What To Know

- Ethereum trades near $4,157 after 7% weekly decline, testing $4,000 support.

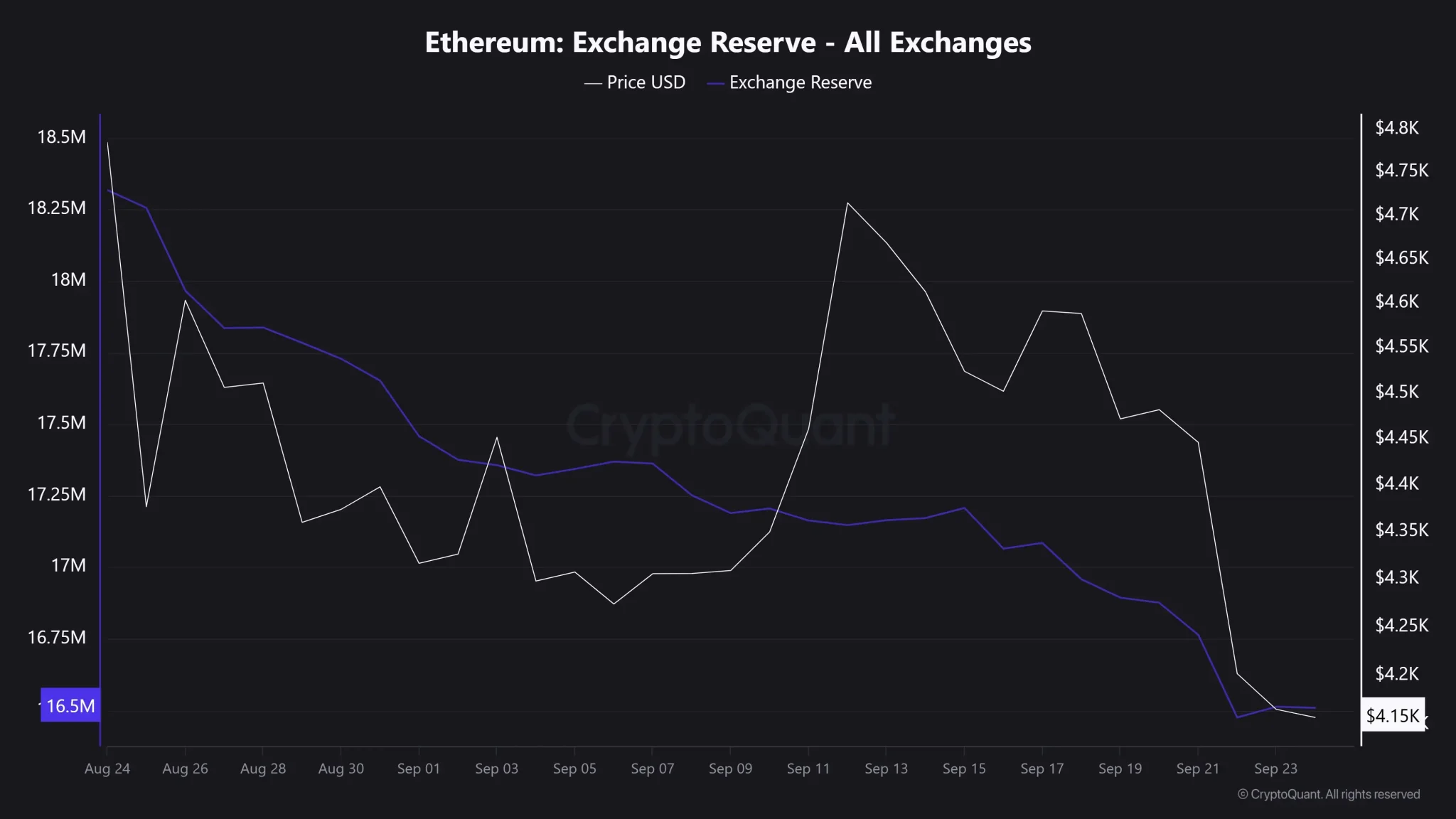

- Exchange reserves drop from 18M to 16.5M ETH, signaling strong investor confidence.

- Weakening funding rates raise concerns about Ethereum’s momentum toward $4,400 recovery.

As the market condition once again turned hostile for investors, Ethereum (ETH) also witnessed corrections as its weekly and daily chart became red. This latest decline is now pushing Ethereum’s price towards a crucial support level. However, the better news is that in case ETH manages to successfully test that support, then it might soon begin its journey towards $4400, as predicted by analysts.

Ethereum and its $4k support

The second-largest crypto in the world has been facing downward pressure lately, by way of a price decline of about 7% in the past seven days, which is essentially a reflection of the broader market’s weakness. At the time of writing, ETH trades at $4,157.19, with a market cap worth $501.8 billion, keeping a strong grasp on the title of second-largest cryptocurrency in the world.

While these lull times surely create panic in the investor’s psyche, market experts have their keen eyes fixed on one critical level: the $4,000 support zone. According to famed crypto analyst Ali Martinez, if Ethereum can hold this critical support level, it will create the catalyst for renewed bullish momentum that may see the price lifted back to $4,400. This, therefore, makes this $4k zone a short-term make-or-break level for Ethereum.

