- Over 45,000 altcoin inflow transactions were recorded on Binance in early August, per CryptoQuant.

- A ripple effect followed Binance’s inflow surge, fueling renewed attention toward major altcoins.

- ZYN pointed to a classic bull flag formation following a 60% climb from the recent market bottom.

Altcoin activity on Binance has reached its highest level in 18 months, according to CryptoQuant analyst Maartunn. The most recent on-chain data indicate that the 7-day cumulative inflow of transaction count has increased to over 45,000, which was last observed in late 2024.

This sudden surge follows the recent moment when Bitcoin passed the $120,000 threshold, an occurrence that has redirected the focus towards other alternative cryptocurrencies. Maartunn noted that inflow activity had remained stable for months while Bitcoin’s price moved sideways. However, that calm period has now been disrupted by a sudden surge in deposits.

Altcoins Exchange Inflow Transaction (Source: Cryptoquant)

The accompanying chart from CryptoQuant confirms this shift. Binance shows a steep spike in inflow transactions, far outpacing activity on other exchanges like Bybit, OKX, and Coinbase. The rise began in early August 2025 and marks the strongest inflow signal since the previous peak in Q4 2024.

Historically, spikes in exchange inflows have matched moments of heightened market engagement. This pattern is visible again, as Bitcoin’s price movement appears to correlate with the increase in altcoin transactions.

According to Maartunn, large inflows usually signal that users are preparing to trade rather than store assets. Although the data does not specify whether the users are willing to purchase or sell, the growth is evident of a new activity in the altcoin market.

Ripple Effect Sparks Altcoin Rebound Across Markets

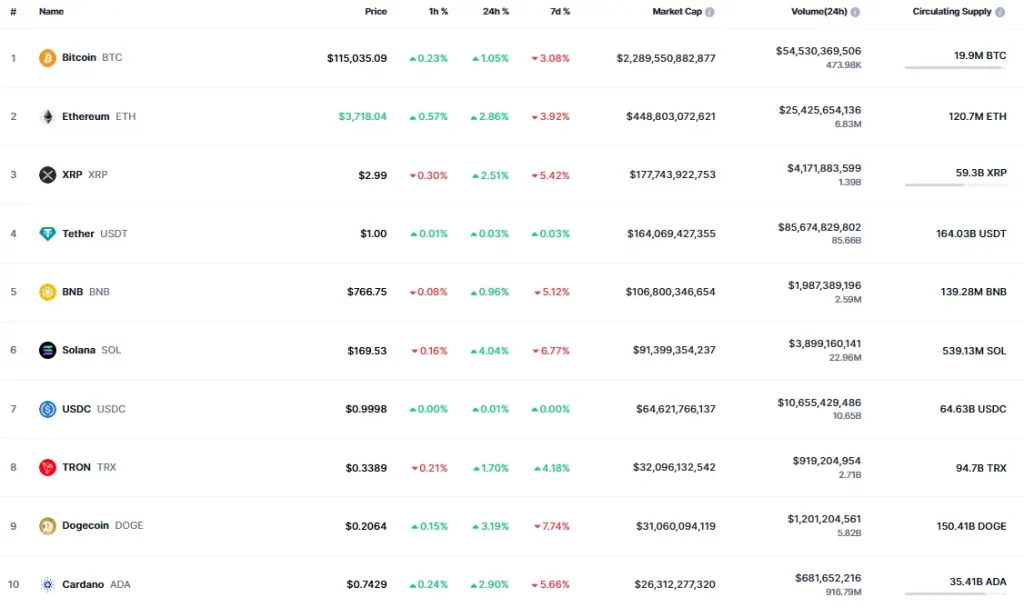

The surge in Binance altcoin inflows has sparked a domino effect across the crypto market, breathing fresh life into major digital assets. Ripple (XRP) is the first, with a price of $2.99, following a gain of 2.51% in the last 24 hours. Although XRP is still down by 5.42% over the week, its short-term gains are an indication of the increased trade activity.

Solana (SOL) also reported a robust 4.04% daily increase, currently trading at $169.53, but is down 6.77% in the past week. Ethereum (ETH), the second-largest cryptocurrency, increased by 2.86% to $3,718.04. Although still down 3.92% on the week, ETH’s daily gains align with the current inflow momentum.

Altcoin Market Outlook (Source: CoinMarketCap)

Cardano (ADA) joined the rebound with a 2.90% rise to $0.7429, even as it faces a 5.66% weekly loss. Meanwhile, BNB and TRON (TRX) saw modest increases of 0.96% and 1.70%, respectively. Dogecoin (DOGE) is up 3.19% to $0.2064 but still holds the steepest 7-day loss at 7.74%.

This recovery in the daily prices of several altcoins indicates a shift toward a more pronounced change in traders’ behavior, spurred by the rise in exchange activity. Although the majority of tokens are still trading in the red at weekly trends, short-term profits indicate a possible reversal in the altcoin market conditions.

Altcoin Market Prepares for Next Big Move

Crypto analyst ZYN has identified a bullish formation within the altcoin market with a possible breakout in the future. After climbing 60% from its bottom, the total altcoin market cap is currently down just 10%—a healthy pause rather than a reversal, according to the analyst.

The chart provided is characterized by a distinct bull flag, which is typical in powerful uptrends as a sign of continuation. This pattern, characterized by a short period of consolidation after a sharp advance, indicates that the market is resting before the next upswing.

Altcoin Market Cap Chart (Source: X)

At present, the total market cap for altcoins, excluding Bitcoin, hovers around $1.41 trillion. The structure has held up even to the recent dips, which ZYN feels are in the larger accumulation process. The analyst indicated that any dips prior to that are buying, further instilling confidence in the current trend.

ZYN also responded to the increasing concern of a few traders who consider the recent pullback a show of weakness. But with only a 10% retracement after a 60% rally, the analyst maintains that the overall outlook remains bullish.

With a breakout expected in the coming weeks, attention is now on whether altcoins will confirm this technical pattern with renewed upward momentum. Until that time, the development remains a positive indicator to market observers.

Read More: Bit Origin Unveils $500M Treasury Initiative with Dogecoin at Its Core