- Grayscale files Solana ETF at 0.35% fee as SEC review continues amid market focus.

- GSOL to list on NYSE Arca with Coinbase Custody securing Solana assets.

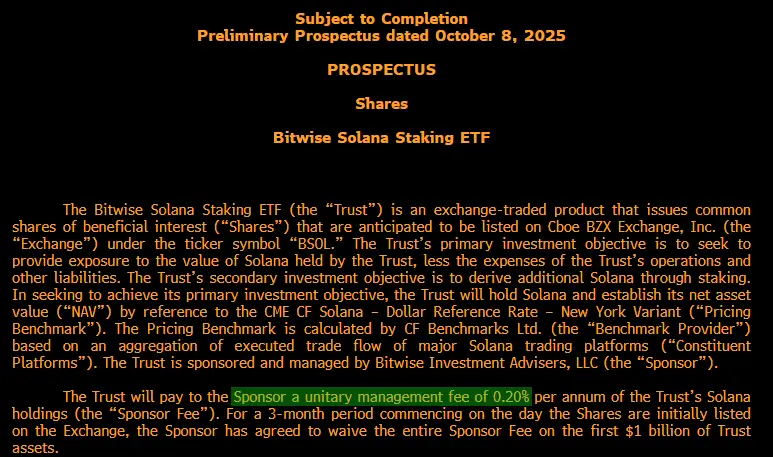

- Bitwise cuts Solana ETF fee to 0.20%, aiming to dominate early investor inflows.

Grayscale Investments is pushing deeper into the exchange-traded fund market with its latest plan to launch a Solana ETF carrying a 0.35% management fee. The move comes as the asset manager waits for the U.S. Securities and Exchange Commission to deliver its final decision, now held up by the federal government shutdown.

A filing submitted on October 9 shows that the Solana Trust has been updated to include new disclosures, risk statements, and a clear fee structure. The sponsor fee will be paid in Solana (SOL), and, for now, Grayscale does not plan to waive it.

Once approved, the ETF will trade on NYSE Arca under the ticker symbol GSOL, offering investors regulated access to Solana’s market performance. The document also outlines Grayscale’s operational framework.

The Bank of New York Mellon will serve as transfer agent and administrator, Coinbase Custody Trust Company will handle primary custody, and Anchorage Digital Bank will act as an additional custodian. Legal guidance will come from Davis Polk & Wardwell, while accounting duties fall to KPMG and Marcum LLP.

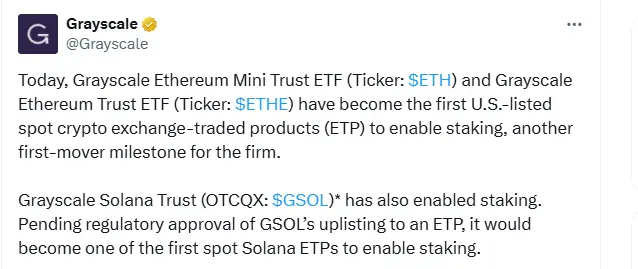

Grayscale Pioneers Secure Staking for Solana Investors

According to reports, Grayscale recently activated staking for its Solana Trust, allowing investors to earn rewards without running their own validator nodes. This step links traditional investment tools with the growing world of blockchain-based income.

Grayscale Activates Staking on Solana Trust (Source: X)

Still, the company’s filing acknowledges that staking carries certain risks. It warns that validators could face losses or reduced participation, which might affect the network’s reliability.

“Validators may suffer losses due to staking, or staking may prove unattractive to validators, which could adversely affect the Solana Network.”

On the other hand, CEO Peter Mintzberg views staking as a cornerstone of its innovation strategy. “Staking in our spot Ethereum and Solana funds is exactly the kind of first mover innovation Grayscale was built to deliver,” he acknowledged. He added that the firm’s scale and experience allow it to deliver new opportunities in a secure, regulated structure.

Fee Competition Among Solana ETFs

Grayscale’s proposed 0.35% fee places it slightly higher than competitors. Bitwise Asset Management, which introduced its Solana Staking ETF earlier this week, set its fee at 0.20%, the lowest in the group. Bitwise also waived its charge for the first three months or until it gathers $1 billion in assets, signaling a strong push to attract early inflows.

Bitwise Solana Staking ETF Filing. (Source: X)

Bloomberg’s senior ETF analyst Eric Balchunas described the pricing move as proof that “Bitwise is not playing around,” reflecting the growing intensity of competition among issuers hoping to dominate Solana-based products.

Regulatory Focus and Market Reaction

The impending decision of the SEC is likely to have a significant impact on the mindset of regulators regarding future crypto-linked funds. If Grayscale’s Solana ETF receives approval, it may lead to a situation where wider institutional engagement occurs, similar to the market reaction that followed the introduction of the first Bitcoin and Ethereum ETFs.

Prediction market data from Polymarket points to a 99% chance that a Solana ETF will go live by 2025. That optimism, however, hasn’t lifted Solana’s price this week. The token has experienced a decline of approximately 2% over the last 24 hours and is now trading at around $219. However, the trading volume has increased by around 5%, which may indicate that some traders are taking advantage of the dip and are thus buying the token.

Conclusion: Institutional Confidence in Focus

Grayscale’s proposed Solana ETF signals its larger plan to connect digital assets and traditional finance. The emphasis on regulated custody, transparent fees, and staking rewards aims to make the entry of large investors without direct crypto ownership more comfortable, utilizing the fund as a channel.

Should the SEC approve the application, GSOL may well turn out to be one of the first Solana ETFs to offer staking support. Moreover, it would also fortify the existing trend of regulated crypto funds becoming the primary actors in the next phase of institutional adoption.