- Bitcoin dropped 5% after hitting a record $126K before stabilizing near $123K.

- Whale traders flipped short, driving sell pressure and trimming leveraged positions.

- Open interest near $90B and positive funding rates hint that bullish sentiment persists.

Bitcoin (BTC) cooled off after a strong rally that carried it to $126K, its highest level yet. Within a day, the token’s price fell by roughly five percent, touching lows near $120.5K. The move came as whale traders turned short across major exchanges, signaling a possible pause in the latest uptrend.

Large Holders Shift Direction

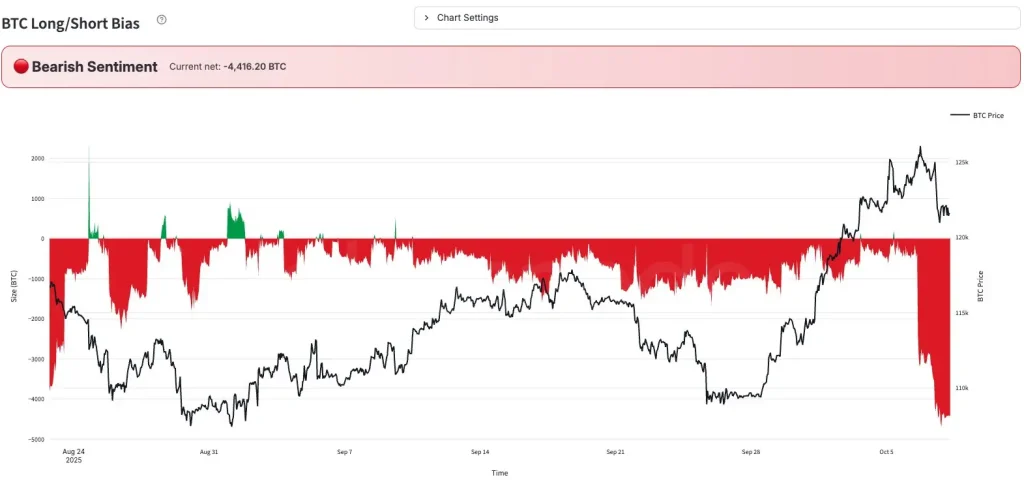

Data from Glassnode shows a clear tilt toward bearish sentiment, with a net short bias of –4,416 BTC. The chart paints a picture of rising sell orders and fading momentum. Whales who had been building long positions for weeks appear to have taken profits, switching sides to guard against a deeper pullback.

BTC Long/Short Bias (Source: X)

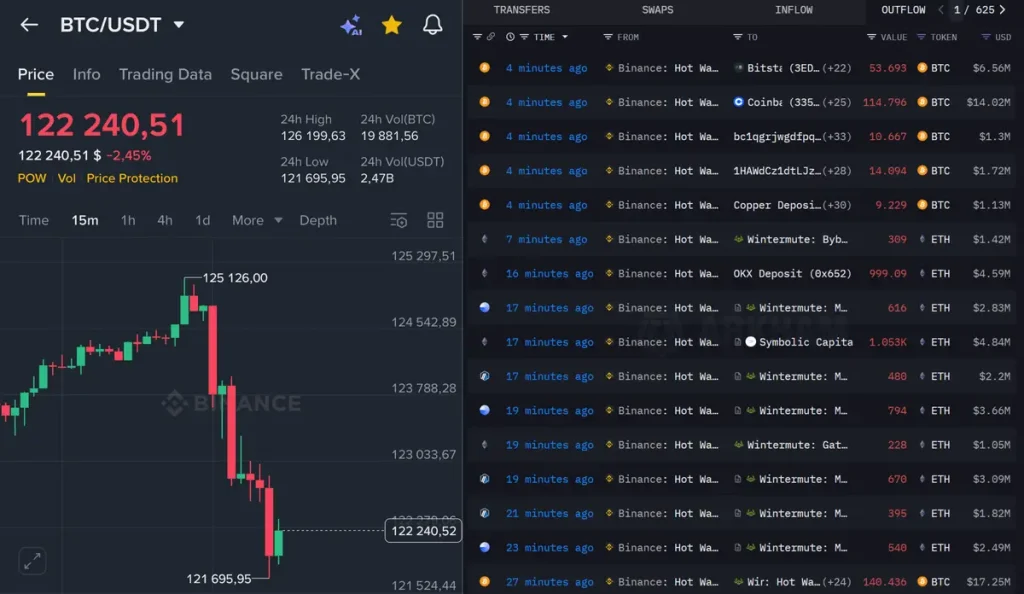

On Binance, the drop was swift and heavy. In just a few hours, BTC/USDT slipped from $125K to $121K, erasing much of the previous session’s gains. More than $15 billion traded hands, and open interest dropped sharply as leveraged longs were flushed out.

