rejection around $4,800, traders should watch for a potential retracement to $4,600. A drop below that zone could expose the $4,400 area, where previous consolidation took place.