If $4,000 holds as support, Ethereum $ETH could rebound to $4,400. pic.twitter.com/JJ6YoVqbGq

— Ali (@ali_charts) September 24, 2025

The bearish angle is corroborated by a dwindling exchange reserves for Ethereum in the past month. Data reveal that centralized exchanges saw a reduction in ETH tokens from 18 million to 16.5 million. This is the sort of occurrence that implies more investors were transferring ETH into cold storage wallets, which indirectly becomes a constraint on the amount of Ethereum flowing in sell pressure.

A downward movement in exchange reserves is typically an investment confidence indicator as well as the expectation of price increases, and the fact that fewer tokens are in the immediate market. This suggests that holders have piled quite heavily on ETH at this price, with the speculation of a strong defense at $4,000, they could potentially initiate a rally toward $4,400.

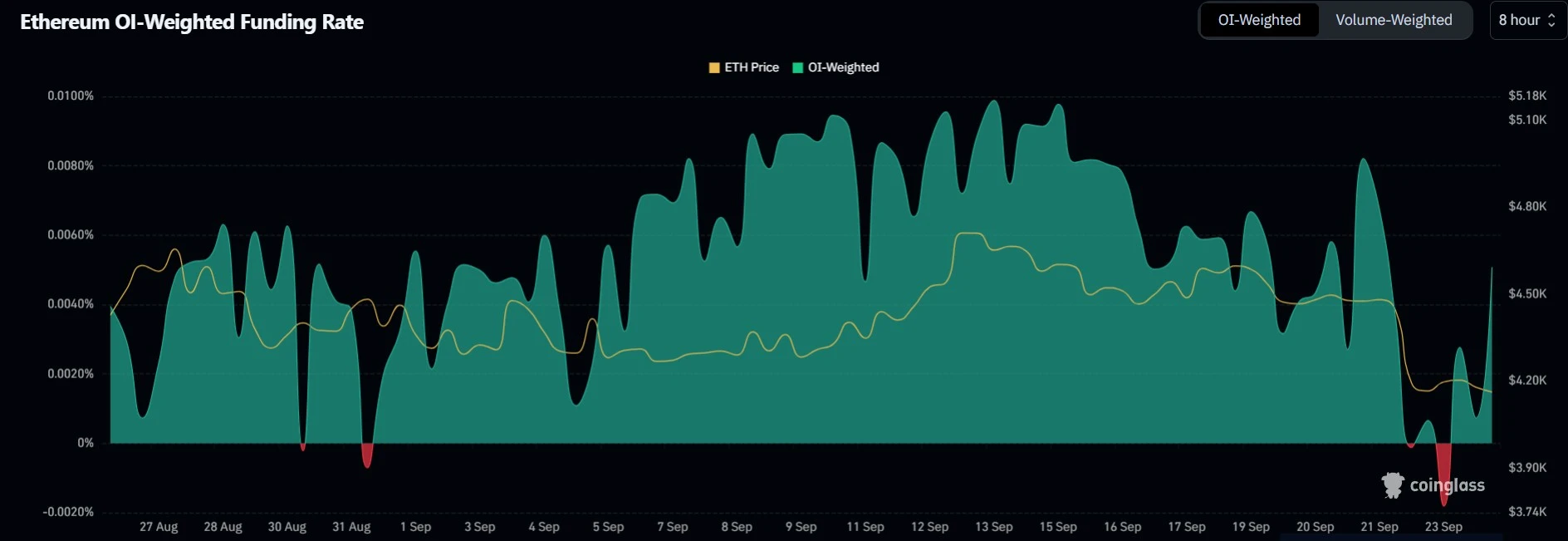

But it’s worth noting that none of this seems entirely bullish for Ethereum. One bearish sign comes from funding rates, which have been moving lower for the past weeks. The funding rate is a mechanism involved in perpetual futures contracts to keep the contract price close to the spot market price.

When talking with little jargon, if the funding rate is positive, then the long traders (those who foresee prices to go up) pay that fee to the short traders (those who expect prices to go down). The other way means that the short traders now owe the money to the long traders. Falling funding rates would then indicate that the demand for going long is diminishing, so, theoretically, donors amongst traders can turn less bullish.

In the case of Ethereum, this drop in the funding rates could be detrimental, as it may represent a dwindling appetite for leveraged buying. If it indeed continues further, it would restrain Ethereum’s ability to make a clean upward momentum, even with support at $4,000 holding in. Ergo, while exchange reserves and potent support levels provide some hope, the weakening funding rate serves as a warning sign that the very road to $4,400 may not be without a couple of bumps.

Wrapping Up

Ethereum finds itself at an important juncture, with the $4,000 level serving as a key support area. Declining exchange reserves fuel the confidence of investors, while weakening funding rates spread a note of caution. Should the ETH price sustain itself above this level, then it is more inclined to bounce back toward $4,400, yet a failure toward holding may accelerate deeper corrections, making the upcoming sessions decisive for its short-term fate.