- BTC ETFs extend a three-day inflow streak as prices edge closer to key support levels

- ETH funds return to inflows while weak technical signals keep broader sentiment cautious

- Market fear deepens as BTC and ETH move in step with a wider risk-off shift in equities

Spot Bitcoin (BTC) and Ethereum (ETH) ETFs notched a third consecutive day of inflows on Feb. 10, even as both assets slipped below key technical lines that traders have been watching for weeks. The pattern has become familiar: steady fund allocations on one side, uneasy price action on the other, with neither fully dictating market direction.

The divergence sharpened at the start of the week. Bitcoin ETFs pulled in another wave of institutional capital, while ETH products recovered from their recent outflow stretch. Yet spot prices moved the opposite way, weighed down by a broader risk-off sweep that crossed over from equities into digital assets.

ETF Inflows Extend Streak Despite Market Pullback

According to SoSoValue data, Bitcoin ETFs absorbed $166.56 million in fresh inflows on Feb. 10, extending gains from Feb. 9 ($145 million) and Feb. 6 ($371.15 million). Taken together, the week’s net inflow stands at $311.56 million, enough to erase the previous week’s $318.07 million drawdown, though not enough to shift sentiment on its own.

BTC ETFs Net Inflow (Source: SoSoValue)

Ethereum funds moved in the same direction, but the day’s activity was concentrated almost entirely in one product. Grayscale’s Ethereum Mini Trust posted $13.32 million in inflows, while Fidelity’s FETH recorded just $501.13K, matching the full daily total for the asset class.

ETH ETFs Net Inflow (Source: SoSoValue)

Combined with the prior session’s $57.05 million, ETH ETFs have pulled in roughly $70.87 million week-to-date after shedding $165.82 million last week. The inflows offer a contrast to the market’s underlying tone, which has drifted cautiously lower as traders reassess broader macro conditions.

Bitcoin Slips After Brief Peak as Correlation Holds

From a technical perspective, BTC opened with a mild bid that carried it to $69,266 before momentum faded. Sellers pushed it down nearly 4% to a low of $66,547. It later steadied near $67,029 at press time but was still down 2.63% on the day. Besides, trading volumes retreated 13.91% to $42.42 billion, adding to the sense of a market pulling back rather than capitulating.

Its decline tracked the wider landscape. The total crypto market cap fell 2.74% to $2.28 trillion. Moreover, Bitcoin’s 24-hour correlation with the S&P 500 hovered around 50%, enough to suggest that the move was influenced by traditional markets rather than an internal catalyst. No clear macro event appeared in the data, leaving traders to point instead to a broad retreat in appetite for risk.

Crypto Fear and Greed Index (Source: CoinMarketCap)

The Fear & Greed Index also drifted into “extreme fear” at 9, with the recent swing low at $60,074 emerging as the level that now anchors near-term direction. Holding above it could lead to range-bound trading between $60,074 and $69,266. Yet, a slip beneath that floor would turn attention toward $58,742.

Ethereum Tracks BTC as Technical Levels Break

Meanwhile, ETH mirrored Bitcoin’s pattern, slipping 2.75% while moving almost in lockstep throughout the session. The asset briefly revisited $2,031 before dropping to $1,937. It later settled at $1,951. Sector data reinforces the cautious tone.

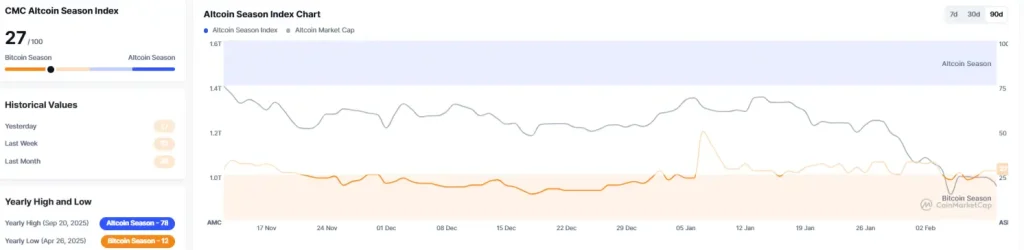

Altcoin Season Index (Source: CoinMarketCap)

The Altcoin Season Index sits at 25, signaling a stronger preference for BTC over higher-beta assets. Ethereum also broke beneath the 78.6% Fibonacci retracement level at $1,978.25 on $21.23 billion in volume, enough to confirm the bearish break rather than chalk it up to noise.

Nonetheless, the RSI at 27.41 places ETH deep in oversold territory, though oversold conditions do not guarantee relief. Therefore, the near-term hinge remains around the $1,937 region. Holding that line opens room for a move back toward the $1,978–$2,031 band. However, a failure there would force the market to reassess lower support zones.

Market Searches for a Floor as Funds Keep Flowing

Overall, ETF flows continue to show steady allocation into BTC and ETH products, but spot prices remain pinned beneath resistance. Extreme fear, soft equity sentiment, and shrinking volumes have kept the market on edge. For now, capital is entering, just not enough to break the downtrend.