What To Know

- Altcoins lose steam as Bitcoin regains dominance in the crypto market.

- Bitcoin Rainbow Chart flashes bullish “BUY” signal, hinting at a potential rally.

- Declining miner inflows reduce sell pressure, strengthening Bitcoin’s bullish outlook.

Altcoins have a tendency to follow the king of crypto, Bitcoin’s (BTC) price action quite often, thanks to its large market capitalization. Interestingly, this trend changes sometimes and altcoins decouple, leading to an altcoin season. A similar scenario happened a few weeks back but the trend has changed once again as per latest data. Does this mean Bitcoin is once again ready to push its price up? Let’s take a closer look.

Has the Altcoin Season Ended?

The latest statistics coming out of Alphractal, a highly regarded crypto analytics platform, add further insight into how the broader trend shifts once again in Bitcoin’s favor. As per the recent post by Alphractal, “altcoins are back on BTC’s path.” September had truly been an unbelievably volatile month for the crypto space, during which many altcoins considered outperforming Bitcoin, though for a brief period of time.

Altcoins are back on BTC’s path! September brought significant volatility to the crypto market, and many altcoins briefly outperformed Bitcoin, causing their correlation with BTC to drop—a historical sign of risk and imminent volatility. But now, most altcoins are following BTC… https://t.co/5cS8Taa7is pic.twitter.com/S4Q0OzdzjX

— Alphractal (@Alphractal) September 24, 2025

This decoupling led to a weakening of their correlation with BTC, which historically is often viewed as a signal of increased risk and near-term volatility. However, the scenario has been turned on its head now, as most altcoins have started to follow Bitcoin motion for motion. If that makes it simpler: altcoins rise with BTC and fall with it, too. This re-correlation is quite normal because altcoins rarely break away from Bitcoin’s trend for prolonged periods, and that shows just how dominating Bitcoin is when it comes to setting the direction of the crypto market.

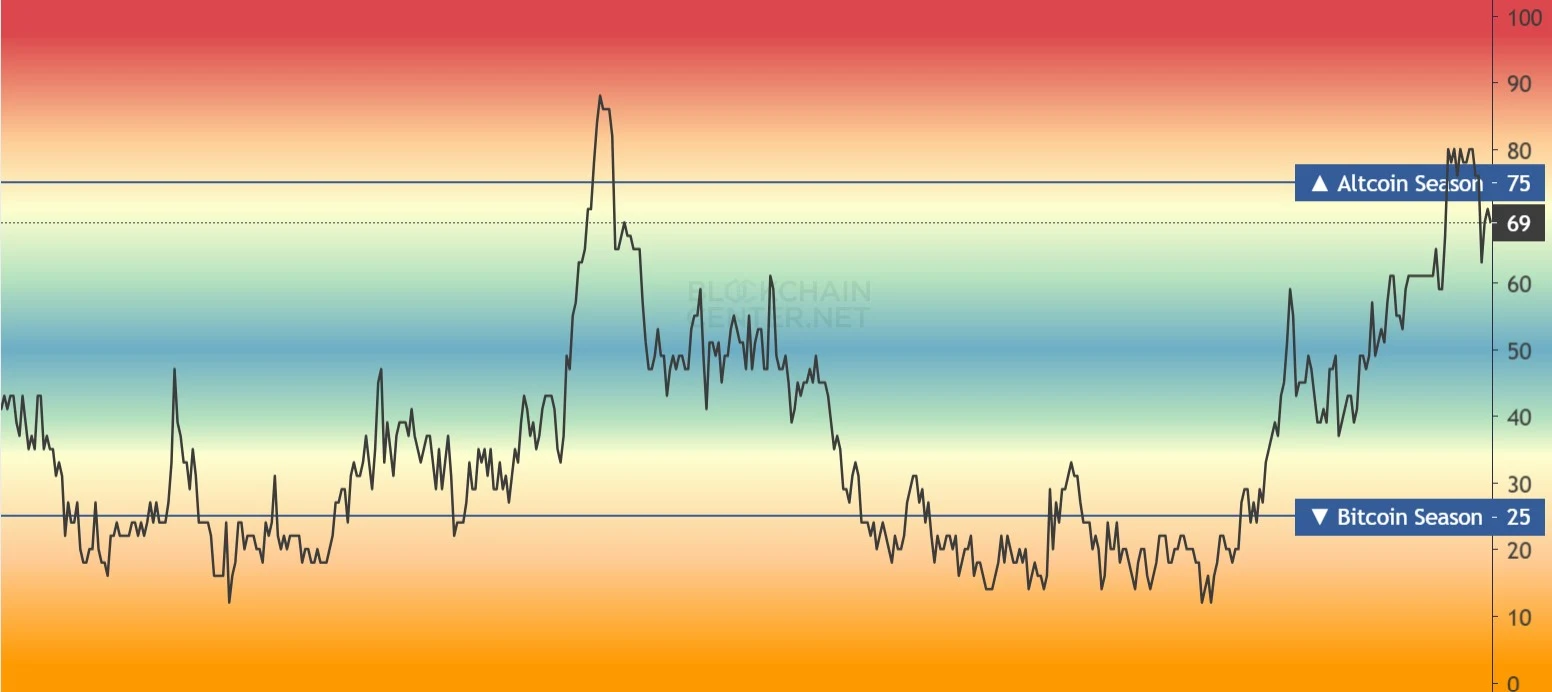

Further powering this paradigm shift is the Altcoin Season Index’s behavior, a very popular metric used to monitor if altcoins are following Bitcoin. Recently, it crossed above 75, which is commonly regarded as the level for the actual starting point of an altcoin season. However, since then, the index started to decline, falling back to 69, which clearly signals Bitcoin coming back from the loss of momentum and capital, seizing the market narrative once again.