Tracking data revealed significant outflows from Binance’s hot wallets to other destinations, including Coinbase and Bitstamp, with transfers exceeding 114K BTC. Ethereum movements followed the same trend, with large sums flowing to market makers, including Wintermute and OKX.

BTC and ETH Transfers (Source: X)

Crypto commentator DefiWimar claimed that Binance was “dumping millions of BTC and ETH at all-time highs to liquidate longs,” calling it “classic exchange manipulation.” While no evidence supports that claim, the timing matched the spike in volatility and short bias across trading platforms.

In past cycles, such phases often reset leverage, cool sentiment, and set the stage for a fresh push higher. The tone from most desks is watchful but not fearful. At press time, Bitcoin hovered near $123K, trading sideways as buyers attempted to defend the $120K support zone.

BTC Holds Steady as Bulls Test $126K Resistance Zone

Bitcoin has managed to steady itself after a quick pullback, trading between $123K and $126K. This range has turned into a real battleground for traders, marking the point where either momentum builds again or the rally stalls. If the buying pressure holds, BTC could make another push toward $126K and possibly climb to $130K, adding roughly 6% from current prices.

If the market softens instead, the price could drift down toward the $117K–$114K area. That zone, which lines up with the 50% Fibonacci retracement, has acted as a strong base before. A clean break beneath it could unsettle the bullish setup and open the way toward $112K or even $108K, the level last seen in late September.

BTC Price Action (Source: TradingView)

Momentum data backs the idea of a pause rather than a reversal. The RSI is holding near 65, easing from the overbought mark of 70. There’s still room for a pullback, but the reading shows that buyers aren’t done yet. The trend in RSI remains slightly upward, hinting that bullish sentiment still lingers beneath the surface.

Market Data Points to Steady Optimism

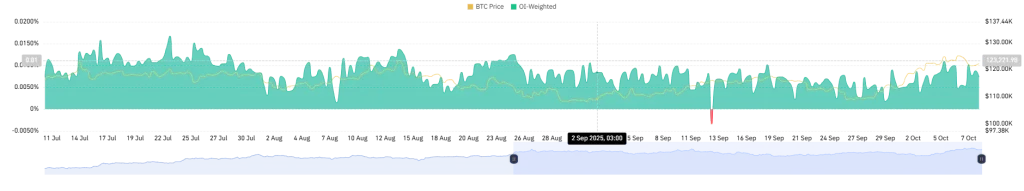

Bitcoin traders are holding their ground, as market data clearly shows. The funding rate, weighted by open interest, has stayed in positive territory at about 0.0074%. That means long holders are paying short sellers to keep trades open, a sign that optimism remains strong and that many still believe the price has room to climb.

BTC Weighted Funding Rate (Source: CoinGlass)

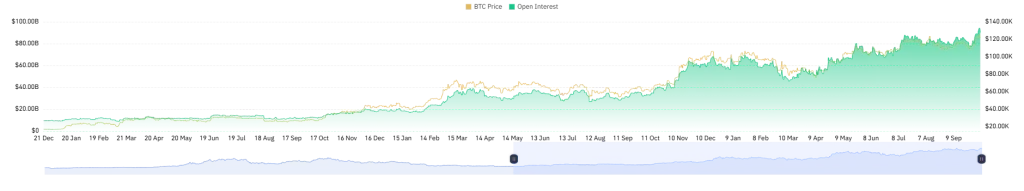

The open interest tells the same story. It now sits around $90 billion, one of the highest levels seen this quarter. Instead of cashing out, traders are choosing to stay in their positions, suggesting confidence in Bitcoin’s next move rather than caution.

BTC Open Interest (Source: CoinGlass)

When funding rates remain positive and open interest continues to rise, it typically indicates a market leaning bullish. Right now, that’s precisely where Bitcoin stands, a space charged with conviction and steady momentum rather than uncertainty.