- PENGU’s likely dip to $0.025 sparks analyst optimism of a rebound toward higher levels.

- The token earlier surged over 1,000% from April lows near $0.0037 to July highs.

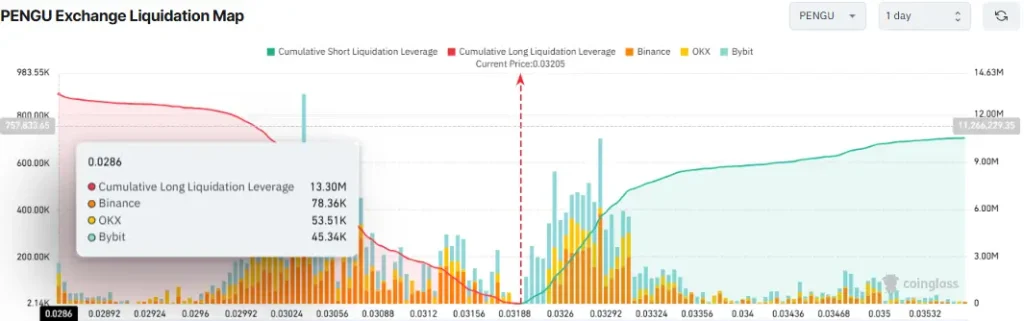

- Long positions worth $13.35M face risk of liquidation below the $0.0286 level.

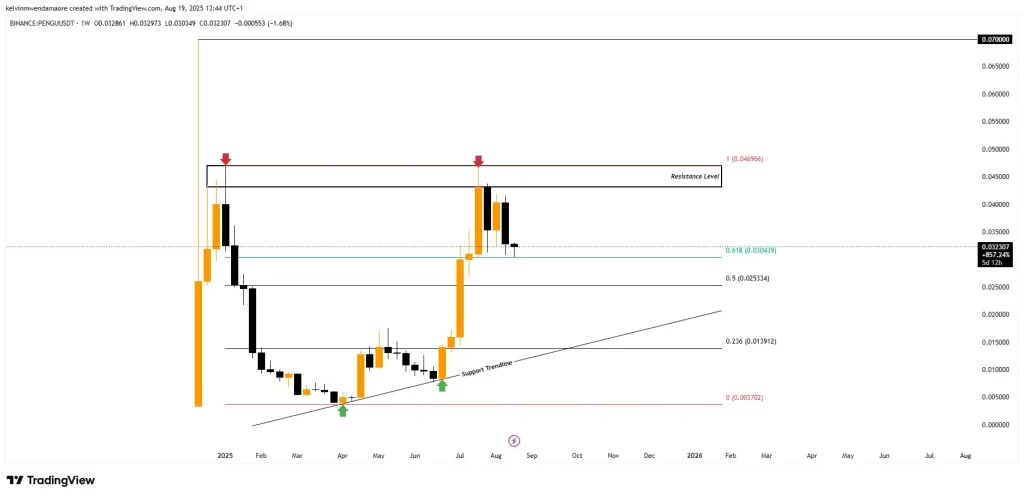

PENGU experienced what analysts termed a healthy correction after reaching a peak near the $0.046 resistance level in late July. The move marks a 31% retracement from the high, with experts viewing it as a natural correction in the token’s market cycle rather than a reversal on the bearish side.

It corrected following the extraordinary rally earlier this year, when the token surged more than 1,000%, from an April low of $0.0037 to a July high. During this uptrend, the token respected a rising support trendline that allowed pullbacks to be cushioned and simultaneously supported momentum.

PENGU Price Chart (Source: TradingView)

The token currently trades near the 0.618 Fibonacci retracement level of about $0.030, which acts as a short-term support. However, analysts argue that the $0.046 area is now considerable resistance, having formed a double top pattern, making it difficult for buyers to push it further up.

Meanwhile, the cryptocurrency presents a weekly price loss of 11% and a surge in volume to $436.11 million, indicating that selling pressure mounts.

$0.025 Emerges as PENGU’s Critical Support Zone

Market analyst Ali projected that PENGU might further correct toward $0.025, which is a strong technical support area. He said the token consolidates between $0.027 and $0.039 after the retracement from its peak in August.

In his outlook, Ali saw the $0.025–$0.027 area as a possible oven for incubating the next bullish leg. He also noted that, despite some short-term volatility, the overall market structure for PENGU remains intact.

PENGU Price Chart (Source: X)

According to him, upward zones above $0.047 lie on the wish list, and with long-term momentum behind it, the $0.11 zone could be the eventual target if the buyers regain command. Apart from the chart-based signals, Ali cited a few other factors that would reinforce the bullish case further.

These factors include an anticipated ETF filing, wider adoption in Asian markets, and increased revenues from toy sales related to the token’s ecosystem. He indicated that these fundamentals, when combined with technical resilience, cast a bullish medium-term outlook.

Given that the correction manages to hold above the projected support zone, analysts expect the cryptocurrency to follow in the footsteps of its earlier rallies, whereby the range-bound consolidations ended quickly in sharp upward moves.

For now, the price of $0.025 remains on every analyst’s watch list, as it could determine whether the current dip turns into a buying opportunity or signals deeper weakness.

Long Squeeze Threatens to Drag PENGU to $0.025

Fresh liquidation data adds another layer to the story. Looking at the liquidation map, long positions worth $13.35 million could get liquidated if prices go below $0.0286, which analysts warn is a level that might cause a forced selling spree. This could further accelerate downside momentum and push prices to the $0.025 zone on the short horizon.

PENGU Liquidation Map (Source: CoinGlass)

The largest cluster of risk sits just below current trading levels. Long positions worth about $8.80 million remain exposed around $0.030, as the market appears to be at the brink of either facing a defensive rally or embracing a full-blown cascade sell-off.

Data also reveals that over $648,000 in long positions have already been liquidated at current prices, compared with a negligible $285.08 in shorts. The extreme disparity indicates how much the market has been tilted toward bulls, setting up the squeeze if these support levels break. Analysts warn that an initial cascade of liquidations could trigger a further chain reaction of sell-offs.

PENGU Total Liquidation Chart (Source: CoinGlass)

Meanwhile, signs of resilience remain. PENGU’s funding rate has recovered to the 0.0060% level from the earlier negative one of -0.0370%, showing traders are still paying to keep long positions. This attitude shift tells us that the bulls still have confidence despite near-term risks.

With the market at a tipping point, all eyes are fixed on the $0.0286 support. A breakdown could confirm a long squeeze, while a successful defense may stabilize momentum and open the door to a recovery.