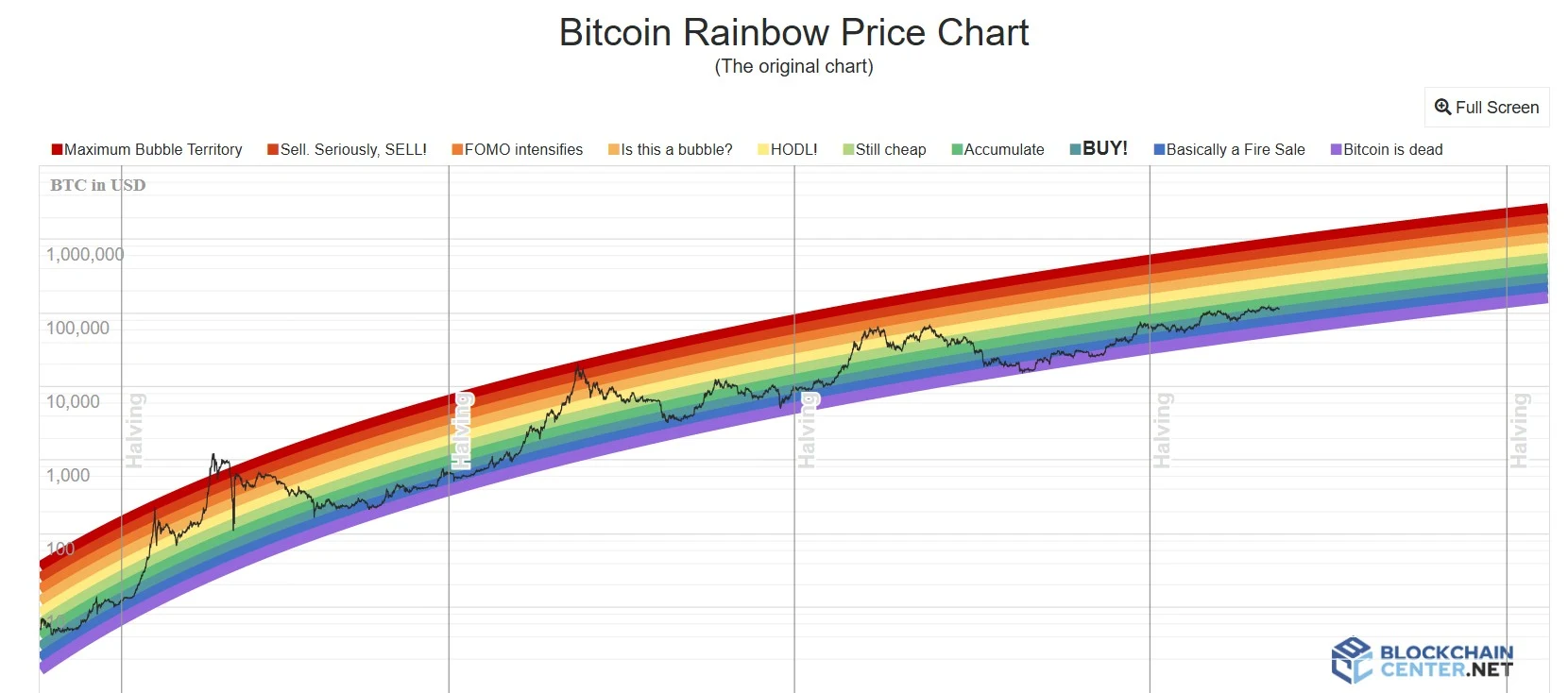

Meanwhile, the Bitcoin Rainbow Chart, a long-term visual indicator traders use to gauge valuation bands for Bitcoin, is flashing a “BUY” signal. Such signals have usually proceeded with upside moves in BTC price, thus indicating that a rally might be looming ahead. With strong supports in place, Bitcoin is firm and winning against altcoins, while the market is beginning to smell the potential for another big BTC bull run.

Another critical milestone is derived from the Bitcoin mining industry, as its activities assist in ensuring the operational stability of the network, while the sentiments of the market are influenced indirectly. Having examined the miner data on CryptoQuant, CryptoMoonPress found that the miner inflows saw an increase but now have slowly started going down.

Generally, the lower the miner inflows, the more investors believe that miners will be holding onto their coins rather than sell them into the open market. The immediate sell pressure is thus lowered, thereby causing a squeeze in supply that would be felt if demand remains constant or rises. By all means, waning miner inflows are thus bullish indicators that show the growing confidence of miners towards the potential outcome of Bitcoin in price terms.

Closing Summary

This latest market landscape very strongly suggests that Bitcoin is regaining a primary status whilst altcoins lose steam. With the Altcoin Season Index waning, the Rainbow Chart flashing a “BUY” signal, and miner inflows funneling downwards, the stage is set for Bitcoin to take charge in the next big move. While a consistent dose of caution is always recommended, the mounting data seem to suggest a new Bitcoin bull run.